Will Soft Comps Hurt Cheesecake Factory (CAKE) Q4 Earnings?

The Cheesecake Factory Inc. CAKE is scheduled to report fourth-quarter fiscal 2017 numbers on Feb 21, after market close.

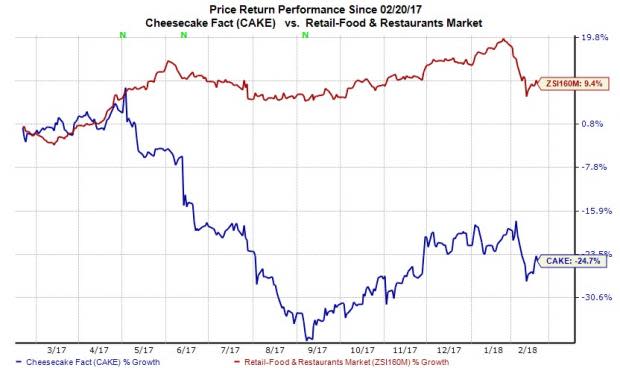

Last quarter, shares of the company have declined 24.7% against the industry’s 9.4% gain. A challenging operating environment in the U.S. restaurants space has been affecting the company’s performance.

Unfortunately, the situation is expected to remain unchanged in the to-be-reported quarter as well. Let’s find out why.

Tough Sales Environment to Weigh on Revenues

The company initiatives to boost sales and traffic via menu innovations, roll out an improved server training program, launch mobile payment app and increase focus on delivery service are impressive. However, continuous choppy sales environment in the overall restaurant space along with weak comps are likely to hurt revenue growth in the to-be-reported quarter.

The Zacks Consensus Estimate for the quarter's sales is projected at $562.8 million, reflecting a 6% decrease year over year. In the preceding quarter, sales of $555 million declined 0.8% year over year.

As far as comps are concerned, The Cheesecake Factory expects fourth-quarter comps to be in the band of down 1% to flat. Again, the Zacks Consensus Estimate for comps decline is pegged at 0.6%. In the year-ago quarter, the company witnessed comps growth of 1.1%.

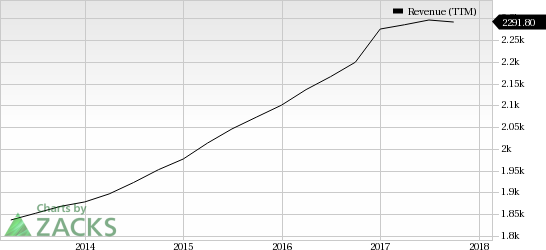

The Cheesecake Factory Incorporated Revenue (TTM)

The Cheesecake Factory Incorporated Revenue (TTM) | The Cheesecake Factory Incorporated Quote

Expense Woes to Continue

Higher labor costs, pre-opening costs of outlets and expenses related to execution of the initiatives are expected to keep profits under pressure. Markedly, the consensus estimate for earnings is pegged at 53 cents, reflecting a year-over-year decline of 20.9%.

Our Model Suggests a Beat

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The sell-rated stocks (Zacks Rank #4 or 5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Cheesecake Factory has an Earnings ESP of +0.82% and a Zacks Rank #3, a combination that increases the odds of an earnings beat.

Stocks to Consider

Here are a few stocks from the restaurant space that investors may consider as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Domino’s DPZ has an Earnings ESP of +0.37% and a Zacks Rank #2. The company is slated to report quarterly numbers on Feb 20. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Wendy's Company WEN has an Earnings ESP of +3.71% and a Zacks Rank #3. The company is slated to report quarterly results on Feb 21.

Zoe's Kitchen ZOES has an Earnings ESP of +13.16% and a Zacks Rank of 3. The company is slated to report quarterly numbers on Feb 22.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Wendy's Company (The) (WEN) : Free Stock Analysis Report

Zoe's Kitchen, Inc. (ZOES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance