Sorrento (SRNE) Rises on FDA IND Clearance for COVID Drug

Sorrento Therapeutics SRNE surged 10.1% on Jul 19 after the company announced that FDA cleared the investigational new drug (“IND”) application for STI-1558 in patients with impaired renal and hepatic function.

STI-1558 is an oral SARS-CoV-2 main protease and Cathepsin L inhibitor capable of interrupting viral replication, effectively blocking viral entry into host cells. It provides a dual mechanism of action in conjunction with protease inhibition to further protect against COVID-19.

FDA has cleared a phase I study which will examine the pharmacokinetic (PK) of STI-1558 in patients with moderate renal and hepatic impairment.

In the clinical study, the efficacy of two doses of STI-1558 (300 mg and 600 mg) will be studied in 12 subjects, using a cross-over design across three cohorts —12 normal subjects, 12 renally-impaired subjects and 12 hepatically-impaired subjects.

The successful results from the study are likely to allow Sorrento to proceed with the remaining phases of the clinical study of STI-1558 that is required to apply for an emergency use authorization (EUA) for the COVID-19 drug.

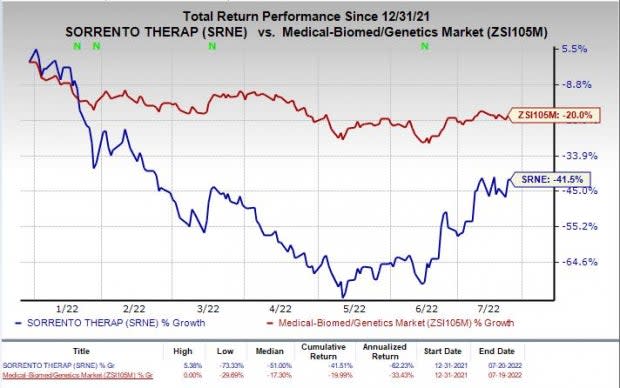

Shares of Sorrento have plunged 41.5% so far this year compared with the industry’s decline of 21.7%.

Image Source: Zacks Investment Research

In June, Sorrento announced that it dosed the first subject in phase I clinical study (NCT05364840) of STI-1558.

The previously-announced phase I study, being conducted in Australia, evaluated the safety, tolerability, and pharmacokinetics of STI-1558 in single ascending doses (SAD) followed by multiple ascending doses (MAD) in healthy volunteers in comparison to placebo.

The drug has been orally administered to patients across three cohorts with doses of 300, 600, and 1,200 mg. The study is in its final arm of administering patients with a dose of 2000 mg of the oral drug in the final cohort. Per the data from the study, STI-1558 has been well-tolerated in subjects to date.

Sorrento will prepare for a global phase II study in patients with acute onset of COVID-19 symptoms after completing the SAD/MAD study.

Sorrento Therapeutics, Inc. Price

Sorrento Therapeutics, Inc. price | Sorrento Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Sorrento Therapeutics currently carries a Zacks Rank #3 (Hold)

Some better-ranked stocks in the same sector include Alkermes ALKS and Seagen SGEN, each carrying a Zacks Rank #1 (Strong Buy) and BioNTech BNTX, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ALKS’ loss estimates for 2022 have narrowed to a cent from a loss of 3 cents in the past 30 days. The earnings estimate for 2023 has remained steady at 56 cents in the same time frame.

Alkermes surpassed earnings in all the trailing four quarters, the average being 350.48%.

Seagen’s loss per share estimates for 2022 have narrowed from $3.50 to $3.49 in the past 30 days. The same for 2023 has widened from $1.41 cents to $1.43 cents in the same time frame. SGEN has returned 11.8% in the year-to-date period.

Earnings of Seagen missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 40.08%.

BioNTech’s earnings per share estimates for 2022 have narrowed from $34.79 to $33.51 in the past 30 days. The same for 2023 has increased from $15.60 to $16.27 in the same time frame.

Earnings of BioNTech beat estimates in all the trailing four quarters, the average surprise being 13.42%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

Sorrento Therapeutics, Inc. (SRNE) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance