Solid Business Model & Strong Housing Demand Benefit NVR

NVR, Inc. NVR has been benefiting from improving demand amid low existing home inventory, prevailing economic conditions and interest rate woes.

NVR, which engages in the construction and sale of single-family detached homes, townhomes and condominium buildings, banks on a disciplined business model and strong orders and backlog.

Also, a focus on maximizing liquidity and minimizing risks is likely to help this Zacks Rank #1 (Strong Buy) company generate more returns for shareholders in the long term.

Along with NVR, the industry bigwigs like PulteGroup, Inc. PHM, D.R. Horton, Inc. DHI and Toll Brothers, Inc. TOL have undertaken various strategic actions to drive margins, which is encouraging.

A Quick Glance at Historical Performance & Growth Prospect

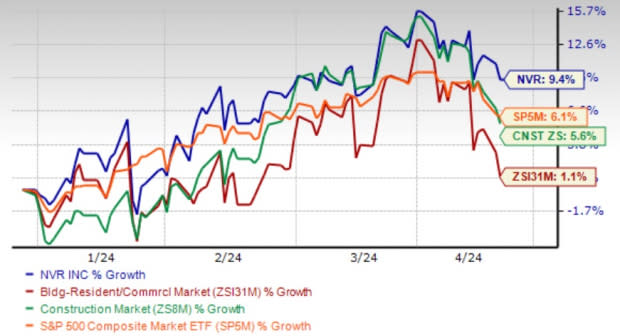

Shares of the company have gained 9.4% so far this year versus the Zacks Building Products - Home Builders industry’s 1.1% growth and S&P 500’s 6.1% rally. Impressively, NVR has also outperformed the Zacks Construction sector’s 5.6% rise. The upside is stemmed from solid earnings surprise activity. Its earnings topped analysts’ expectations in the trailing five quarters.

Image Source: Zacks Investment Research

Earnings estimates for 2024 have moved up to $497.80 per share from $484.48 over the past 30 days. The current-year earnings per share reflect 7.4% year-over-year growth on a 7.6% increase in revenues.

Also, it currently has a Growth & Momentum Score of B, which increases confidence in the company’s future. This positive trend signifies analysts’ bullish sentiments.

Factors Bridging for Solid Future: Growth Potential & Outperformance

Improving Housing Market: The scarcity of available existing homes for sale, coupled with a positive trend in mortgage rates and indications from the Federal Reserve suggesting a potential rate cut, indicates growing optimism in the homebuilding industry.

The market is also bolstered by robust order growth backed by reduced cancelation rates as well as affordable homes. This positive trend will continue to boost homebuilders’ margins, supported by easing inflation and overall economic stability. The Federal Open Market Committee's recent decision to maintain the benchmark interest rate within a targeted range of 5.25%-5.5% provides a sense of stability for homebuilders.

On Mar 20, 2024, the Federal Reserve chose to keep its key interest rate unchanged for the fifth consecutive meeting, citing the need for additional data before considering any rate adjustments. While Fed officials grapple with the challenge of finding the right timing for potential actions, the majority still anticipate three rate cuts throughout 2024.

Disciplined Business Model: NVR’s main business involves selling and building quality homes and acquiring finished building lots without the risk of owning and developing land in a cyclical industry. This business strategy is in sharp contrast to that of the other homebuilders.

The lot acquisition strategy helps the company avoid financial requirements and risks associated with direct land ownership and land development. This strategy allows it to gain efficiencies and a competitive edge over its peers.

Robust Orders & Backlog Level: NVR’s business has been witnessing strong orders in recent months. During 2023, new orders (net of cancelations) increased 13.4% to 21,729 units compared with 19,164 units in the prior year. The decline in the average selling price of homes increased consumer affordability, which aided the demand trend in the high mortgage rate environment in 2023. The new order cancelation rate also provided stability (declined 12.8% in 2023 versus 14.2% in 2022). At the end of 2023, backlog improved 12% on a unit basis and grew 10% on a dollar basis.

Stock’s Returns & Profitability

Return on Equity or ROE is an important measure to see how a company makes use of its equity and the returns are generated on it. NVR’s trailing 12-month ROE currently stands at 38.5% compared with the industry’s 18.2%.

The forward 12-month price-to-earnings (P/E) ratio, which is calculated to see the company's value relative to its earnings, for NVR is 15.27x currently versus 10.10x for the industry. This means the stock is overvalued than the industry. The company has a Beta of 1.13, while the industry as a whole is more risky, with a higher Beta of 1.63. It is to be noted that the stocks with betas above 1.0 have a very high degree of systematic risk.

A Brief About Other Stocks

PulteGroup engages in homebuilding and financial services businesses, primarily in the United States. PulteGroup is benefiting from its solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups. Owing to better demand conditions, the company raised investment in land development and the purchase of new land assets over the years.

The Zacks Consensus Estimate for PHM’s current-year earnings per share has improved to $11.79 from $11.77 over the past 30 days. PHM presently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

D.R. Horton is one of the leading national homebuilders, primarily engaged in the construction and sale of single-family houses both in the entry-level and move-up markets. The company has been benefiting from its production capabilities, industry-leading market share, solid acquisition strategy, broad geographic footprint and diverse product offerings across multiple brands and price points. The company’s strategic shift toward more entry-level affordable homes has been paying off, with the segment experiencing strong demand and limited supply.

The Zacks Consensus Estimate for DHI’s current-year earnings per share has improved to $14.25 from $14.24 over the past seven days. DHI currently has a Zacks Rank of 2.

Toll Brothers, a Zacks Rank #1 homebuilding company, has been benefiting from strong market demand, combined with its policy of boosting its supply of spec homes and focusing on operational efficiency. Also, the emphasis on affordable luxury communities and its build-to-order model bodes well.

The Zacks Consensus Estimate for TOL’s current-year earnings per share has improved to $13.71 from $12.23 over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance