Sonoco Products Co (SON) Q1 2024 Earnings: Misses EPS Estimates Amid Strategic Shifts

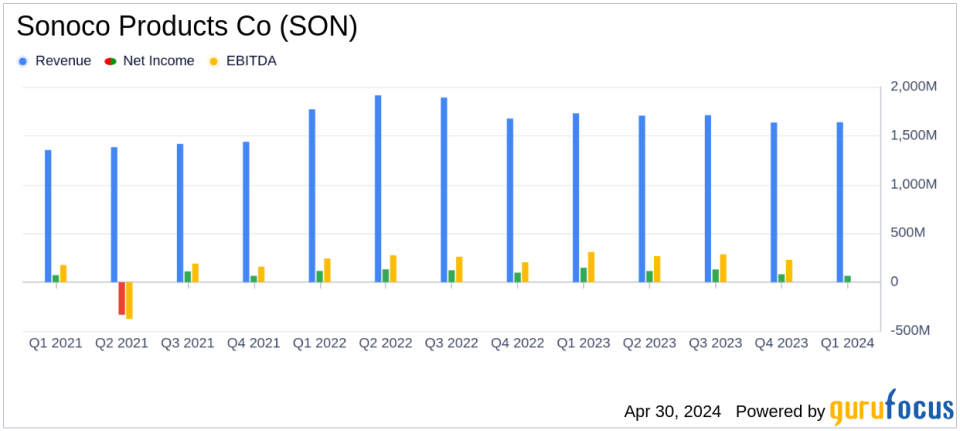

Net Income: Reported at $65 million, falling short of the estimated $100.52 million.

Revenue: Totaled $1.638 billion, below the estimated $1.674 billion.

Earnings Per Share (EPS): Achieved $0.66, significantly below the estimated $1.05.

Free Cash Flow: Generated $80 million, demonstrating strong cash management despite a slight decrease from the previous year's $86 million.

Dividend: Increased the quarterly dividend to $0.52 per share, marking the 41st consecutive year of dividend growth.

Operating Cash Flow: Improved to $166 million from $98 million in the prior year, reflecting effective operational efficiencies.

Adjusted EBITDA: Reached $245 million, indicating robust profitability though lower than the previous year's $276 million.

Sonoco Products Co (NYSE:SON), a leader in sustainable global packaging solutions, disclosed its first quarter results for 2024 on April 30, revealing figures that fell short of analyst expectations for earnings per share but provided a detailed account of strategic adjustments and productivity improvements. The full details can be accessed through Sonoco's 8-K filing.

With a rich history spanning over a century, Sonoco Products has developed a robust portfolio of industrial and consumer packaging solutions, including flexible and rigid plastics, and composite cans, primarily serving markets across North America. The company has also demonstrated a strong commitment to shareholder returns, consistently increasing its dividend for over three decades.

Financial Performance Overview

For Q1 2024, Sonoco reported net sales of $1.638 billion, a decrease of 5% year-over-year, primarily due to pricing adjustments and changes in recycling operations. The reported EPS of $0.66 significantly missed the estimated $1.05, while adjusted EPS was $1.12, closer to but still below expectations. The operating cash flow was robust at $166 million, with free cash flow also strong at $80 million.

The company's net income attributable to Sonoco stood at $65 million, a stark decline from the previous year's $148 million. This drop reflects the absence of gains recognized in Q1 2023 from asset sales, alongside ongoing price/cost pressures and lower volumes in certain segments.

Strategic and Operational Highlights

Sonoco's strategic maneuvers included the sale of its Protective Solutions business, aiming to simplify its portfolio. The proceeds from this sale were primarily used to reduce debt. Furthermore, the company entered into a Virtual Power Purchase Agreement to secure a significant portion of its expected U.S. electricity needs for 2025, aligning with its sustainability goals.

Despite a challenging demand environment and persistent price/cost headwinds, Sonoco's focus on operational discipline and productivity, yielding $51 million, cushioned some negative impacts. The integration of its flexible and thermoformed packaging businesses within the Consumer segment is expected to streamline operations and foster growth.

Segment Performance

The Consumer Packaging segment saw a 5% decrease in net sales to $911 million, affected by lower consumer purchases due to inflationary pressures. The Industrial Packaging segment also experienced a 4% decline in sales to $593 million, driven by lower pricing and weak global demand for converted products.

Future Outlook

Looking ahead, Sonoco anticipates adjusted EPS for Q2 2024 to range between $1.25 and $1.35. For the full year, the company expects adjusted EPS between $5.00 and $5.30, with operating cash flow projected between $650 million and $750 million. These forecasts reflect expected improvements in metal packaging sales and ongoing productivity benefits.

CEO Howard Coker commented on the results and outlook, emphasizing the company's strategic progress and focus on financial discipline. "At the midpoint of second quarter 2024 guidance, we expect sequential adjusted earnings per share improvement of 16% over first quarter results from increased sales in metal packaging and trade paper and continued strong productivity across all businesses," stated Coker.

As Sonoco continues to navigate a complex market environment, its strategic initiatives and operational adjustments will be crucial in maintaining stability and driving future growth.

Explore the complete 8-K earnings release (here) from Sonoco Products Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance