ServiceNow (NOW) to Redefine NASCAR's Employee Experience

ServiceNow NOW announced that NASCAR will implement its employee workflows and low-code solutions in May 2023 to streamline processes and save time.

ServiceNow’s Employee Center is a unified portal converting manual processes into simple digital workflows. The expansion will further streamline NASCAR’s employee service processes, thereby improving their productivity and making up time to focus on their fanbase.

App Engine, ServiceNow’s low-code solution, will help non-technical NASCAR employees to develop software applications with minimum coding. This will help employees to address industry-specific challenges more quickly.

The aim of ServiceNow and NASCAR is to increase latter’s employee potential and divert focus on fans and racing, which is their key priority. NASCAR leverages on the flexibility of the NOW platform to implement immediate solutions and create a digital and seamless experience for fans when attending NASCAR events.

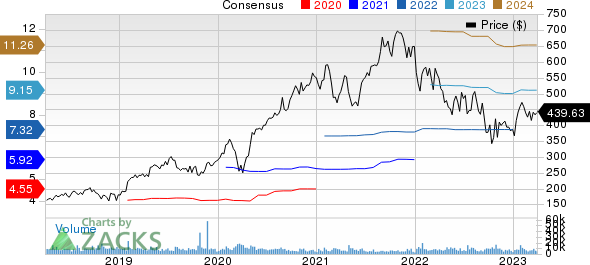

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

ServiceNow’s Strong Portfolio to Aid Prospects

ServiceNow offers a diverse portfolio of cloud-based workflow platforms and solutions that automates digital workflows to accelerate enterprise IT operations. It has been benefiting from the rising adoption of its workflows by enterprises undergoing digital transformation.

Its IT products include IT Service Management, IT Operations Management and IT Business Management solutions. Non-IT products include Customer Service, HR and Security Operations.

ServiceNow’s expanding clientele, global presence, and strategic acquisitions are further expected to bolster growth prospects.

Earlier this month, it announced the launch of Now Platform Utah, its latest version of the intelligent, end-to-end platform to enhance automation, simplify the work process and offer greater organizational agility to ServiceNow customers.

New innovations like automated service suggestions, Service Request Playbook, and Workplace Scenario Planning came out in fourth-quarter 2022 to address workplace productivity challenges and eliminate complexity for a better experience.

In February 2023, ServiceNow and AT&T T announced their co-development of a global telecom network inventory to help communications service providers manage 5G and fiber network inventory.

At the end of fourth-quarter 2022, ServiceNow had 1,637 total customers paying more than $1 million in annual contract value. Its subscription revenues increased 22% year-over-year to $1.86 billion. Its strong product portfolio is helping win new customers and drive subscription revenues.

ServiceNow Faces Stiff Competition

ServiceNow is suffering from high inflation, unfavorable forex and a challenging macro-economic environment. Stiff competition is expected to hurt prospects in the long term.

ServiceNow is facing stiff competition in its customer service and HR solutions segment from the likes of Salesforce CRM and Oracle ORCL.

In the recently reported quarterly earnings, Salesforce’s subscription and support revenues increased 14% year over year to $7.79 billion. Oracle’s cloud services and license support revenues increased 20% year over year to $8.9 billion.

ServiceNow shares have declined 21.1% in the past year, underperforming the Zacks Computer & Technology sector’s decline of 14.6% in the same time frame.

Shares of Salesforce have declined 7.4%, while shares of Oracle have gone up 9.4% in the past year.

This Zacks Rank #3 (Hold) company reported earnings of $2.28 per share, which increased 56% year over year. The earnings beat the Zacks consensus estimate by 13.43%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ServiceNow expects first-quarter 2023 subscription revenues between $1.99 billion and $2 billion, suggesting year-over-year growth of 22-22.5% on a GAAP basis. At constant currency (cc), subscription revenues are expected to grow 25-25.5%.

ServiceNow raised its guidance for 2023. It expects subscription revenues between $8.44 and $8.5 billion, which suggests a rise of 22.5-23.5% over 2022 on a GAAP basis and at cc.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $2.09 billion, indicating a 21.39% growth from the year-ago quarter’s reported figure.

The consensus mark for earnings has remained unchanged at $2.02 per share in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance