Splunk (SPLK) Tops Estimates in Q3 Earnings, Revenues Up Y/Y

Splunk SPLK reported third-quarter fiscal 2022 non-GAAP loss of 37 cents per share, which beat the Zacks Consensus Estimate by 30.2% but widened from 7 cents reported in the year-ago quarter.

Revenues increased 19% year over year to $664.8 million and beat the consensus mark by 1.7%.

Splunk shares were up 2.1% in after-hours trading.

Quarter in Details

License revenues (37.5% of revenues) were $249 million, up 3.7% year over year. Cloud services revenues (36.6% of revenues) surged 67.9% year over year to $243 million. Maintenance & service revenues (26% of revenues) fell 0.5% to $172.7 million.

Cloud represented 68% of total software bookings in the reported quarter, higher than 54% in the previous quarter and 46% in the year-ago quarter.

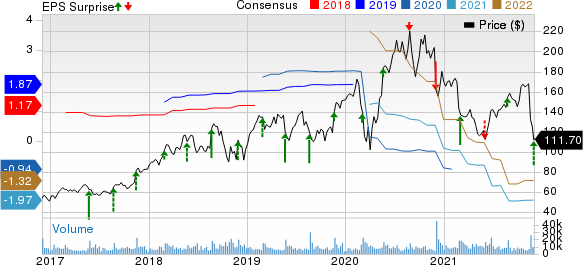

Splunk Inc. Price, Consensus and EPS Surprise

Splunk Inc. price-consensus-eps-surprise-chart | Splunk Inc. Quote

Splunk ended the quarter with total annual recurring revenues (“ARR”) of $2.83 billion, up 36.9% year over year. Cloud ARR soared 75.6% year over year to $1.11 billion.

The company ended fiscal third quarter with 635 customers generating ARR greater than $1 million, up 43% year over year. Splunk had 270 customers with Cloud ARR greater than $1 million, up 96% year over year.

Remaining performance obligation (“RPO”) was $2.07 billion, up 20.8% year over year. The company expects to recognize $1.35 billion (indicating a 30% year-over-year increase) of this RPO as revenues over the next 12 months.

Operating Details

Non-GAAP gross margin contracted 320 basis points (bps) from the year-ago quarter to 76.6%. Splunk’s non-GAAP cloud gross margin expanded 270 bps from the year-ago quarter to 64.7%

Non-GAAP operating expenses, as a percentage of revenues, increased to 86.6% from 81.6% reported in the year-ago quarter. Research & development, and general & administrative expenses expanded 400 bps and 210 bps year over year, respectively. Sales & marketing expenses declined 100 bps.

Non-GAAP operating loss was $66.1 million compared with loss of $9.5 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Oct 31, 2021, cash & cash equivalents, including investments, were $1.65 billion compared with $2.49 billion as of Jul 31, 2021.

Net cash flow used in operating activities was $19.4 million compared with the year-ago quarter’s $43 million and the sequential quarter’s $55.9 million.

Free cash outflow was $24.848 million at the end of the fiscal third quarter compared with the year-ago quarter’s $45.6 million.

Key Highlights

During the reported quarter, Splunk and Accenture ACN expanded their partnership by forming the Accenture Splunk Business Group.

Accenture Splunk Business Group brings together Splunk’s platform with Accenture’s functional knowledge, deep industry and technical expertise. This will help clients maximize insights from data, with a specific focus on AI-powered IT operations, security automation and intelligent supply chain.

Splunk unveiled the latest enhancements to Splunk Cloud Platform and Splunk Enterprise during the reported quarter. These enhancements will help organizations manage and thrive throughout their cloud journeys.

Guidance

For fourth-quarter fiscal 2022, Splunk expects revenues in the range of $740-$790 million. Non-GAAP operating margin is likely to be between -2% and -8%.

Total ARR is expected between $3.085 billion and $3.135 billion. Cloud ARR is expected to be between $1.33 billion and $1.35 billion.

Zacks Rank & Stocks to Consider

Splunk currently has a Zacks Rank #3 (Hold).

Splunk shares are down 34.3%, underperforming the Zacks Internet Software industry’s decline of 17.9% and Computer & Technology sector’s return of 23.6% year to date. Long term earnings growth rate stands at 30%.

A couple of better-ranked stocks in the Computer & Technology sector are Nova Measuring Instruments NVMI and Advanced Micro Devices AMD.

Currently, Nova Measuring sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Long-term earnings growth rate stands at 32.2%.

Nova Measuring shares have returned 83% year to date compared with the Zacks Electronics-Semiconductors industry’s growth of 36.7% and the Computer & Technology sector’s return of 23.6%.

Long-term earnings growth rate for AMD, a Zacks Rank #2 (Buy) stock, is currently pegged at 46.2%.

AMD shares have returned 62.6% year to date, outperforming the Electronics-Semiconductors industry’s growth of 36.7% and the Computer & Technology sector’s return of 23.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Nova Ltd. (NVMI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance