Slowing Demand & Economic Woes: Are Industrial REITs at Risk?

As global economies face decelerating consumer demand and economic uncertainties, investors are reassessing the potential impact on various investment classes. One such class is industrial real estate investment trusts (REITs). Industrial REITs typically own and manage warehouses, distribution centers, and other industrial properties, which are essential for the logistics and supply chain industry.

This article evaluates the financials of four major industrial REITs – Prologis PLD, Rexford Industrial Realty REXR, Americold Realty Trust COLD, and EastGroup Properties EGP – to determine whether these concerns should impact investor sentiment.

Prior to that, let us delve into the industrial real estate market fundamentals and check how this asset category performed in the first quarter.

Industrial Real Estate Market Fundamentals in Q1

Per a Cushman & Wakefield CWK report, in the first quarter, amid high inflation and high-interest rates, slowing consumer demand and uncertainty in the economy, U.S. leasing totals witnessed a 9.4% decline from the prior quarter. There has been an uptick in the overall U.S. industrial vacancy rate, which moved higher by 40 basis points (bps) in the first quarter to 3.6%.

However, the vacancy is still lower than the 10-year historical average of 5.3%. Also, there has been a flight to quality by logistic tenants, with tenants executing 59.1 msf of deals in industrial facilities built since 2020 during the quarter, marking 46.4% of the total.

Asking rental rate growth remained high during the quarter. The same increased 3.5% sequentially, reaching another new high of $9.19 per square foot (psf) and surpassing the $9.00-psf mark for the first time.

Construction starts have started slowing, with the under-construction pipeline ending the first quarter with 663.3 msf of space under construction, declining in each of the last two quarters and marking the lowest total since the first quarter of 2022. Construction starts are expected to temper further in the current year, with the procurement of financing becoming more difficult amid the current economic environment.

Stock Discussion

Prologis: Prologis is a global leader in logistics real estate, with a portfolio that spans 19 countries. Despite the economic uncertainty, PLD has shown resilience in terms of rental growth and occupancy rates.

Recently, PLD reported better-than-expected first-quarter 2023 core funds from operations (FFO) per share of $1.22 on solid rent growth. Cash same-store net operating income (NOI) grew 11.4% and denoted an all-time high. The industrial REIT raised the midpoint of its 2023 guidance.

Per Hamid R. Moghadam, the co-founder and chief executive officer of the company, "We foresee any potential impact on demand as likely to overlap with a deceleration in new deliveries, sustaining momentum with favorable conditions for high occupancy and continued rent growth into 2024."

Going forward, Prologis' diversified global portfolio and high-quality tenants should help it weather potential market volatility. PLD currently carries a Zacks Rank #3 (Hold).

Rexford Industrial Realty: REXR is focused on owning and operating industrial properties in Southern California, a region characterized by high demand and limited supply. In 2022, REXR experienced 98.7% average same-property portfolio occupancy. Moreover, comparable rental rates on 5.1 million rentable square feet of new and renewal leases increased by 80.9% compared to prior rents on a GAAP basis and 58.8% on a cash basis.

While REXR may be vulnerable to regional economic fluctuations, its strategic focus on a supply-constrained market and strong demand drivers could provide stability. The Zacks Consensus Estimate for REXR’s 2023 FFO per share has moved marginally north over the past week to $2.18, suggesting an 11.2% increase year over year.

REXR currently carries a Zacks Rank #2 (Buy) and is scheduled to release its earnings today after market close. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Americold Realty Trust: As the world's largest publicly traded REIT focused on temperature-controlled warehouses, COLD benefits from the rising demand for cold storage facilities. COLD's 2022 annual revenues increased by 7.4% compared to the previous year, while total NOI advanced 10.5% to $696.0 million.

With the growing trend of e-commerce and increasing demand for temperature-controlled supply chains, COLD's specialized asset class could offer a defensive play in uncertain times. The Zacks Consensus Estimate for COLD’s 2023 FFO per share has moved marginally north over the past two months to $1.19, calling for a 7.21% increase year over year.

COLD currently carries a Zacks Rank #2 and is scheduled to release its earnings on May 4 after market close.

EastGroup Properties: EGP is a self-administered equity REIT focused on the development, acquisition, and operation of industrial properties. In 2022, the average occupancy of its operating portfolio was 98.0%, up from 97.1% for 2021. Also, rental rates on new and renewal leases increased by an average of 39.0% on a straight-line basis.

EGP's focus on high-growth Sunbelt markets and diversified tenant base may help it withstand the challenges posed by decelerating consumer demand. The Zacks Consensus Estimate for EGP’s 2023 FFO per share has moved marginally north over the past month to $7.44, calling for a 6.29% increase year over year.

EGP currently carries a Zacks Rank #2 and is scheduled to release its earnings on Apr 25 after market close.

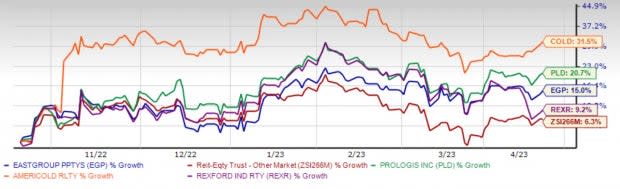

Here’s how PLD, REXR, COLD and EGP have performed over the past six months.

Image Source: Zacks Investment Research

Conclusion

While decelerating consumer demand and economic uncertainty pose challenges to all investment classes, industrial REITs have shown resilience through steady financial growth and strong occupancy rates. The financial performance of PLD, REXR, COLD, and EGP suggests that these companies are well-positioned to navigate the current economic landscape.

Investors should consider the unique characteristics of each industrial REIT when making investment decisions. Prologis, Rexford Industrial Realty, and EastGroup Properties offer geographic diversification and strong market positions, while Americold Realty Trust provides exposure to the specialized cold storage market.

As with any investment, thorough due diligence and risk assessment are crucial. While industrial REITs may face short-term headwinds due to decelerating consumer demand and economic uncertainty, their long-term prospects remain attractive. Investors seeking exposure to the industrial real estate sector should evaluate the fundamentals and growth prospects of PLD, REXR, COLD, and EGP to make informed decisions that align with their risk tolerance and investment objectives.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance