Should Spark Networks (NYSEMKT:LOV) Be Disappointed With Their 13% Profit?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It hasn't been the best quarter for Spark Networks SE (NYSEMKT:LOV) shareholders, since the share price has fallen 26% in that time. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 13%.

Check out our latest analysis for Spark Networks

Spark Networks isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Spark Networks saw its revenue grow by 22%. That's a fairly respectable growth rate. While the share price performed well, gaining 13% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

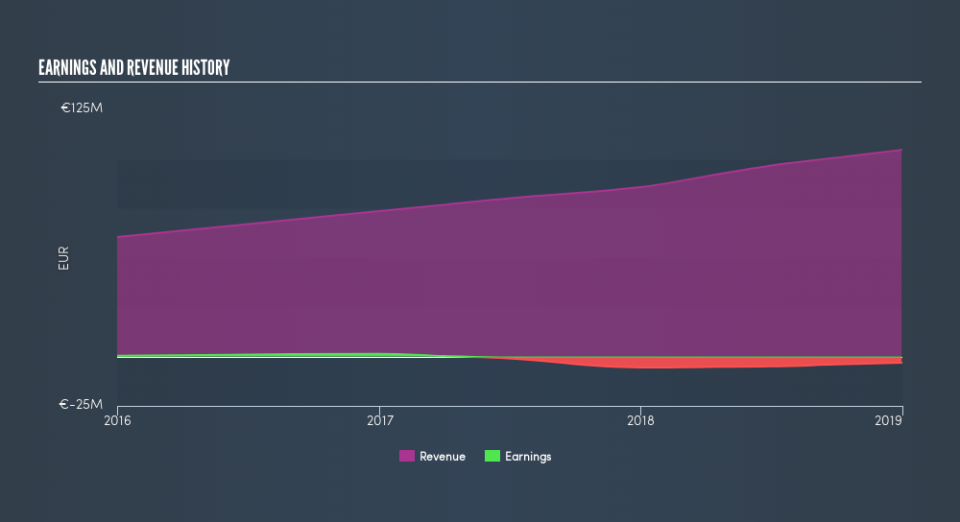

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling Spark Networks stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Spark Networks shareholders should be happy with the total gain of 13% over the last twelve months. We regret to report that the share price is down 26% over ninety days. Shorter term share price moves often don't signify much about the business itself. You could get a better understanding of Spark Networks's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance