Shareholders in Culp (NYSE:CULP) are in the red if they invested five years ago

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Culp, Inc. (NYSE:CULP) for five whole years - as the share price tanked 78%. The falls have accelerated recently, with the share price down 20% in the last three months.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Culp

Given that Culp didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Culp saw its revenue shrink by 3.2% per year. That's not what investors generally want to see. The share price fall of 12% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

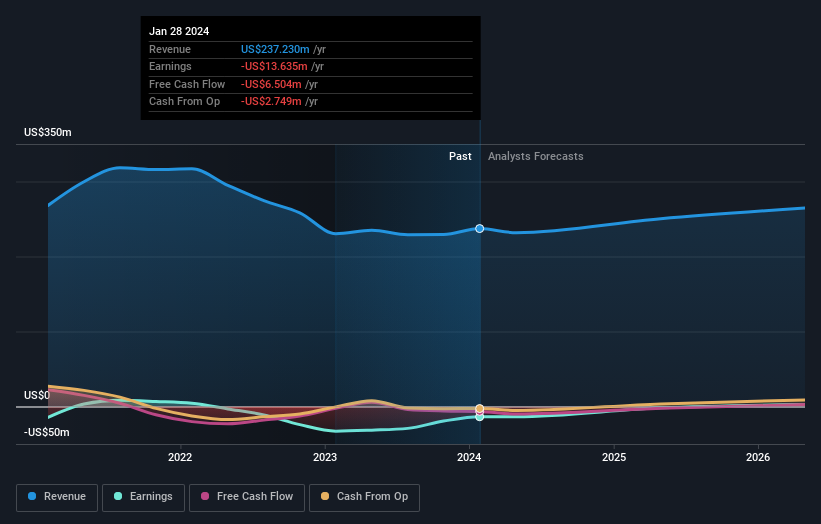

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Culp will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Culp's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Culp's TSR of was a loss of 76% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 28% in the last year, Culp shareholders lost 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Culp you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance