Software Development Stocks Q1 Teardown: JFrog (NASDAQ:FROG) Vs The Rest

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at JFrog (NASDAQ:FROG) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.7%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and software development stocks have had a rough stretch, with share prices down 7.6% on average since the previous earnings results.

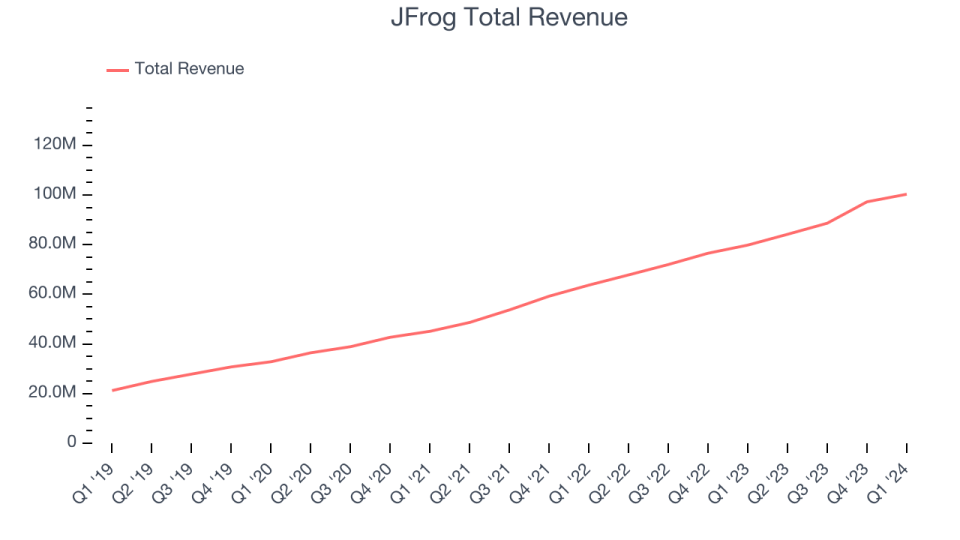

JFrog (NASDAQ:FROG)

Named after the founders' affinity for frogs, JFrog (NASDAQ:FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

JFrog reported revenues of $100.3 million, up 25.7% year on year, topping analysts' expectations by 1.7%. It was a weaker quarter for the company, with a miss of analysts' billings estimates and decelerating growth in large customers.

"The landscape of DevOps and security is undergoing dramatic change, and I'm thrilled about the future prospects for JFrog. Our platform's evolution into a comprehensive solution spanning DevOps, DevSecOps, MLOps and MLSecOps sets a new standard in enterprise capabilities,” stated Shlomi Ben Haim, JFrog CEO and Co-founder.

The stock is down 17% since the results and currently trades at $33.75.

Is now the time to buy JFrog? Access our full analysis of the earnings results here, it's free.

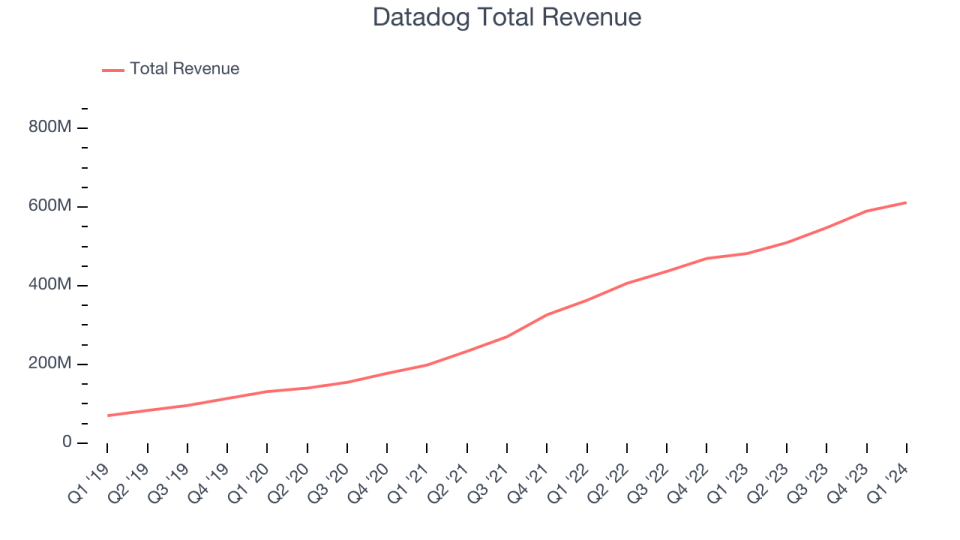

Best Q1: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $611.3 million, up 26.9% year on year, outperforming analysts' expectations by 3.3%. It was a strong quarter for the company, with an impressive beat of analysts' ARR (annual recurring revenue) estimates and accelerating growth in large customers.

The stock is down 6.2% since the results and currently trades at $119.05.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: F5 (NASDAQ:FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $681.4 million, down 3.1% year on year, falling short of analysts' expectations by 0.4%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' billings estimates.

F5 had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 7.4% since the results and currently trades at $168.68.

Read our full analysis of F5's results here.

PagerDuty (NYSE:PD)

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $111.2 million, up 7.7% year on year, falling short of analysts' expectations by 0.3%. It was a solid quarter for the company, with accelerating customer growth and a decent beat of analysts' billings estimates.

The company added 81 customers to reach a total of 15,120. The stock is up 20.7% since the results and currently trades at $21.66.

Read our full, actionable report on PagerDuty here, it's free.

Cloudflare (NYSE:NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare reported revenues of $378.6 million, up 30.5% year on year, surpassing analysts' expectations by 1.4%. It was a weaker quarter for the company, with a miss of analysts' billings estimates.

The stock is down 10% since the results and currently trades at $80.11.

Read our full, actionable report on Cloudflare here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance