Smartsheet (SMAR) to Report Q3 Earnings: What's in the Cards?

Smartsheet SMAR is set to report third-quarter fiscal 2020 results on Dec 4.

For the fiscal third quarter, the company expects revenues between $69 million and $70 million, which calls for a rise of 47-49% year over year.

The Zacks Consensus Estimate for revenues is currently pegged at $69.7 million, which suggests 48.2% rally the year-ago quarter’s reported figure.

Moreover, the consensus mark for third-quarter loss has been steady at 18 cents per share in the past 30 days.

Notably, the company beat the Zacks Consensus Estimate for earnings in all of the trailing four quarters, the average positive surprise being 44.3%.

In the last reported quarter, Smartsheet reported adjusted loss of 8 cents per share, which is narrower than the Zacks Consensus Estimate of a loss of 16 cents.

Moreover, net revenues surged 53.8% from the year-ago quarter’s level to $64.6 million and beat the consensus mark by 1.8%.

Let’s discuss the factors that are likely to get reflected in the upcoming quarterly results.

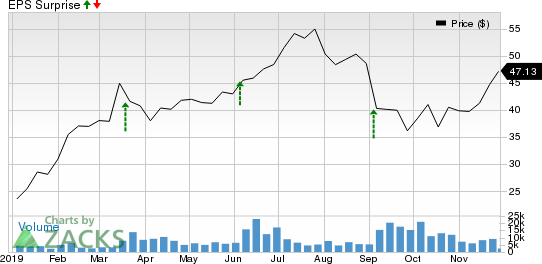

Smartsheet Inc. Price and EPS Surprise

Smartsheet Inc. price-eps-surprise | Smartsheet Inc. Quote

Factors to Consider

Smartsheet’s significant investments in product innovation and the company’s efforts to enhance the reach of their products through advertising campaigns are likely to have added new customers in third-quarter fiscal 2020.

Moreover, the company is constantly rolling out new product offerings to boost value for customers. Additionally, Smartsheet’s efforts to enter new markets and improve existing product capabilities are likely to have contributed to the top line in the to-be-reported quarter.

In August, the company received full FedRAMP (Federal Risk and Authorization Management Program) authorization. This is likely to have helped the company attract new federal customers and expand its existing federal client base in quarter to be reported.

However, Smartsheet’s continued investments in products and additional personnel are likely to have made a negative impact on the company’s margins in the fiscal third quarter.

Moreover, the company made heavy investments on sales and marketing with its third annual ENGAGE conference and brand advertising campaigns. This is expected to have impacted the company’s profitability in the to-be-reported quarter.

What Our Model Says

Our proven model doesn’t conclusively predict an earnings beat for Smartsheet this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Smartsheet has a Zacks Rank #2 and an Earnings ESP of 0.00%.

Stocks to Consider

Canadian Imperial Bank of Commerce CM has an Earnings ESP of +0.61% and a Zacks Rank of 2. You can see You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General Corporation DG has an Earnings ESP of +1.23% and a Zacks Rank of 2.

CarMax, Inc KMX has an Earnings ESP of +0.50% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CarMax, Inc. (KMX) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Smartsheet Inc. (SMAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance