Shareholders in Kistos Holdings (LON:KIST) are in the red if they invested a year ago

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Kistos Holdings Plc (LON:KIST) stock has had a really bad year. In that relatively short period, the share price has plunged 54%. Kistos Holdings may have better days ahead, of course; we've only looked at a one year period. On the other hand, we note it's up 8.6% in about a month.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for Kistos Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

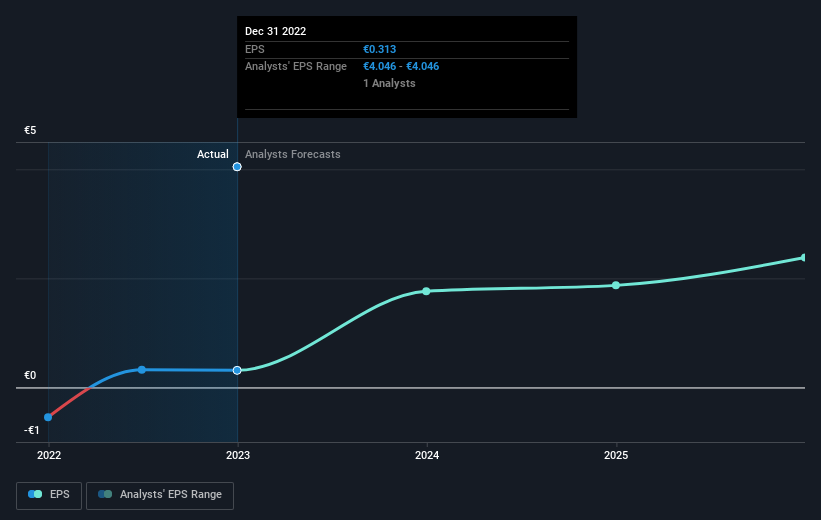

Kistos Holdings managed to increase earnings per share from a loss to a profit, over the last 12 months.

We're surprised that the share price is lower given that improvement. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Kistos Holdings has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Kistos Holdings will grow revenue in the future.

A Different Perspective

Given that the market gained 0.1% in the last year, Kistos Holdings shareholders might be miffed that they lost 54%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 8.6%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Kistos Holdings .

Of course Kistos Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance