Silver Slips to 3-Week Low

Silver prices have steadied on Wednesday, after a considerable decline on Tuesday. Currently, silver is trading at $17.80, down $0.04 or 0.30% on the day.

Silver Falls Off 18.00 Pedestal

Silver prices fell sharply on Tuesday, as the decline of 1.7% was the sharpest one-day drop since December 6. With a lack of U.S. fundamental releases until Thursday, any moves on Wednesday will be subject to technical factors, barring any major geopolitical developments.

We’ll get a look at the first major U.S. release on Thursday, starting with unemployment claims. The indicator fell to 204 thousand last week, its lowest level in six weeks. The forecast for the upcoming release stands at 214 thousand. On Friday, it’s the turn of manufacturing and services PMI. Both indexes are expected to come in slightly over the 50-level, which separates contraction from expansion.

The U.S. economy continues to perform well, with the exception of the manufacturing sector, which has been dampened by the trade war with China as well as a weak global economy. With inflation levels below the Federal Reserve’s target of 2.0%, there is little pressure on the Fed to raise interest rates. That could help explain why silver and gold prices remain relatively high, despite a strong economy and a thriving stock market. As long as interest rates are likely to remain steady or even get trimmed, precious metals should remain attractive to investors.

Silver Technical Analysis

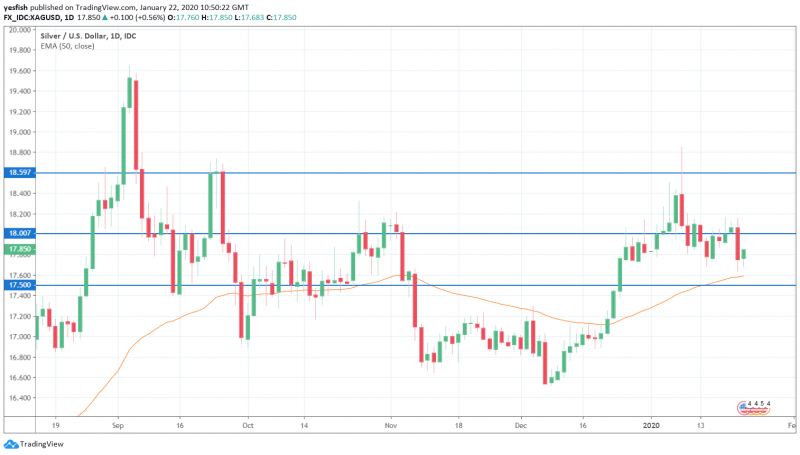

Silver prices sagged on Tuesday, falling to 17.63. There are formidable support levels close by, which so far have prevented the metal from falling further. The 50-EMA line is situated at 17.58, followed immediately by support at 17.50. Given that silver has plenty of support nearby, we could see a recovery back to the 18.00 line or slightly above it. There is resistance at 18.60, followed by resistance at the round number of 19.00.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance