Smartsheet (SMAR) Q3 Earnings and Revenues Beat Estimates

Smartsheet Inc. SMAR reported third-quarter fiscal 2020 non-GAAP loss of 15 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 18 cents. However, the figure was wider than the year-ago quarter’s loss of 9 cents.

Revenues surged 52.6% year over year to $71.5 million and surpassed the Zacks Consensus Estimate by 2.1%. The year-over-year increase in revenues was driven by customer wins and growth in business value.

Smartsheet ended fiscal the third quarter with more than 5.8 million users.

Quarter in Details

Subscription revenues (90% of total revenues) increased 55% from the year-ago quarter to $64.4 million. Professional services (10% of total revenues) revenues rose 34.1% from the year-ago quarter to $7.2 million.

Customers with annualized contract value (ACV) of $5,000 or higher increased 51% year over year to 8421. Additionally, customers with ACV of $50,000 or higher jumped 114% year over year to 770. Moreover, customers with ACV of $100,000 or higher surged 120% year over year to 279.

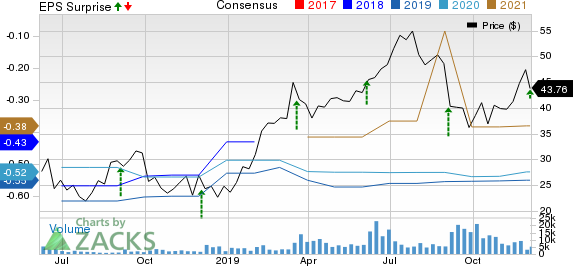

Smartsheet Inc. Price, Consensus and EPS Surprise

Smartsheet was successful in improving business relationship with a few customers, including the U.S. Bank, Krispy Kreme Doughnuts, and Rackspace in the reported quarter.

Notably, 69 companies increased their annual recurring revenues (ARR) by more than $50,000 and of these, 17 companies increased ARR by more than $100,000.

Smartsheet’s net dollar retention rate remained flat year over year at 134% in the reported quarter. Moreover, Smartsheet’s average ACV per domain-based customer grew 48% year over year.

The company ended third-quarter fiscal 2020 with 83,139 domain-based customers, reflecting growing demand for the company’s products like Accelerator, Dynamic View and Data Uploader.

Billings in the reported quarter increased 52% year over year to $83.5 million. Quarterly and multiyear billings represented about 1% of the total reported in the quarter.

Operating Details

Gross profit surged 50.5% year over year to $57.4 million. Gross margin contracted 110 basis points (bps) from the year-ago quarter to 80.3%.

Subscription gross margin was 88%, flat sequentially. Professional services margin increased 1% from the prior quarter at 32%.

Operating expenses surged 63.6% year over year to $89.3 million. As a percentage of revenues, operating expenses increased 840 bps to 124.8%.

Research & development (R&D), general & administrative (G&A) and sales & marketing (S&M) expenses soared 60.6%, 50% and 69.2%, respectively, on a year-over-year basis.

Notably, R&D expenses were higher due to increase in headcount and introduction of features. S&M expenses increased due to customer conferences and brand advertising campaigns held in the reported quarter.

R&D and S&M expenses as a percentage of revenues increased 170 bps and 700 bps, while G&A expenses declined 30 bps, respectively.

Non-GAAP operating loss was $20.7 million, higher than the year-ago quarter’s loss of $10.2 million due to continued investments in the business.

Balance Sheet & Cash Flow

Smartsheet exited the quarter with cash & cash equivalents of $513.4 million compared with $511.2 million in the previous quarter.

Cash flow from operations was $1 million compared with cash flow of $2.4 million in the year-ago quarter. Free cash outflow was $2.9 million compared with free cash outflow of $2 million in the year-ago quarter.

Guidance

Smartsheet expects revenues between $77 million and $78 million in fourth-quarter fiscal 2020, indicating year-over-year growth of 48-50%. Non-GAAP operating loss is expected between $19.5 million and $21.5 million.

Non-GAAP net loss is expected to be 16-17 cents per share.

The company expects sales and marketing to trend lower as a percentage of revenues in the fourth quarter.

Smartsheet anticipates revenues between $269.4 million and $270.4 million for fiscal year 2020, indicating growth of 52%.

The company expects non-GAAP operating loss of $65-$67 million. Non-GAAP net loss is expected between 52 cents and 53 cents.

Calculated billings are expected to grow at 51% year over year to $326-$328 million.

Moreover, net free cash outflow is estimated to be a maximum of $25 million.

Zacks Rank & Other Stocks to Consider

Currently, Smartsheet carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Marchex, Inc. MCHX, Fortinet, Inc. FTNT and Baidu, Inc. BIDU. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Marchex, Fortinet and Baidu is currently pegged at 15%, 14% and 2.3%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Click to get this free report Fortinet, Inc. (FTNT) : Free Stock Analysis Report Marchex, Inc. (MCHX) : Free Stock Analysis Report Baidu, Inc. (BIDU) : Free Stock Analysis Report Smartsheet Inc. (SMAR) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance