Sociedad Quimica (SQM) Q4 Earnings Beat Estimates, Sales Lag

Sociedad Quimica y Minera de Chile S.A. SQM recorded earnings of $4.03 per share for fourth-quarter 2022, up from $1.13 in the year-ago quarter. Earnings per share for the reported quarter beat the Zacks Consensus Estimate of $3.80.

The company registered revenues of $3,133.6 million for the quarter, up around 189% year over year. It, however, missed the Zacks Consensus Estimate of $3,174.8 million. The company gained from the high pricing environment and strong demand for lithium in the reported quarter.

Sociedad Quimica y Minera S.A. Price, Consensus and EPS Surprise

Sociedad Quimica y Minera S.A. price-consensus-eps-surprise-chart | Sociedad Quimica y Minera S.A. Quote

Segment Highlights

Revenues from the Lithium and Derivatives segment surged more than fivefold year over year to $2,525.1 million in the reported quarter. The upside was driven by strong prices and volumes. Demand in the fourth quarter was driven by driven by higher cathode and electric vehicle production.

The Specialty Plant Nutrients ("SPN") segment raked in revenues of $274.2 million, up around 2% year over year. The company benefited from a favorable pricing environment.

Revenues from the Iodine and Derivatives unit came in at $212.6 million, up around 94% year over year. The segment benefited from increased demand in the iodine market.

Revenues from the Potassium Chloride and Potassium Sulfate business fell roughly 61% year over year to $80.5 million. Sales were impacted by weaker prices in the potassium chloride market during the quarter.

The Industrial Chemicals unit recorded sales of $34 million, down around 9% year over year.

FY22 Results

Earnings for full-year 2022 were $13.68 per share, up from $2.05 per share a year ago. Net sales rose nearly four-fold year over year to $10,710.6 million.

Financials

The company’s cash and cash equivalents were $2,655.2 million at the end of 2022, up around 75% on a year-over-year basis. Long-term debt was $2,394.2 million, down around 7% year over year.

Outlook

Moving ahead, the company envisions lithium demand to grow more than 20% year over year in 2023 factoring in growing electric vehicles sales in all markets, especially in the United States. In SPN, the company expects some demand recovery in 2023.

In Iodine and Derivatives, it sees demand growth of 1.2% in overall iodine market in 2023. The company saw a nearly 7% sequential growth in average price in the fourth quarter and expects prices to remain at these levels during the first half of 2023.

For the potassium chloride business, SQM envisions some price recovery this year. It also expects potassium sale volumes to exceed 500,000 metric tons in 2023.

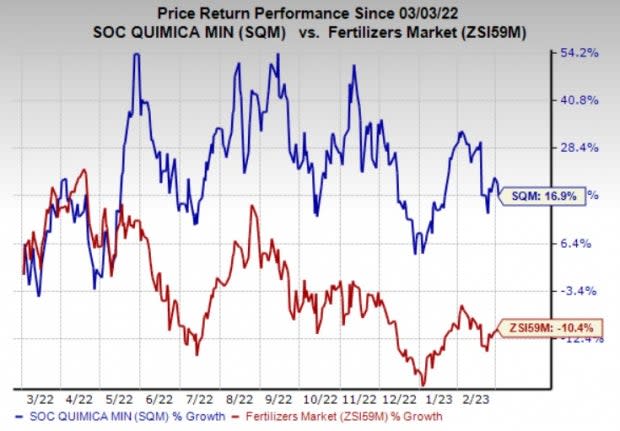

Price Performance

Shares of Sociedad Quimica are up 16.9% over a year compared with the industry’s decline of 10.4%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Sociedad Quimica currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Commercial Metals Company CMC and Nucor Corporation NUE.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 22.3% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has rallied around 72% in a year.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 10% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 16.7%, on average. CMC has gained around 31% in a year.

Nucor currently carries a Zacks Rank #1. The Zacks Consensus Estimate for NUE’s current-year earnings has been revised 12.5% upward in the past 60 days.

Nucor beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.7% on average. NUE’s shares have gained roughly 28% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance