Snowflake (SNOW) Q1 Earnings Top Estimates, Revenues Up Y/Y

Snowflake SNOW reported first-quarter fiscal 2023 non-GAAP earnings of 1 cent per share, beating the Zacks Consensus Estimate by 200%. The company had reported a loss of 24 cents in the year-ago quarter.

Revenues of $422.4 million beat the consensus mark by 3.11% and jumped 84.5% year over year.

Top-Line Details

Snowflake’s product revenues accounted for 93.4% of total revenues. The figure was $394.4 million, up 84.4% year over year and much ahead of SNOW’s guidance range of $383 million-$388 million.

Professional Services and other revenues contributed 6.6% to total revenues. The figure was $27.9 million, up 85.2% year over year.

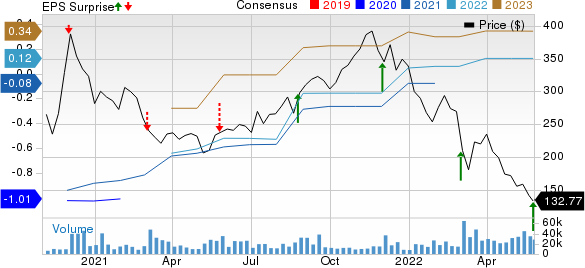

Snowflake Inc. Price, Consensus and EPS Surprise

Snowflake Inc. price-consensus-eps-surprise-chart | Snowflake Inc. Quote

In the fiscal first quarter, Snowflake witnessed a net revenue retention rate of 174% for existing customers, better than the 168% reported in the year-ago quarter but slightly lower than the 177% reported in the previous quarter.

Snowflake reported 40% year-over-year growth in the number of customers, reaching 6,322 in the reported quarter. The company added 16 Forbes Global 2000 customers. Snowflake booked four eight-figure deals in the reported quarter, up from two in the year-ago quarter.

Snowflake had 206 customers (with more than $1 million in product revenues), up 98% year over year, in the reported quarter.

Product revenues from customers in the health care and life sciences vertical grew more than 100% year over year in the reported quarter.

Snowflake is benefiting from a strong partner base. Amazon AMZN and Cognizant CTSH are the key technology partners of Snowflake.

Amazon’s cloud division, AWS, helps SNOW provide seamless integration among different cloud platforms to help customers store and analyze data in the Healthcare and Life sciences industry. Meanwhile, Cognizant is building solutions on Snowflake platforms for clients in the Healthcare industry.

Operating Details

The non-GAAP gross margin expanded by 260 basis points (bps) year over year to 71%.

The product gross margin expanded by 300 bps on a year-over-year basis to 75%, driven by product improvements, favorable cloud agreement pricing, improving scale and a growing enterprise customer base.

Research & development expenses, as a percentage of revenues, decreased by 370 bps on a year-over-year basis to 17.3%.

General & administrative expenses, as a percentage of revenues, were 9.8%, down 400 bps year over year.

Sales and marketing expenses, as a percentage of revenues, declined by 570 bps on a year-over-year basis to 43.5%.

Total operating expenses, as a percentage of revenues, were 70.6% compared with the 84% reported in the year-ago quarter.

The operating income was $1.7 million in the reported quarter against the year-ago quarter’s operating loss of $35.8 million.

Balance Sheet & Cash Flow

As of Apr 30, 2022, Snowflake had cash, cash equivalents and short-term investments of $3.82 billion compared with $3.85 billion as of Jan 31, 2022.

The remaining performance obligations at the end of the first quarter of 2023 were $2.61 billion, up 82% year over year.

The adjusted free cash flow was $181.4 million in the reported quarter compared with the previous quarter’s $102.1 million.

Guidance

For the second quarter of fiscal 2023, Snowflake expects product revenues in the range of $435 million-$440 million. The projection range indicates year-over-year growth of 71-73%.

The operating loss margin is expected at 2% for the second quarter.

For fiscal 2023, Snowflake now expects product revenues in the range of $1.885 billion-$1.900 billion, suggesting year-over-year growth of 65-67%.

The non-GAAP product gross margin is expected at 74.5% and the non-GAAP operating margin is expected at 1%.

The non-GAAP adjusted free cash flow margin is expected at 16% in fiscal 2023.

Zacks Rank & Stock to Consider

Snowflake currently has a Zacks Rank #3 (Hold).

SNOW shares have surged 60.8% against the Zacks Computer & Technology sector’s decline of 17.9% year to date (YTD).

A better-ranked stock in the Computer & Technology sector is Samsara IOT, which has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Samsara is scheduled to release first-quarter fiscal 2023 results on Jun 2. IOT shares have been down 61.8% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Samsara Inc. (IOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance