Spotting Winners: Seagate Technology (NASDAQ:STX) And Semiconductors Stocks In Q1

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Seagate Technology (NASDAQ:STX) and the rest of the semiconductors stocks fared in Q1.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1.8%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but semiconductors stocks have exhibited impressive performance, with the share prices up 11.4% on average since the previous earnings results.

Seagate Technology (NASDAQ:STX)

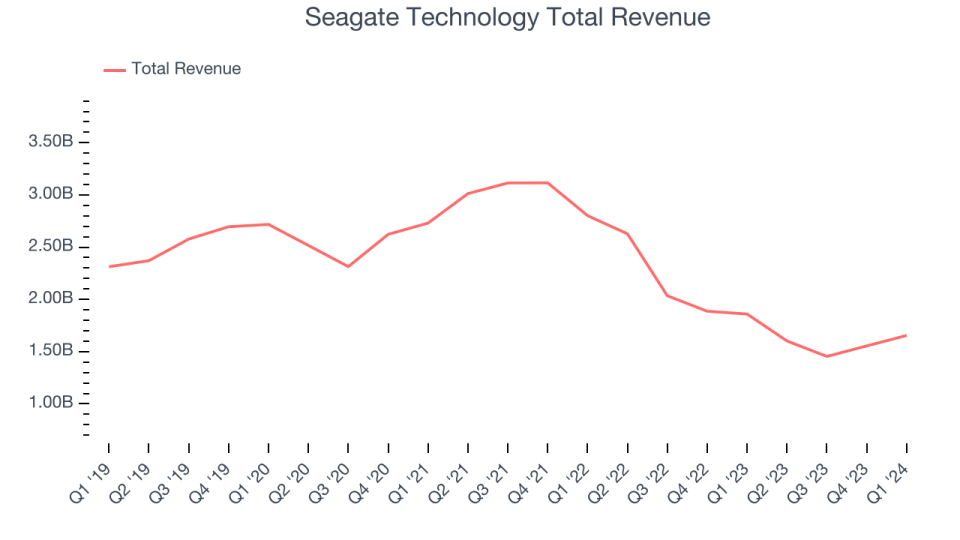

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $1.66 billion, down 11% year on year, falling short of analysts' expectations by 0.4%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

"Seagate’s March quarter revenue grew 6% and non-GAAP EPS more than doubled over the December quarter as we benefit from improving cloud demand, our strong operating discipline and price execution. This combination sets the foundation for a return to target margin performance as the markets recover," said Dave Mosley, Seagate’s chief executive officer.

The stock is up 20.9% since the results and currently trades at $104.87.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it's free.

Best Q1: Micron Technology (NASDAQ:MU)

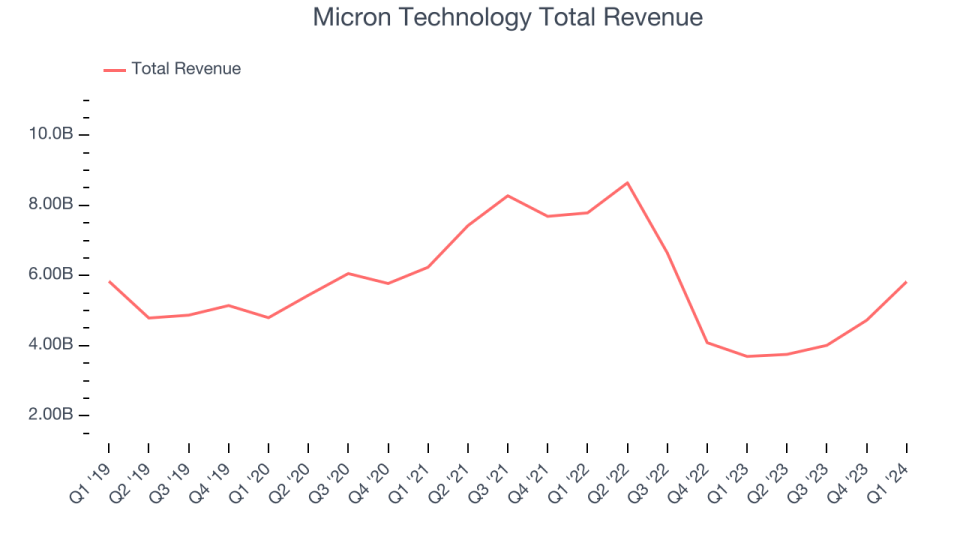

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $5.82 billion, up 57.7% year on year, outperforming analysts' expectations by 8.8%. It was a stunning quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 50.2% since the results and currently trades at $144.56.

Is now the time to buy Micron Technology? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.33 billion, down 40.6% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Microchip Technology had the slowest revenue growth in the group. The stock is down 1.4% since the results and currently trades at $92.5.

Read our full analysis of Microchip Technology's results here.

Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $25.43 million, down 23.6% year on year, surpassing analysts' expectations by 8.2%. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 19.4% since the results and currently trades at $5.92.

Read our full, actionable report on Amtech here, it's free.

Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $141.8 million, up 7.3% year on year, surpassing analysts' expectations by 3.7%. It was a strong quarter for the company, with an impressive beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

The stock is up 30.9% since the results and currently trades at $237.31.

Read our full, actionable report on Nova here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance