Would Shareholders Who Purchased Highwood Oil's (CVE:HOCL) Stock Year Be Happy With The Share price Today?

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Highwood Oil Company Ltd. (CVE:HOCL) have tasted that bitter downside in the last year, as the share price dropped 10%. That's well below the market decline of 2.1%. Because Highwood Oil hasn't been listed for many years, the market is still learning about how the business performs.

See our latest analysis for Highwood Oil

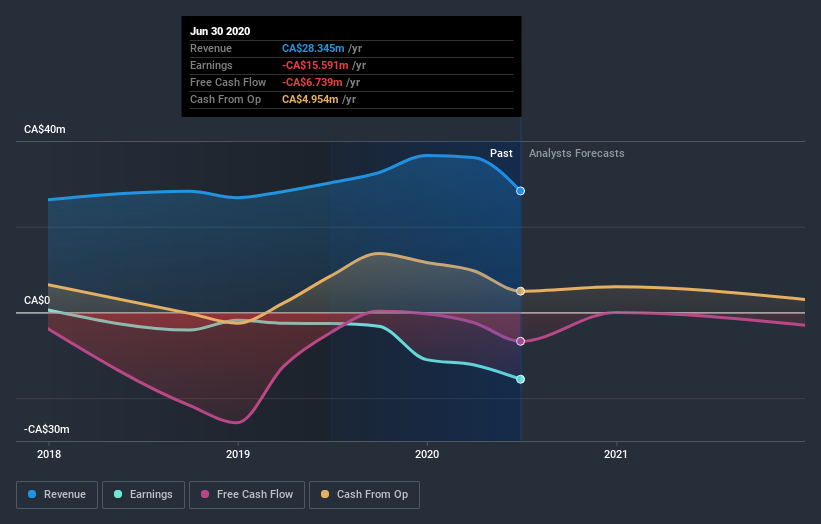

Given that Highwood Oil didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Highwood Oil saw its revenue fall by 6.4%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 10% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Highwood Oil shareholders are down 10% for the year, even worse than the market loss of 2.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 1.0%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Highwood Oil better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Highwood Oil (including 2 which is can't be ignored) .

But note: Highwood Oil may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance