Significant Portfolio Adjustments at Jana Partners Highlight Freshpet Inc's Impact

Insights from Jana Partners (Trades, Portfolio)' Latest 13F Filing for Q1 2024

Jana Partners (Trades, Portfolio) LLC, established in 2001 by Barry Rosenstein, is a New York-based investment management firm known for its value-oriented, event-driven investment strategy. The firm focuses on identifying undervalued companies poised for significant value unlocking through specific catalysts, occasionally stepping in as an active shareholder to foster this change. Jana's investment approach spans both long and short positions across equity and debt structures.

Summary of New Buys

Jana Partners (Trades, Portfolio) expanded its portfolio by adding two new stocks in the first quarter of 2024:

Wolfspeed Inc (NYSE:WOLF) was the primary new addition with 4,557,881 shares, making up 7.35% of the portfolio and valued at $134.46 million.

QuidelOrtho Corp (NASDAQ:QDEL) followed, comprising 3.13% of the portfolio with 1,195,800 shares valued at $57.33 million.

Key Position Increases

The firm also increased its stakes in five stocks, with notable adjustments in:

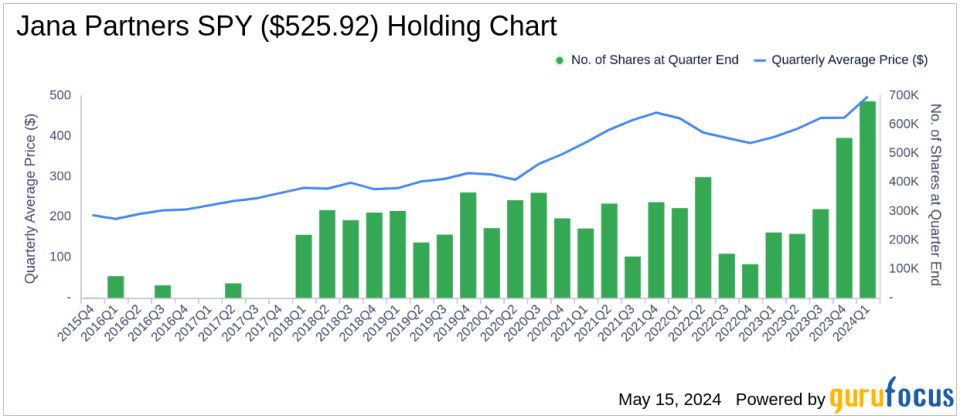

S&P 500 ETF TRUST ETF (SPY) saw an addition of 126,800 shares, bringing the total to 680,733 shares. This adjustment increased the share count by 22.89% and impacted the portfolio by 3.62%, with a total value of $356.07 million.

Mercury Systems Inc (NASDAQ:MRCY) had an additional 1,713,761 shares, bringing the total to 6,924,896 shares. This represents a 32.89% increase in share count, valued at $204.28 million.

Key Position Reductions

Reductions were made in two stocks, significantly impacting the portfolio:

Freshpet Inc (NASDAQ:FRPT) saw a reduction of 1,700,477 shares, a 60.86% decrease, impacting the portfolio by -9.53%. The stock traded at an average price of $96.67 during the quarter and has returned 43.13% over the past three months and 46.65% year-to-date.

Enhabit Inc (NYSE:EHAB) was reduced by 2,700 shares, a minor -0.13% decrease in shares with negligible portfolio impact. The stock traded at an average price of $10.02 during the quarter, returning 0.56% over the past three months and -12.66% year-to-date.

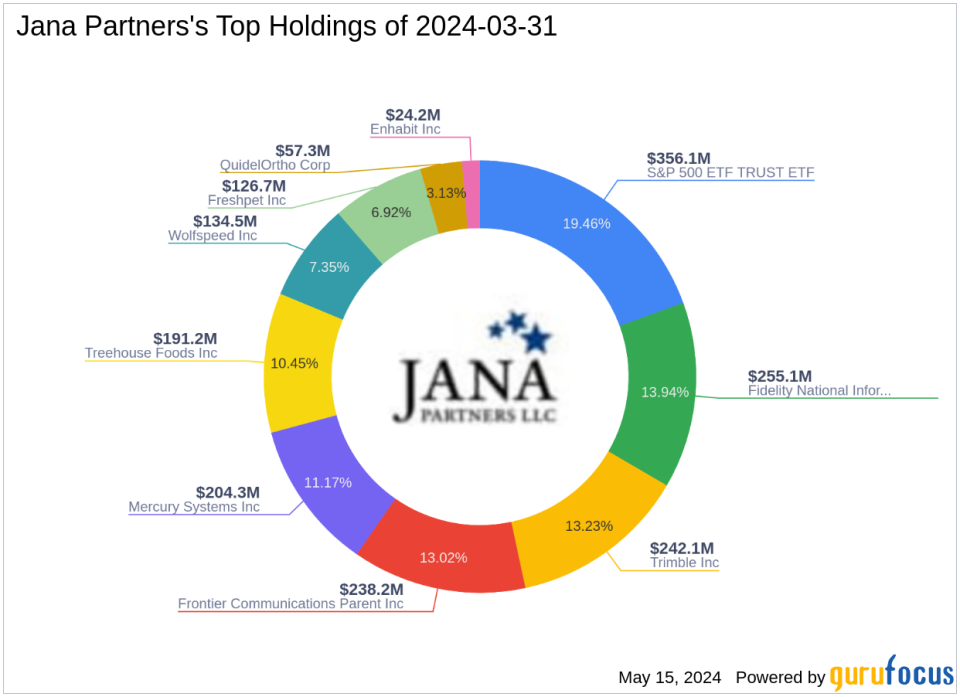

Portfolio Overview

As of the first quarter of 2024, Jana Partners (Trades, Portfolio)' portfolio included 10 stocks. The top holdings were:

19.46% in S&P 500 ETF TRUST ETF (SPY)

13.94% in Fidelity National Information Services Inc (NYSE:FIS)

13.23% in Trimble Inc (NASDAQ:TRMB)

13.02% in Frontier Communications Parent Inc (NASDAQ:FYBR)

11.17% in Mercury Systems Inc (NASDAQ:MRCY)

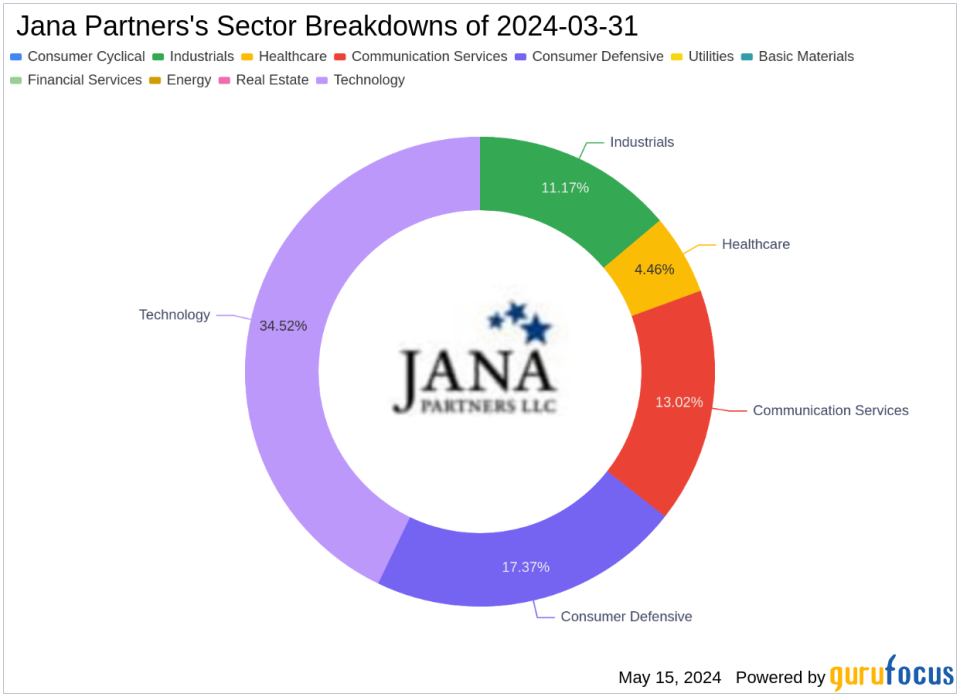

The holdings are predominantly concentrated in five industries: Technology, Consumer Defensive, Communication Services, Industrials, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance