'Acceptable' gambling: Share expert drops truth bomb

As countries around the world entered lockdown, many people used the extra time at home to start trading shares.

However, Stockspot chief executive Chris Brycki, who started trading when he was just 10 years old, is worried for them.

"It’s great to see that a new generation [is] taking an interest in the share market, but it concerns me that most have fallen into the alluring trap of daytrading," he wrote on his blog.

"I fell into the same trap of confusing trading luck for skill during the 1990s tech boom. I was a teenager at the time."

Trading is different to investing. The former is a short-term attempt to buy cheap then sell at a profit, while the latter is to buy and hold for a long time.

'Day traders' refers to those who trade real-time or almost real-time during business hours.

But not even professionals can beat the market, so amateurs certainly have no chance.

"Let's be clear, research shows that almost all aspiring day traders lose money," said Brycki.

"There have been numerous studies that show how badly traders actually perform. The results in the US, Taiwan and even Brazil all show that between 80 to 97 per cent of day traders lose money."

Share trading is 'socially acceptable' gambling

The simple fact is that no one, professional or novice, has a crystal ball to see where the market or any particular stock will go in the future.

"The studies show the more you trade, the worse you do. Less than 1 per cent of day traders consistently beat the returns from a low-cost ETF."

So for those who try, it is a pure punt. Those who win big are lucky, while most lose.

And the share trading apps know it.

"Though they mightn’t know it, for most people who try, share trading is just a socially acceptable form of gambling," Brycki said.

"The various apps offering trading to newbies know this and have built platforms that are as addictive as slot machines in orchestrating your slow release of dopamine though their flashing lights, sounds, charts and updating profit numbers."

Professionals sell while amateurs buy

Share markets have seen much turbulence this year.

Australia and US markets were at all-time highs in late February before they crashed more than 30 per cent as the coronavirus restrictions came in.

Then since the trough in late March, markets have recovered stunningly – now almost recouping all their losses.

But this rally has experts anxious, because it's all been driven by "retail" investors – everyday folks, not big financial institutions.

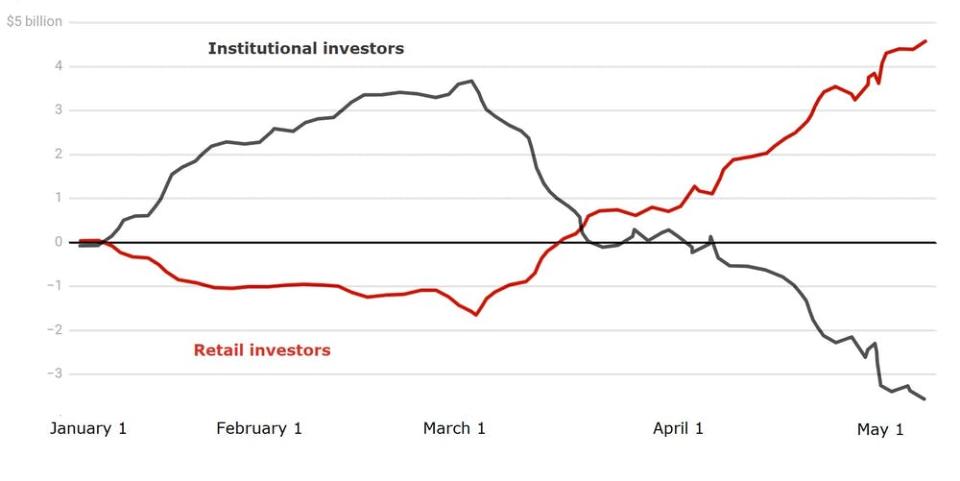

In fact, a joint UNSW and University of Melbourne analysis has shown retail traders bought more stocks in recent months than the professionals have sold.

"Between March 23 (when the stock market started rising) and May 2, retail investors were net buyers of $3.57 billion," wrote UNSW professor Carole Comerton-Forde and University of Melbourne senior lecturer Zhuo Zhong.

"At the same time the 'professional' institutional investors – including super funds – were net sellers of $3.27 billion."

This is a complete reversal of simpler times pre-virus, when big institutions have much more clout in the market than mum-and-dad investors.

Amateurs buying high-risk shares

Not only is retail trading activity at an all-time high, but the Average Joe is buying up high-risk shares for fatter profits (or fatter losses) – rather than the "safer" blue chip companies.

"Our analysis shows retail investors were net buyers not only of large-cap companies such as BHP and Commonwealth Bank but highly volatile stocks such as AMP and Webjet, highly leveraged stocks such as Domino’s Pizza and SEEK, and stocks whose prices were falling prior to the lockdown, such as Myer and Flight Centre," said Comerton-Forde and Zhong.

"In contrast, institutional investors were net sellers of all these stocks."

Why are retail investors behaving so wildly?

Comerton-Forde and Zhong can only speculate, but they suspect an element of gambling for entertainment – rather than serious investing – is at play.

"It may be due people looking for entertainment in the absence of usual leisure activities. This has been dubbed the 'Boredom Markets Hypothesis'.

"It might also just be another form of gambling – 'taking a punt' in the absence of sports betting opportunities."

Like Brycki, the two academics also fear recent gains cannot be sustained and will expose many novice traders to massive losses.

"Many listed companies have withdrawn or suspended the earnings guidance they usually provide to the stock exchange, [which is] key information for investors," they wrote.

"We caution awareness of the risks in hoping for the best."

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance