ServiceNow Could Be One of the More Durable AI Players

The market for artificial intelligence looks very attractive at this time, and ServiceNow Inc.'s (NYSE:NOW) position in it is currently strong. However, over 10-plus years, which is my usual holding period goat, there are likely to be several market and economic shifts that could deplete the returns of some newer AI companies, meaning less security for ServiceNow shareholders than might come with an investment in big tech companies.

Operations analysis

From my research on ServiceNow, what stands out is the business has developed a consistently low customer churn rate of around 2% over the past several years. This indicates it is offering products and services that are truly valuable to its customers. Part of the reason why is that many of its products help to streamline organizational workflows. While previously one business had one digital workflow provider for each department, the company is able to unify these into one primary provider at lower total cost and higher overall efficiency. One of the other core value-adds that I have noticed is the company's products help to aid in organizational communication, which also then contributes to a greater net benefit in operational effectiveness, driving revenue and profitability. Most businesses understand an investment in technology that drives better results and, in turn, improves earnings and administration, which is aided through its AI offerings, is a clear choice to opt in to and then to choose to maintain as a business expense. In other words, the cost-benefit analysis of using ServiceNow dominantly comes out as very positive.

Additionally, the business has a favorable recurring revenue model, which runs via subscriptions. This is good for shareholders because it provides more stable income than one-off expenses. In addition, the business is able to attract customers of a wide range, and even if the customer is lower in annual contract value than its current preference of $1 million-plus, it can slowly work on up-selling and cross-selling to these customers. The greatness of this is that it is not selling goods that its customers do not need. It can train them and educate them that through the effective use of its technologies, the prospective business can generate potentially higher earnings.

However, there is a lot of competition in the market, including from big names like Salesforce (NYSE:CRM), Workday (NASDAQ:WDAY), SAP (NYSE:SAP), Adobe (NASDAQ:ADBE) and Oracle (NYSE:ORCL). However, ServiceNow was one of the first providers of use case-specific generative AI for enterprises. As such, I think it has as a competitive advantage. By maintaining this attitude of innovation, it may be able to consistently carve out a portion of the market that focuses on deep user quality and brings the associated long-term customer retention.

ServiceNow also does not have as much competition as it otherwise could because the cost of businesses transferring digital workflow providers is so high that unless a larger organization or a new one developed a model which was similarly effective but at a highly reduced cost, it makes little sense for present users to defect unless the company begins to fail in product and service quality. To date, the evidence mounts that ServiceNow is highly motivated to provide the best customer experience possible, and I believe as long as it maintains this, it should be able to continue to drive great growth and customer retention.

Financial and valuation analysis

To help outline the long-term worth of ServiceNow, consider the following statistics:

NOW | CRM | SAP | ADBE | ORCL | |

3-year revenue growth rate % | 25 | 15.70 | 4.60 | 16.80 | 15 |

3-year EPS without NRI growth rate % | 140.60 | 45.30 | -5.10 | 14.10 | 2.90 |

Net margin % | 20.34 | 11.87 | 16.41 | 24.08 | 20.27 |

Equity-to-asset ratio | 0.46 | 0.60 | 0.59 | 0.54 | 0.04 |

PE ratio | 81.56 | 68.19 | 41.29 | 46.21 | 32.46 |

Given the data outlined in the table above, investors should consider that ServiceNow is the most highly valued of the group, and I would argue it deserves to be so. With an equity-to-asset ratio of 0.46, which is decent, the highest growth rates by a long shot and boasting the second-best net margin of the group, investors would be wise to consider the valuation of ServiceNow as fair.

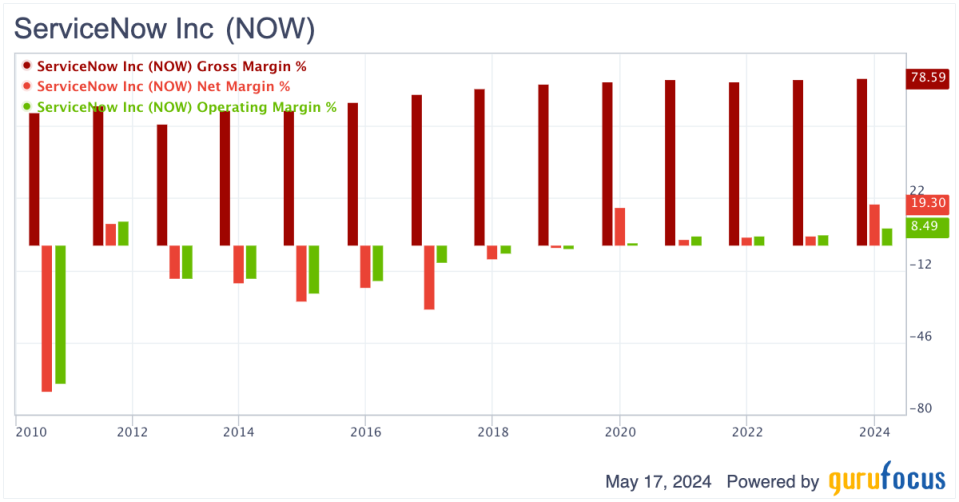

Additionally, the company's margins have been improving significantly over the long term, with steady growth in gross margins and more stable growth recently in operating margins contributing to its overall profitability.

The company has good financial management, which is evidenced by the fact the balance sheet is also improving from an equity-to-asset ratio of 0.31 to the 0.46 recorded at the time of writing. ServiceNow seems to be driving internal efficiency, which is evident in its margin expansion. I think this is something it is going to be looking to maintain over the long term. In my opinion, this is being well guided by Chief Financial Officer Gina Mastantuono. All of these factors are helping to bolster the company's free cash flow margin, which currently stands at a very high 33%, up from the 10-year median of 25.60%.

At such a high price-earnings ratio of around 75, however, investors need to be aware that if the company fails to meet its already very high expectations, the stock could likely experience a lot more downside volatility than otherwise. This is even if it manages to maintain growth but it is just reduced from what analysts are currently forecasting. That presents an element of speculation to the stock because it is trading much higher than what might be deemed intrinsic value in a discounted earnings model.

Based on analyst estimates, a 20% compound annual growth rate for earnings over the next decade is reasonable to input into a DE model, and the result shows an intrinsic value of around $346, with the stock price at the time of writing being $763. That is if I incorporate a 10% discount rate, which I consider the market average annual return expectation, and a 4% terminal stage growth rate, which is in line with typical U.S. inflation.

In my opinion, as long as the demand for ServiceNow stock remains high, which I do not see changing, its share price should continue to climb over the next decade. At this time, I believe it is only apt for a company like ServiceNow, which has demonstrated operational excellence and proven strength in profitability, to be considered trading at an efficient valuation. However, shareholders would be wise to be cautious and closely monitor the enterprise AI market because any deep competitive attacks could inflict high unexpected depletion in the stock valuation.

Key elements

I believe ServiceNow is highly focused on customer satisfaction and innovation. If this ethos continues, the company may be able to command space in the future as one of the lasting leaders in enterprise AI. It has already proven a high level of value in the market, which is growing quickly and evidently sustainable due to its very low customer churn rate. Fuelling this is its primary selling point in that it adds tangible efficiency to its customer's business operations, in turn helping to increase their revenues and net income.

ServiceNow's exceptional growth and expanding margins are now well established, but investors need to be cautious of the valuation. While not necessarily too expensive at this time, it presents little room for operational error. I believe investors would be wise to invest in ServiceNow over a decade or more than for a few years. The associated volatility that could arise in shorter time frames due to momentary operational setbacks makes me skeptical that an investment in ServiceNow is right for investors without a long-term strategy.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance