Shop window on London Stock Exchange news nears milestone as dealmaking frenzy takes hold

There is a debate over the future of London’s stock exchange rippling out across the City and beyond, amid fears that the tide is going out on its status as a trading centre.

This week, research run by investment bank Peel Hunt and the Standard revealed the value of companies heading out of London’s stock exchange neared £100 billiion.

But there is another landmark moment approaching more quietly for a service that has long been a vital part of the City, and the story of its longevity reflects the transformation of share ownership in the UK, not least in the way it helped unlock a vital source of capital.

Now known as Investegate, it goes back to before the Big Bang reforms of the 1980s and operated throughout the rise of shareholder capitalism and the age of the internet, it remains the shop window on the City.

It is still one of the best-used ways of screening the company announcements released each day, which make up the lifeblood of trading decisions which unite money with opportunity.

Delivering around 3.5 million page impressions per month, it is about to handle is nine-millionth news release, running in real time and offering investors free access to a vast archive going back to the 1990s.

Its story runs parallel with that of how technological change shaped City trading itself, and what lies ahead for Investegate in the artificial intelligence era may hold clues to the future and ways London can bring in capital.

/ And that database is vast, as well as being a major resource for research into listed companies of all sizes, throughout the market. Investegate remains one of the most powerful ways of doing that, and remains unique to London.

It offers free access to live stock market announcements, known as regulatory news filings - those critically vital corporate news events - that all companies listed on the London stock exchange are obliged to disseminate to the market.

That amounts to an invaluable resource when it comes to making investment decisions.

Its managing director, John Blowers, took control of Investegate last year, when the site was sold off by former parent Financial Express to Stockomendation, the leading site for retail investors.

He told the Standard that the “level playing field” Investegate offers is crucial.

“It’s a very democratic service, No one can buy earlier access that’s the great thing. As the new custodians of it, we definitely do not want to change its focus.”

The extent of its reach also creates some interesting patterns. Its most-read list includes major corporate announcements as would be expected on any corporate news service.

So far this year, its most-read articles relate to deal news. The top slot went to Aviva’s acquisition of Probitas, with Barratt’s all-share offer for Redrow in second place, and CEVA’s bid for Wincanton in third.

But the annual financial results of Celtic Football Club are usually a big hit, showing that it is well known as trusted means to the direct source of company news, including for sports fans keen to keep tabs on the financial health of their clubs.

While the rise of AI will help the firm offer new ways for investors to mine the vast archive of company news, Blowers also points out that a reliable and established source of information is needed to stand out in the crowd.

That came across during the explosion in sources brought by social media.

“We are the direct source for many investors. Whatever your technology, you cannot get ahead of the regulatory news service,” Blowers pointed out.

And its history itself offers insight into how the City itself has developed into the critical juncture where it currently stands. Its first owner was British Telecom and it ran via a modem connection, displaying news on regular TV screens.

Prestel, the post office’s subscription-based teletext information service, ran it from 1984, selling it 10 years later when it had 90,000 users to Scottish Power. Its next parent was Financial Express, early in the firm’s start-up days.

By the time FE fundinfo, as it is now known was going global, it sold off Investegate to its current owners, although Blowers prefers the term “custodians”.

There was some turbulence when the site switched to new software to keep access open to the database, and its rich archive of news.

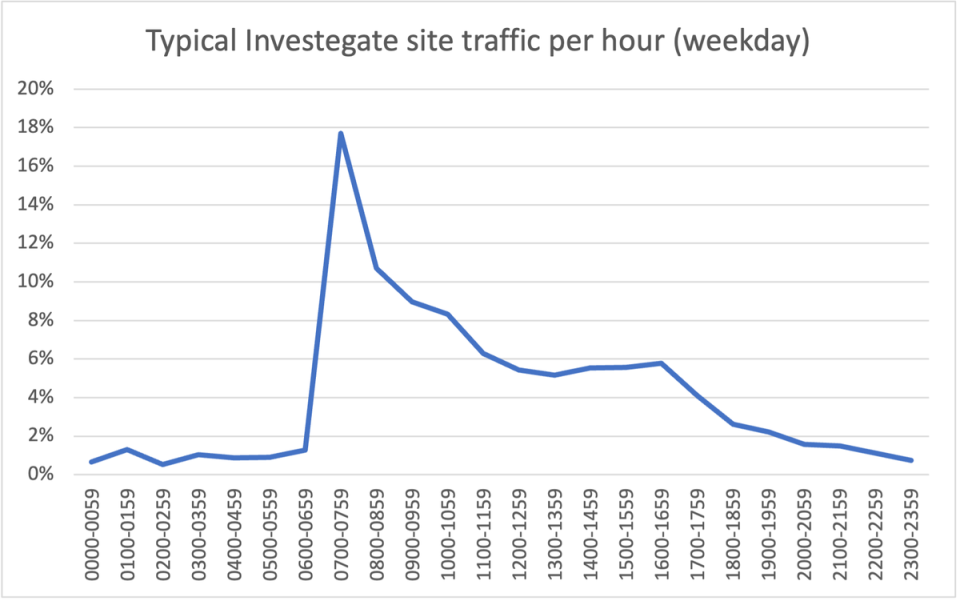

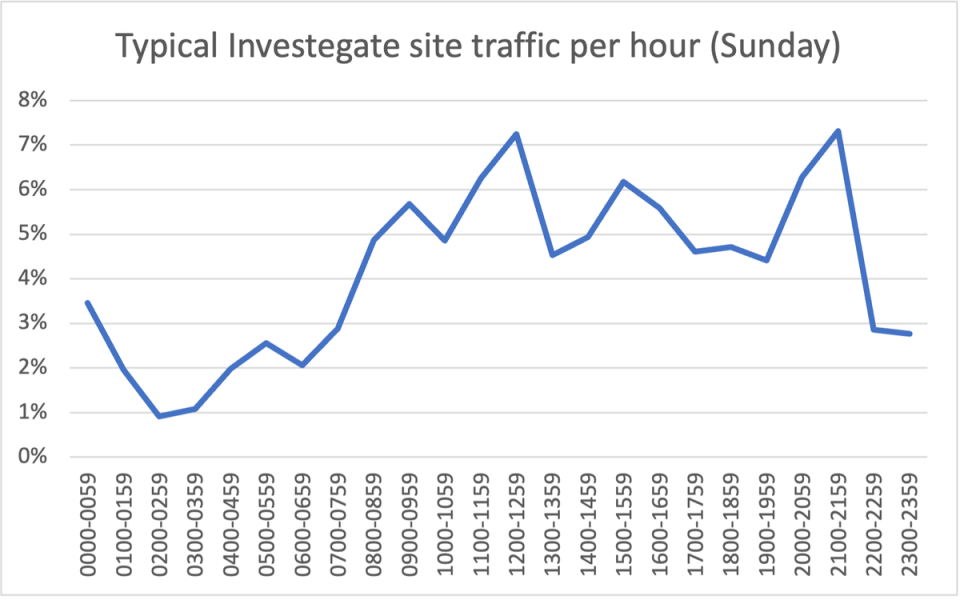

“We lost a few people at the swap over, it dipped down a bit, but they all came back”, he said, with usership back at 350,000 to 400,000 monthly users, most of whom use it daily. It is even popular at weekends, as the private investors it is designed for check in.

“Twenty-five years ago, Investegate morphed from being a terminal-based service to using the internet. We already use social media to reach beyond the standard user. We have an AI project with a university in the UK,” Blowers adds.

He adds: “We always want users to have access to the full archive, but AI has the potential to significantly enhance search, linking together the associated data points over time to create a more coherent story.”

That should help keep access to a vital resource of shareholder capitalism, at a time when the spotlight is on London’s ability to unite money with opportunity and the international competition for stock listings means the City needs all the liquidity it can get.

“Throughout, people want to see company news from the actual source, if they are checking a dividend payment or a company action, from a database that is free to access and easy to search,” Blowers says.

Yahoo Finance

Yahoo Finance