Silvercrest Asset Management Group And Two More Top Dividend Stocks To Consider

Amidst a backdrop of fluctuating US equity futures and economic indicators suggesting a cooling economy, investors are navigating through a landscape marked by potential Federal Reserve rate cuts and shifting market sentiments. In such an environment, dividend stocks like Silvercrest Asset Management Group often draw attention for their potential to provide steady income streams, making them an appealing consideration for those looking to bolster their portfolios against uncertainty.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.62% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.96% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.77% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.07% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.85% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.84% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.02% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.76% | ★★★★★★ |

Franklin Financial Services (NasdaqCM:FRAF) | 4.83% | ★★★★★☆ |

Union Bankshares (NasdaqGM:UNB) | 6.34% | ★★★★★☆ |

Click here to see the full list of 209 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Silvercrest Asset Management Group

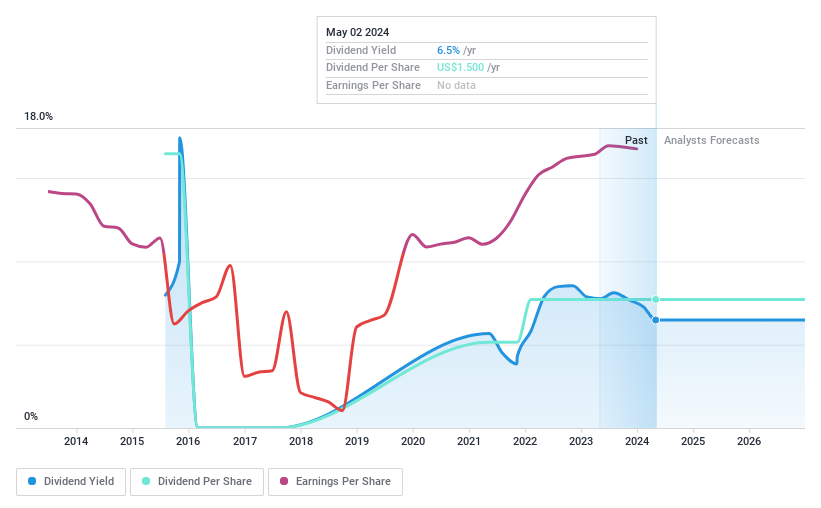

Simply Wall St Dividend Rating: ★★★★★★

Overview: Silvercrest Asset Management Group Inc. is a U.S.-based wealth management firm offering financial advisory and related family office services, with a market capitalization of approximately $212.93 million.

Operations: Silvercrest Asset Management Group Inc. generates its revenue primarily from the investment management industry, totaling approximately $118.25 million.

Dividend Yield: 4.8%

Silvercrest Asset Management Group maintains a stable dividend yield at 4.77%, positioning it in the top quartile of US dividend payers. Despite a recent dip in net profit margins from 12.1% to 7.5%, the company's dividends are well-covered with an earnings payout ratio of 80.5% and a cash payout ratio of 55.8%. The firm's earnings are projected to grow by 21.19% annually, supporting future dividend reliability and growth, while trading at a significant discount to estimated fair value (38.8% below). Recent strategic hires aim to bolster investment capabilities, potentially enhancing future performance.

Global Ship Lease

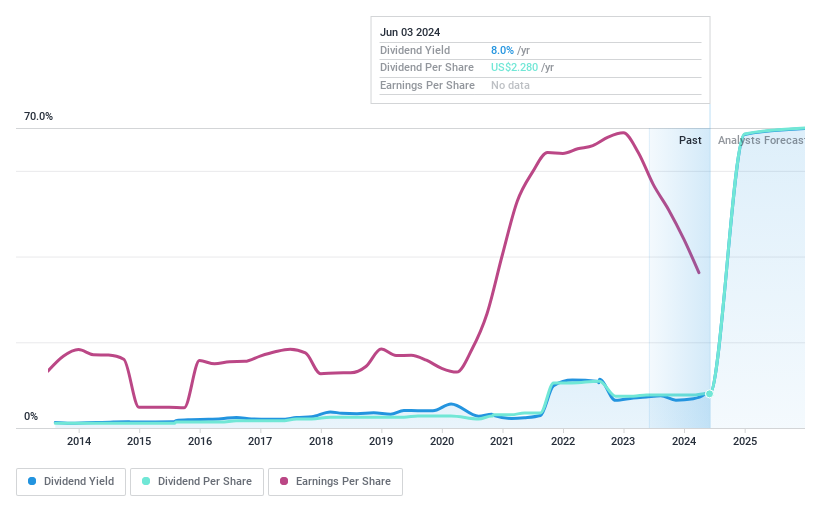

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates globally, owning and chartering containerships under fixed-rate charters to various container shipping companies, with a market capitalization of approximately $1.05 billion.

Operations: Global Ship Lease, Inc. generates its revenue primarily from the transportation and shipping segment, totaling approximately $688.85 million.

Dividend Yield: 5%

Global Ship Lease (GSL) offers a dividend yield of 5.03%, ranking in the top 25% of US dividend payers. Despite a volatile dividend history and forecasted earnings decline of 7.2% annually over the next three years, recent financial performance shows strength with an increase in net income and revenue year-over-year as of Q1 2024. Additionally, GSL recently announced a supplemental quarterly dividend, reflecting higher cash flows from extended time charters, suggesting potential short-term support for its dividends amidst underlying challenges.

Haverty Furniture Companies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haverty Furniture Companies, Inc. is a specialty retailer of residential furniture and accessories in the United States with a market capitalization of approximately $460.81 million.

Operations: Haverty Furniture Companies, Inc. generates its revenue primarily through the retailing of home furnishings, amounting to $821.38 million.

Dividend Yield: 8%

Haverty Furniture Companies (HVT) maintains a dividend yield of 7.97%, placing it among the top 25% of US dividend payers. Despite this, its dividends have shown volatility over the past decade and are not fully supported by cash flows, with a cash payout ratio of 101.7%. Recent corporate developments include executive changes and a modest increase in quarterly dividends from US$0.30 to US$0.32 per share as of May 2024, indicating an attempt to maintain shareholder returns despite financial pressures evidenced by a significant drop in Q1 earnings year-over-year.

Make It Happen

Navigate through the entire inventory of 209 Top Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:SAMG NYSE:GSL and NYSE:HVT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance