Will Solid Service Revenues Aid Boeing (BA) in Q1 Earnings?

The Boeing Company BA is set to release first-quarter 2024 results on Apr 24, before the opening bell.

In the last reported quarter, the company incurred a loss of 47 cents per share, which came in narrower than the Zacks Consensus Estimate of a loss of 72 cents. Solid service revenues are likely to have boosted Boeing’s first-quarter earnings amid the adverse impacts of unfavorable commercial and defense deliveries.

Dismal Deliveries Likely to Hurt Results

Boeing’s first-quarter deliveries reflect a 36.2% decline in commercial shipments from the year-ago quarter’s reported figure. Also, defense shipments deteriorated 66.7% year over year.

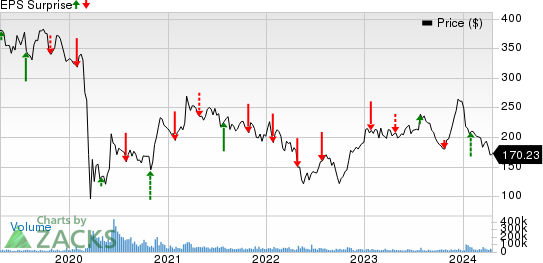

The Boeing Company Price and EPS Surprise

The Boeing Company price-eps-surprise | The Boeing Company Quote

For manufacturing companies like Boeing, successful deliveries of finished products play a crucial role in boosting its revenue growth.

Considering the fact that Boeing’s military and commercial revenues accounted for almost 76% of its total revenues as of 2023-end, the notable decline in delivery figures for both the commercial and defense shipments is likely to have hurt the company’s overall first-quarter top-line performance.

Expectations for Boeing Global Services

We remain optimistic about Boeing Global Services’ (“BGS”) first-quarter performance.

Notably, a steadily growing global commercial air travel is likely to have bolstered fleet utilization, thereby boosting commercial jet service revenues in the first quarter.

This, along with several BA-converted freighter and materials management agreements in the recent past, is projected to have added an impetus to BGS’ quarterly revenues.

In the fourth quarter of 2023, BGS opened a parts distribution center in India and received a follow-on contract to provide sustainment for the C-17. Such a facility construction might have had pushed up operating expenses for this unit in the first quarter, thereby partially affecting BGS unit’s bottom-line performance.

Nevertheless, solid revenue expectations, as well as improved operating margins (backed by stable demand from government service business), must have bolstered BGS unit’s bottom line.

The Zacks Consensus Estimate for the unit’s revenues is pegged at $4,992.2 million, indicating an improvement of 5.8% from the year-ago quarter’s reported number.

The consensus mark for earnings is pinned at $891.3 million, indicating solid growth of 5.2% year over year.

Cash Flow Projections

Strong order activity in the recent past and increased aftermarket services are expected to have favorably contributed to Boeing’s first-quarter cash flow reserve.

Our model predicts a cash flow of $769.8 million for the first quarter of 2024.

Q1 Expectations

Solid service revenues are likely to have bolstered BA’s overall first-quarter performance amid unfavorable revenues expected from its commercial aerospace and defense units.

Positive sales expectations, along with lowering abnormal costs associated with BA’s 787 jet models, must have bolstered the company’s overall bottom-line performance.

The Zacks Consensus Estimate for Boeing’s total revenues is pegged at $17.98 billion, implying a 0.4% increase from the prior-year period’s reported figure. The bottom-line estimate is pinned at a loss of $1.22 per share, indicating an improvement from the year-ago quarter’s reported loss of $1.27.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Boeing this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Boeing has an Earnings ESP of -33.85% and a Zacks Rank #5 (Strong Sell) at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Below are three defense stocks that have the right combination of elements to post an earnings beat this time around.

Huntington Ingalls Industries Inc HII is slated to release first-quarter results on May 2. HII has an Earnings ESP of +1.39% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Huntington Ingalls delivered a four-quarter average earnings surprise of 20.64%. The consensus estimate for first-quarter earnings is pegged at $3.49 per share, while that for sales is pinned at $2.80 billion.

L3Harris Technologies LHX is scheduled to release first-quarter results on Apr 25. LHX has an Earnings ESP of +0.53% and a Zacks Rank #3 at present.

L3Harris delivered a four-quarter average earnings surprise of 1.53%. The Zacks Consensus Estimate for LHX’s first-quarter earnings is pegged at $2.89 per share, while that for sales is pinned at $5.09 billion.

Northrop Grumman NOC is slated to report first-quarter results on Apr 25. NOC has an Earnings ESP of +1.65% and a Zacks Rank #3 at present.

NOC delivered a four-quarter average earnings surprise of 5.64%. The consensus mark for NOC’s first-quarter earnings is pegged at $5.83 per share, while that for sales is pinned at $9.77 billion.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance