The simple rule to calculate how much retirees should take out of their super

How much will you have to live off when you retire?

Perhaps a more pertinent question is: how do you divide up the hard-earned money in your nest egg so you don’t use up too much of it too quickly?

It’s a question that five actuaries from the Actuaries Institute have sought to answer by developing a simple equation for how much you should draw out of your savings in retirement.

What’s the retirement savings ‘rule of thumb’?

There are two steps to calculating your annual drawdown if you’re a retiree.

According to the Actuaries Institute, a single retiree should:

Draw down a baseline rate, as a percentage, that is the first digit of your age (e.g. ‘6’ if you are 60-something years old)

Add 2 per cent if their superannuation account balance is between $250,000 and $500,000 (as long as they meet the statutory minimum drawdown rule).

What does that actually look like?

For instance, let’s look at how much a single retiree can draw down if they retire with $350,000 in superannuation.

Rule of thumb means that the retiree, if they’re between 60 and 69 years old, would draw down 8 per cent: 6 per cent from the first digit of their age, plus 2 per cent due to the amount of super they have.

This means their annual drawdown is 8 per cent of $350,000, which is $28,000.

A 70-something retiree with the same amount of superannuation would draw down 9 per cent, while someone between 80 and 89 years old can withdraw 10 per cent.

Rule of thumb allows Aussies to retire with more

According to Actuaries Institute president Nicolette Rubinsztein, the ‘rule of thumb’ allows retirees to comfortably draw down a little bit more than the minimum stipulated by the Federal government, which will provide a better quality of life in retirement.

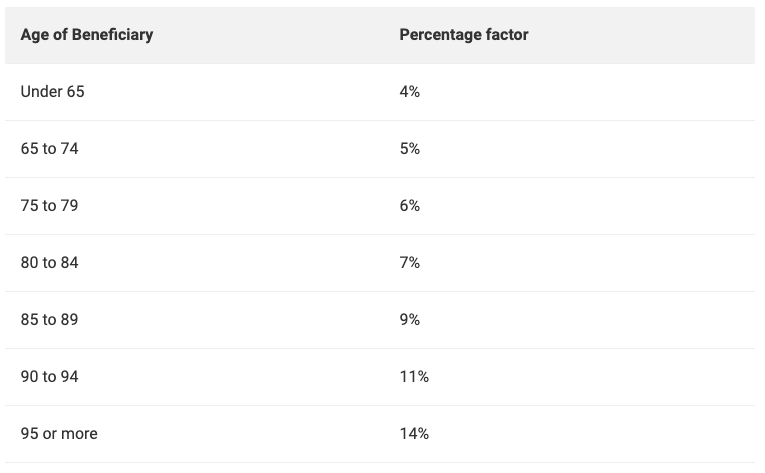

According to the SIS Act, here are the minimum amounts of super that retirees should take out every year according to their age:

“Many retirees draw a bare minimum from their account-based pensions, or their savings, after they stop work,” she said.

Actuary John De Ravin, one of the five actuaries who helped develop the rule of thumb, said it was difficult for retirees – generally risk-averse – to figure out how much of their savings to live off.

“The federal government has encouraged the industry to develop better products to help ensure retirees don’t outlive their spending. But that’s still a way off,” he said.

“In the meantime, we’ve taken a complicated set of equations and scenarios, and worked out what is a simple guideline that works.”

Rubinsztein said: “[Retirees] can’t afford to pay for professional advice from a planner, and they live frugal lives because they fear outliving their savings. But the ‘rule of thumb’ is simple and accurate and takes into consideration a retiree’s asset base and age."

For more information about how it works, the five actuaries – together called the ‘Rule of Thumb’ Working Group – have released a research paper with more details about the simple calculation accessible here.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance