Shareholders in AbCellera Biologics (NASDAQ:ABCL) are in the red if they invested a year ago

Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a AbCellera Biologics Inc. (NASDAQ:ABCL) shareholder over the last year, since the stock price plummeted 76% in that time. A loss like this is a stark reminder that portfolio diversification is important. Because AbCellera Biologics hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 26% in the last 90 days.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for AbCellera Biologics

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

AbCellera Biologics managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. But we may find different metrics more enlightening.

AbCellera Biologics managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

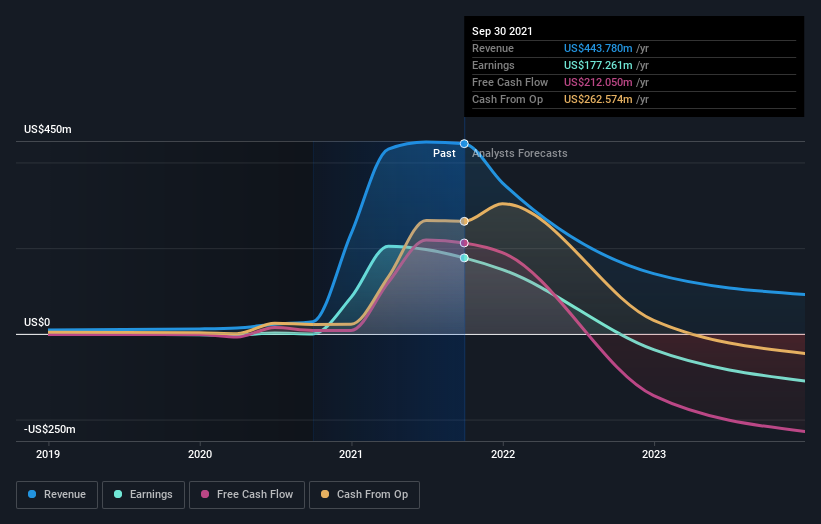

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for AbCellera Biologics in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 23% in the last year, AbCellera Biologics shareholders might be miffed that they lost 76%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 26% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand AbCellera Biologics better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for AbCellera Biologics (of which 1 makes us a bit uncomfortable!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance