Skechers (SKX) Stays Ahead of the Industry Curve: Here's Why

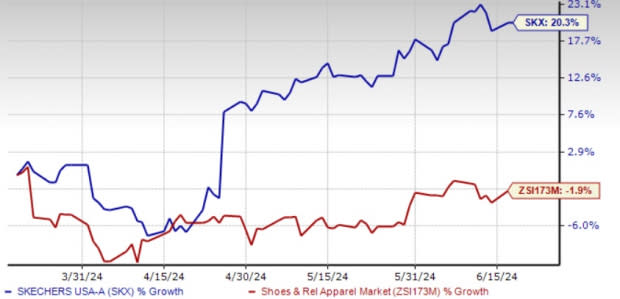

Skechers SKX has showcased impressive resilience and growth in the stock market, achieving notable performance over the last three months. This Manhattan Beach, CA-based company has witnessed a commendable 20.3% increase against the industry’s decline of 1.9%. This success can be attributed to its strategic focus on a diverse brand portfolio, advanced digital innovations and bold global growth initiatives.

Skechers has built a strong reputation in Shoes and Retail Apparel Industry by consistently intensifying its strategic investments in infrastructure and technology. It has expanded its retail footprint, advanced omnichannel capabilities and constructed a second distribution hub in China. Skechers' initiatives of introducing new products calls for innovation and keeps the company relevant in the constantly evolving industry.

The favorable outlook for Skechers is underscored by positive earnings estimate revisions. Over the past 30 days, the Zacks Consensus Estimate for the current and the next fiscal year has risen by 1.5% and 1.9% to $4.08 and $4.64, respectively, suggesting growth of 16.9% and 13.7% from the year-ago levels and showcasing the company’s solid outlook.

With an appealing Value Score of A, the stock’s attractiveness is bolstered, indicating potential for appreciation. As a Zacks Rank #1 (Strong Buy) company, Skechers has positioned itself as an attractive option due to strategic initiatives and a favorable valuation. Investors may find the stock's consistent market performance and proactive stance as an appealing opportunity to explore.

Image Source: Zacks Investment Research

More Insights

SKX’s solid results in the first quarter were mainly backed by innovative marketing efforts, growing base of loyal consumers and expansion in the global market. It saw a robust 17.3% year-over-year sales growth in its direct-to-consumer (DTC) segment. This notable uptick emphasizes the strong appeal of its product offerings among consumers. We expect DTC revenues to increase 11.8% in 2024 and represent 44.4% of overall sales.

Skechers' achievement of exceeding 50% of its sales from the international business segment in the first quarter of 2024 is a noteworthy milestone for the company. Sales of this segment jumped 15.2%, highlighting the company's robust global presence. Notably, the APAC region led with a remarkable 15.9% year-over-year sales growth, while EMEA and China also showed strong performances with an increase of 17.4% and 13.3%, respectively.

Skechers' success in international markets underscores its ability to adapt to diverse consumer preferences, capitalize on emerging trends and implement effective regional distribution strategies. This segment is poised to sustain strong performance and unlock new growth avenues in the coming years.

Looking Ahead

Backed by the progress in this quarter, the company is optimistic about its targets for fiscal 2024. It aims sales to be between $8.6 billion and $8.8 billion. Net earnings per share are suggested to be between $3.65 and $3.85.

For the second quarter of 2024, SKX envisions sales to be between $2.18 billion and $2.23 billion. Net earnings per share are forecast to be between 85 cents and 90 cents.

Management aims to take proactive approach to strengthen and expand its DTC and International segment. Moreover, the company intends to launch 155-170 new company-owned stores worldwide throughout 2024. These endeavors are in line with its long-term growth strategy, focusing on maximizing operational efficiency and expanding its customer base.

Other Key Picks

We have highlighted some other top-ranked stocks in the broader sector, namely Hasbro, Inc. HAS, Hanesbrands HBI and Crocs, Inc. CROX.

Hasbro, a leading company of toy and games, currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 17.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HAS’ current fiscal-year earnings indicates growth of 45.8% from the year-ago reported figures.

Hanesbrands engages in designing, manufacturing, sourcing and selling of apparel essentials for men, women and children in the United States and internationally. It currently flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 10.2%, on average.

The Zacks Consensus Estimate for Hanesbrands current financial-year earnings suggests 666.7% surge from the year-earlier levels.

Crocs develops and manufactures lifestyle footwear and accessories. It currently has a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 17.1%, on average.

The Zacks Consensus Estimate for Crocs current financial-year sales and earnings implies an improvement of 4.3% and 5.2%, respectively, from the prior-year actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance