SSI: Retail Positioning Dictates Potential for British Pound Breakout

FXCM Speculative Sentiment Index (SSI) Statistics:

Download up to 7 years of historical SSI data via this ZIP file.

Automate our SSI-based trading strategies via Mirror Trader free of charge

Understand the Breakout2 Trading System via our previous article

Auto trade the trend reversal-trading Momentum2 system via our previous article.

Trade with strong trends via our Momentum1 Trading System

Use our counter-trend Range2 Trading system

Currency Spotlight:

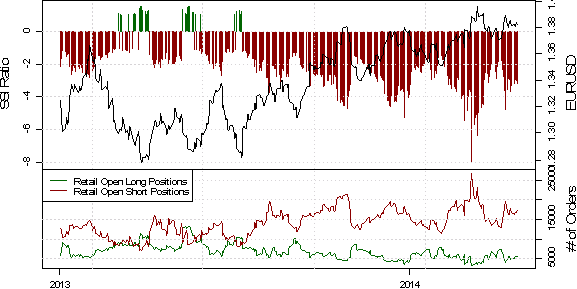

EURUSD - The ratio of long to short positions in the EURUSD stands at -2.99 as 25% of traders are long. Yesterday the ratio was -2.85; 26% of open positions were long. Long positions are 2.2% lower than yesterday and 14.3% above levels seen last week. Short positions are 2.4% higher than yesterday and 3.6% below levels seen last week. Open interest is 1.2% higher than yesterday and 7.0% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the EURUSD may continue higher. The trading crowd has grown further net-short from yesterday but moderated since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

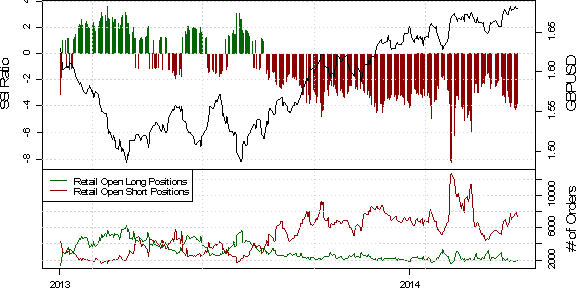

GBPUSD - The ratio of long to short positions in the GBPUSD stands at -3.93 as 20% of traders are long. Yesterday the ratio was -3.41; 23% of open positions were long. Long positions are 9.4% lower than yesterday and 2.1% below levels seen last week. Short positions are 4.3% higher than yesterday and 1.9% below levels seen last week. Open interest is 1.2% higher than yesterday and 10.6% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBPUSD may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

GBPJPY - The ratio of long to short positions in the GBPJPY stands at -1.35 as 43% of traders are long. Yesterday the ratio was -1.25; 44% of open positions were long. Long positions are 8.4% lower than yesterday and 17.2% below levels seen last week. Short positions are 1.3% lower than yesterday and 1.2% below levels seen last week. Open interest is 4.4% lower than yesterday and 3.2% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBPJPY may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

USDJPY - The ratio of long to short positions in the USDJPY stands at 1.51 as 60% of traders are long. Yesterday the ratio was 1.66; 62% of open positions were long. Long positions are 4.1% lower than yesterday and 17.4% below levels seen last week. Short positions are 5.9% higher than yesterday and 24.2% above levels seen last week. Open interest is 0.3% lower than yesterday and 0.5% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the USDJPY may continue lower. The trading crowd has grown less net-long from yesterday and last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

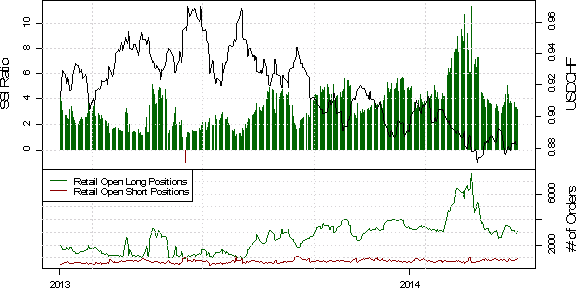

USDCHF - The ratio of long to short positions in the USDCHF stands at 3.64 as 78% of traders are long. Yesterday the ratio was 3.50; 78% of open positions were long. Long positions are 0.0% lower than yesterday and 10.4% below levels seen last week. Short positions are 3.8% lower than yesterday and 3.6% below levels seen last week. Open interest is 0.8% lower than yesterday and 1.0% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the USDCHF may continue lower. The trading crowd has grown further net-long from yesterday but moderated since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

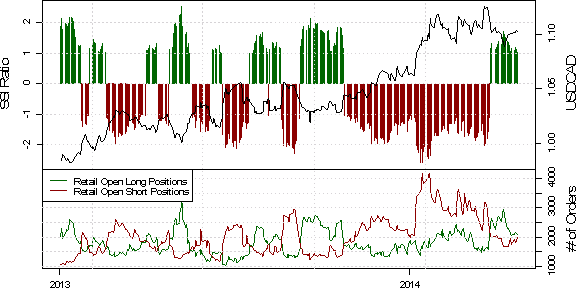

USDCAD - The ratio of long to short positions in the USDCAD stands at 1.11 as 53% of traders are long. Yesterday the ratio was 1.03; 51% of open positions were long. Long positions are 0.4% lower than yesterday and 3.7% below levels seen last week. Short positions are 7.1% lower than yesterday and 4.9% above levels seen last week. Open interest is 3.7% lower than yesterday and 6.8% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the USDCAD may continue lower. The trading crowd has grown further net-long from yesterday but moderated since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

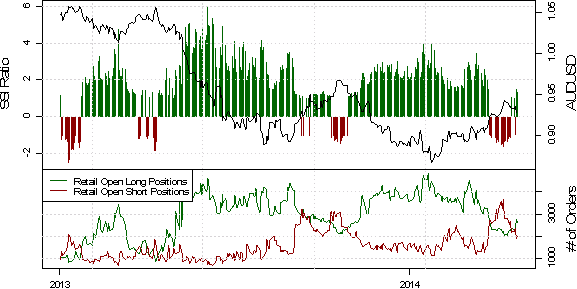

AUDUSD - The ratio of long to short positions in the AUDUSD stands at 1.46 as 59% of traders are long. Yesterday the ratio was 1.47; 60% of open positions were long. Long positions are 1.5% lower than yesterday and 17.2% above levels seen last week. Short positions are 0.5% lower than yesterday and 25.0% below levels seen last week. Open interest is 1.1% lower than yesterday and 7.9% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the AUDUSD may continue lower. The trading crowd has grown less net-long from yesterday but unchanged since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

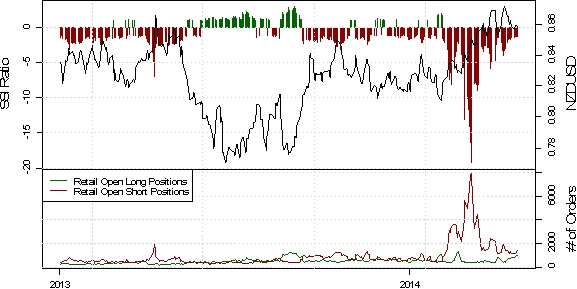

NZDUSD - The ratio of long to short positions in the NZDUSD stands at -1.10 as 48% of traders are long. Yesterday the ratio was -1.20; 45% of open positions were long. Long positions are 11.2% higher than yesterday and 31.5% above levels seen last week. Short positions are 1.4% higher than yesterday and 2.2% below levels seen last week. Open interest is 5.9% higher than yesterday and 5.5% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the NZDUSD may continue higher. The trading crowd has grown less net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

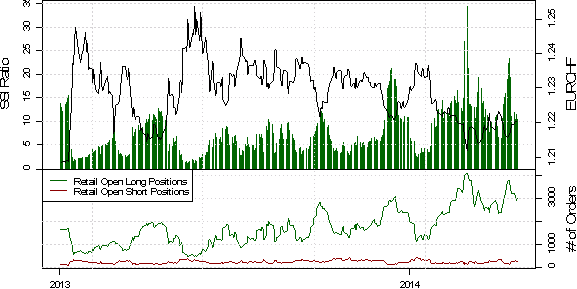

EURCHF - The ratio of long to short positions in the EURCHF stands at 12.96 as 93% of traders are long. Yesterday the ratio was 12.23; 92% of open positions were long. Long positions are 1.6% higher than yesterday and 11.3% below levels seen last week. Short positions are 4.1% lower than yesterday and 27.7% above levels seen last week. Open interest is 1.2% higher than yesterday and 1.2% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the EURCHF may continue lower. The trading crowd has grown further net-long from yesterday but moderated since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

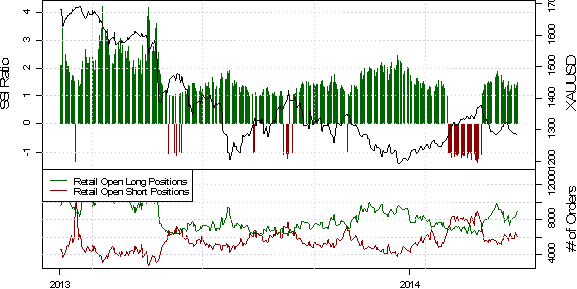

XAUUSD - The ratio of long to short positions in the XAUUSD stands at 1.52 as 60% of traders are long. Yesterday the ratio was 1.43; 59% of open positions were long. Long positions are 6.3% lower than yesterday and 6.0% above levels seen last week. Short positions are 11.9% lower than yesterday and 14.2% below levels seen last week. Open interest is 8.6% lower than yesterday and 3.7% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the XAUUSD may continue lower. The trading crowd has grown further net-long from yesterday and last week. The combination of current sentiment and recent changes gives a further bearish trading bias.

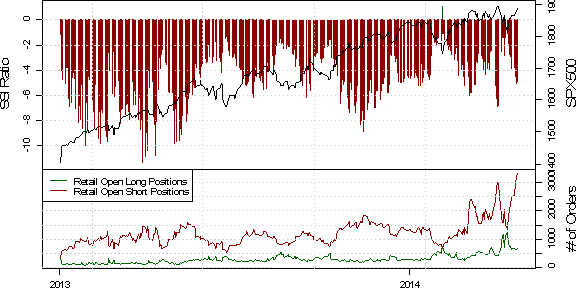

SPX500 - The ratio of long to short positions in the SPX500 stands at -4.48 as 18% of traders are long. Yesterday the ratio was -4.81; 17% of open positions were long. Long positions are 1.7% higher than yesterday and 13.4% below levels seen last week. Short positions are 5.3% lower than yesterday and 25.8% above levels seen last week. Open interest is 4.1% lower than yesterday and 25.0% above its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the SPX500 may continue higher. The trading crowd has grown less net-short from yesterday but further short since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

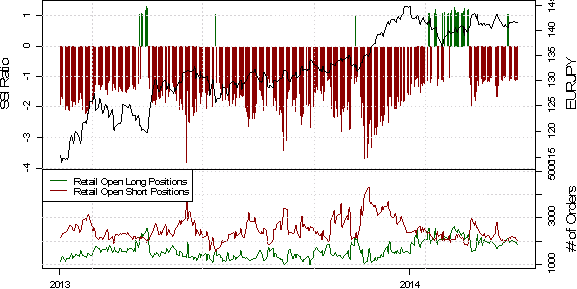

EURJPY - The ratio of long to short positions in the EURJPY stands at -1.00 as 50% of traders are long. Yesterday the ratio was -1.09; 48% of open positions were long. Long positions are 2.8% higher than yesterday and 0.7% above levels seen last week. Short positions are 5.4% lower than yesterday and 6.9% below levels seen last week. Open interest is 1.5% lower than yesterday and 2.7% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the EURJPY may continue higher. The trading crowd has grown less net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

How do we interpret the SSI? Watch an FXCM Expo Presentation that explains the SSI.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance