Spring housing market update

Boy things have changed in our property markets during the year.

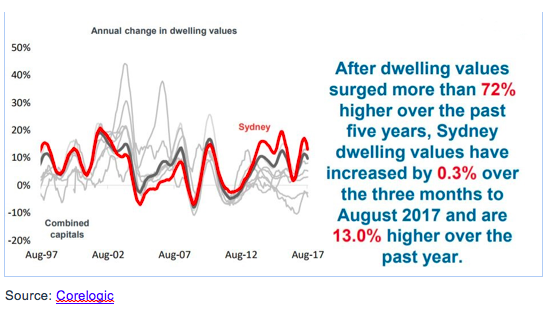

After a heady start to the year, the latest Corelogic figures show property values are levelling out.

In fact, dwelling values were virtually unchanged across the nation in the month of August with capital city values rising by only 0.1% and combined regional areas seeing values fall -0.2%.

A.P.R.A seems to be getting its way putting pressure on lenders to encourage principal and interest loans plus larger deposits and the latest ABS Housing Finance data shows a sharp drop in investor housing commitments.

At the same time home buyers are back in the market, particularly first-time buyers, who had been squeezed out of the market by investors, encouraged by State Government incentives like duty deductions and grants for new home buyers.

As always the markets were fragmented:

Source: Corelogic

LOOKING BACK OVER THE LAST 12 MONTHS:

Dwelling values are 8.9% higher over the past year, 9.7% higher across the combined capital cities and 5.8% higher across the combined regional markets.

Over the year, Sydney, Melbourne and Hobart have recorded property price growth well in excess of 10%, while home values are lower in Perth and Darwin than they were a year ago.

WHAT’S HAPPENING AROUND THE STATES?

The Melbourne property market, which has been the top performing market over the last decade is taking a breather, but still grew a respectable 1.9% over the last three months and a whopping 12.7% over the last year.

Also read: House prices are rising in this area, only

Strong population growth (around 2.2% per annum) and a booming economy creating more jobs than anywhere else in the country have underpinned the Melbourne property market.

The Melbourne apartment market has not performed as well as the house market, but is likely to pick up over the rest of this year as the First Home Buyers Grant brings a raft of new home buyers enter the market buying up established apartments.

Sydney property values grew 13% in the last 12 months.

Having said that, the Sydney has had virtually no growth for a few months now.

In Sydney auction clearance rates are falling and the buyers agents at Metropole are finding fewer people at open for inspections and it easier to buy properties pre auction – a sign that sellers are getting a little less confident.

But there is no evidence of a bubble bursting or a hard landing.

There are still a number of growth drivers including a strong economy, population growth and overseas investment (albeit at lower levels.)

However, Sydney property values are stabilising after more than five years of strong growth where the value of the average home has risen by 75% during that time.

Price growth is now likely to moderate over the balance of this year, but the markets are fragmented with secondary properties being harder to sell.

The overall Brisbane’s property market only rose 3.0% over the last year, but there is great potential upside for Brisbane houses which are considerably cheaper than Sydney or Melbourne, so maybe they’ll still have their day in the sun.

Brisbane’s market is very fragmented and there are some areas that are performing respectably with good investment prospects and great places for young families to live cheaply.

Also read: 5 lessons learned from losing $1 million

On the other hand, there is a significant oversupply of new high rise off the plan apartments overshadowing the inner city area and nearby suburbs with owners now giving significant incentives to attract tenants.

Canberra’s property market is a “quiet achiever” having performed well with home values increasing by 8% over the last year.

Other than Melbourne and Sydney, Canberra is the only market to have achieved levels of capital growth above inflation over the last decade.

The Darwin property market is still suffering from the effects of the end of our mining boom and values across the city are 18.6% lower than their peak in August 2010.

As opposed to the east coast capital cities where many jobs are being created, Darwin had a net increase of only 153 jobs last year, showing how its economy is languishing.

Darwin does not have significant growth drivers on the horizon and would be best avoided by investors.

The Hobart property market was the best performing market over the last year increasing in value by 13.6%

The local economy is picking up helped by the redevelopment of the Royal Hobart Hospital and upgrades to universities, hotels and retail precincts.

Even though some commentators are suggesting it’s a good place to invest, I don’t agree as there are few long term growth drivers and despite Hobart’s current fast rate of growth, dwelling values only increased 26.7% over the last 10 years.

While some have called the bottom for the Perth property market, our research suggests it is still in its slump with a significant oversupply of properties for sale. And the latest stats seem to confirm this.

Like the rest of Australia, the Adelaide property market is very fragmented with some suburbs showing three times the capital growth of others.

Also read: Why the smashed avo debate is over

Overall home values are up 5.8 % over the last 12 months while unit values only increased by 1.1%.

There are few growth drivers in Adelaide with fewer than 8,000 new jobs created there last year.

The Bottom Line.

The question many are asking is: Is the Australian property market consolidating in preparation for another boom- in other words are we experiencing a mid cycle breather like the markets have exhibited a few times over the last five strong years.

Or have we finally reached a tipping point where prices start to drop?

With the Spring selling season is just around the corner we’ll soon find out if there’ll be enough demand to absorb the additional supply.

We can be sure of one thing: uncertainty and risk are increasing, meaning home buyers and investors can’t count on automatic capital growth as we move ahead, so it will me important to use good judgment in deciding whether to buy, sell or hold.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Yahoo Finance

Yahoo Finance