Southern Cross Electrical Engineering (ASX:SXE) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Southern Cross Electrical Engineering (ASX:SXE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Southern Cross Electrical Engineering with the means to add long-term value to shareholders.

Check out our latest analysis for Southern Cross Electrical Engineering

Southern Cross Electrical Engineering's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. In previous twelve months, Southern Cross Electrical Engineering's EPS has risen from AU$0.056 to AU$0.058. That's a modest gain of 5.2%.

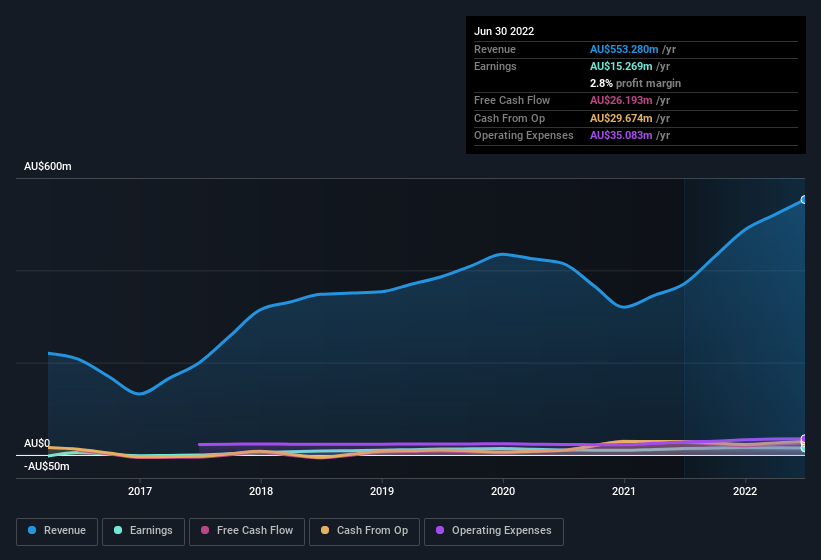

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Southern Cross Electrical Engineering remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 49% to AU$553m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Southern Cross Electrical Engineering is no giant, with a market capitalisation of AU$184m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Southern Cross Electrical Engineering Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Non-Executive Director, Karl Paganin, paid AU$85k to buy shares at an average price of AU$0.64. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Southern Cross Electrical Engineering insiders have a valuable investment in the business. Indeed, they hold AU$42m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 23% of the company; visible skin in the game.

Is Southern Cross Electrical Engineering Worth Keeping An Eye On?

As previously touched on, Southern Cross Electrical Engineering is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Still, you should learn about the 1 warning sign we've spotted with Southern Cross Electrical Engineering.

Keen growth investors love to see insider buying. Thankfully, Southern Cross Electrical Engineering isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance