Spotting Winners: Central Garden & Pet (NASDAQ:CENT) And Household Products Stocks In Q1

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the household products industry, including Central Garden & Pet (NASDAQ:CENT) and its peers.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a solid Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and household products stocks have held roughly steady amidst all this, with share prices up 0.2% on average since the previous earnings results.

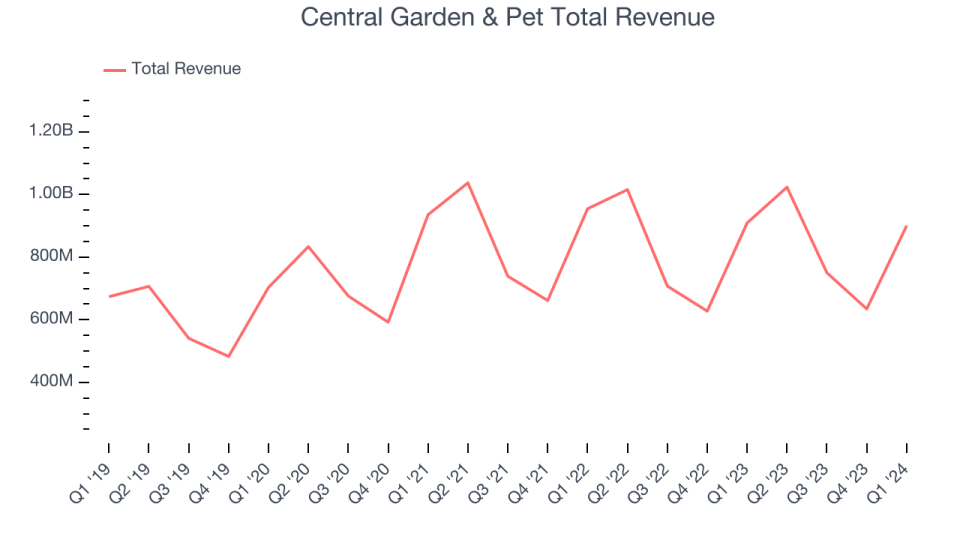

Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $900.1 million, down 1% year on year, topping analysts' expectations by 1.4%. It was a strong quarter for the company, with an impressive beat of analysts' organic revenue growth estimates and a solid beat of analysts' earnings estimates.

The stock is up 2.7% since the results and currently trades at $42.86.

Is now the time to buy Central Garden & Pet? Access our full analysis of the earnings results here, it's free.

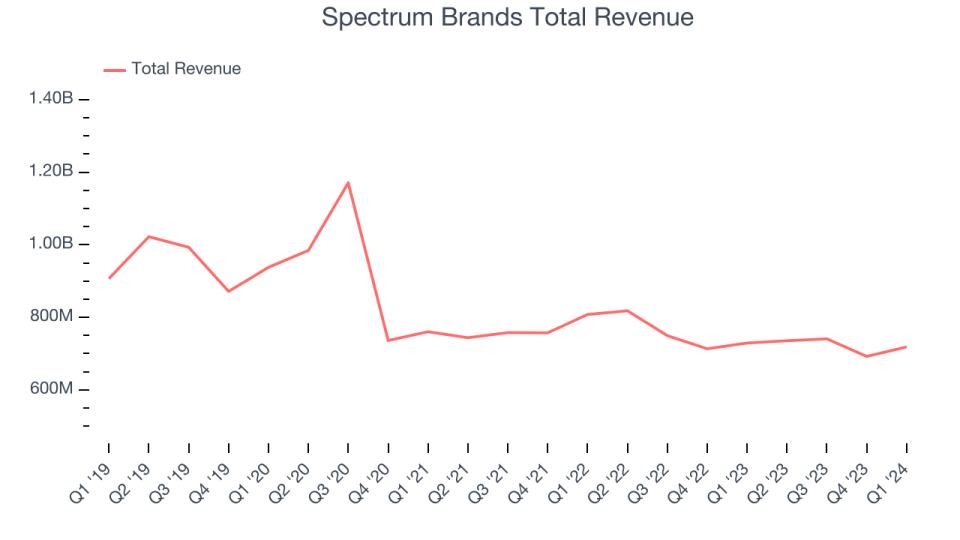

Best Q1: Spectrum Brands (NYSE:SPB)

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $718.5 million, down 1.5% year on year, outperforming analysts' expectations by 1.5%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 6.2% since the results and currently trades at $89.73.

Is now the time to buy Spectrum Brands? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $663.3 million, down 3% year on year, falling short of analysts' expectations by 0.1%. It was a weak quarter for the company, with a miss of analysts' organic revenue growth estimates.

The stock is down 3.2% since the results and currently trades at $28.5.

Read our full analysis of Energizer's results here.

Colgate-Palmolive (NYSE:CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $5.07 billion, up 6.2% year on year, surpassing analysts' expectations by 2.1%. It was a strong quarter for the company, with an impressive beat of analysts' organic revenue growth estimates and a decent beat of analysts' gross margin estimates.

The stock is up 5.3% since the results and currently trades at $93.99.

Read our full, actionable report on Colgate-Palmolive here, it's free.

Kimberly-Clark (NYSE:KMB)

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE:KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $5.15 billion, down 0.9% year on year, surpassing analysts' expectations by 1.2%. It was a very strong quarter for the company, with an impressive beat of analysts' organic revenue growth estimates.

The stock is up 6.6% since the results and currently trades at $137.38.

Read our full, actionable report on Kimberly-Clark here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance