Splunk's (SPLK) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

Splunk SPLK reported first-quarter fiscal 2021 non-GAAP loss of 56 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 57 cents. The company had reported non-GAAP earnings of 2 cents per share in the year-ago quarter.

Revenues increased 2.2% year over year to $434.1 million but missed the Zacks Consensus Estimate by 2.2%. The year-over-year upside was driven by greater utilization of Splunk’s products by existing customers and new customer wins.

Quarter in Details

License revenues (34.2% of revenues) were $148.4 million, down 26.9% year over year.

Meanwhile, Cloud services revenues (25.8% of revenues) increased 80.7% year over year to $112.2 million on the back of increased utilization of cloud-based services. Maintenance & service revenues (40% of revenues) rose 8.5% to $173.5 million.

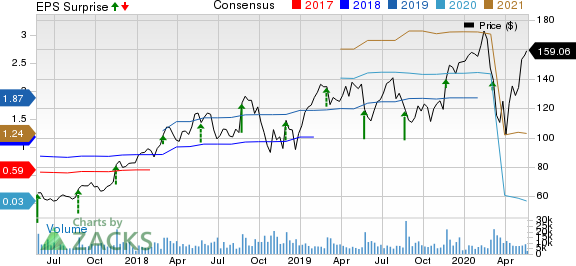

Splunk Inc. Price, Consensus and EPS Surprise

Splunk Inc. price-consensus-eps-surprise-chart | Splunk Inc. Quote

Notably, Cloud represented 44% of total software bookings for first-quarter fiscal 2021.

Remaining performance obligation (RPO) was $1.72 billion, up 44% year over year. The company expects to recognize $1 billion (indicating a 23% year-over-year increase) of this RPO as revenues over the next 12 months. RPO bookings declined 3.2% year over year to $352.8 million.

Splunk ended the period with total annual recurring revenue (ARR) of $1.77 billion, up 52% year over year, comprising $480 million from cloud and $1.29 billion from term license and maintenance contracts.

Splunk added new enterprise customers in the first quarter. Zoom ZM opted for Splunk’s Enterprise Security services in the reported quarter. Additionally, Shopify SHOP expanded its use of Splunk’s offerings by purchasing the newly launched SignalFx Microservices APM platform.

Moreover, Take-Two Interactive TTWO expanded the use of Splunk Cloud to increase its visibility into security of its gaming environment.

The Zacks Rank # 3 (Hold) company recorded 81 orders worth more than $1 million in contract value, up 76.1% from 46 in the year-ago period. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Splunk’s Data-to-Everything Platform including new products such as Data Fabric Search (DFS), Data Stream Processor (DSP) and Splunk Mission Control, launched in the third quarter, witnessed rapid adoption in the reported quarter.

Operating Details

Non-GAAP gross margin contracted 560 basis points (bps) from the year-ago quarter to 76% due to greater proportion of cloud revenue contribution. Splunk’s non-GAAP cloud gross margin expanded 780 basis points (bps) from the year-ago quarter to 15.2%

Non-GAAP operating expenses, as a percentage of revenues, expanded to 101.6% from 83.4% in the year-ago quarter. Research & development (R&D) expanded 850 bps, general and administrative (G&A) expanded 370 bps while sales & marketing (S&M) expenses expanded 600 bps year over year, respectively.

Non-GAAP operating loss was $111.1 million compared with a loss of $7.2 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Apr 30, 2020, cash & cash equivalents, including investments, were $922.5 million compared with $778.6 million reported in the previous quarter.

Guidance

For second-quarter fiscal 2021, Splunk expects revenues of $520 million. Non-GAAP operating margin is likely to be between negative 10% and negative 15%.

The company withdrew its previous guidance for its fiscal 2021 due to coronavirus-related uncertainties.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TakeTwo Interactive Software, Inc. (TTWO) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance