SelectQuote Inc. (SLQT) Surpasses Quarterly Revenue Expectations and Adjusts Fiscal Guidance Upward

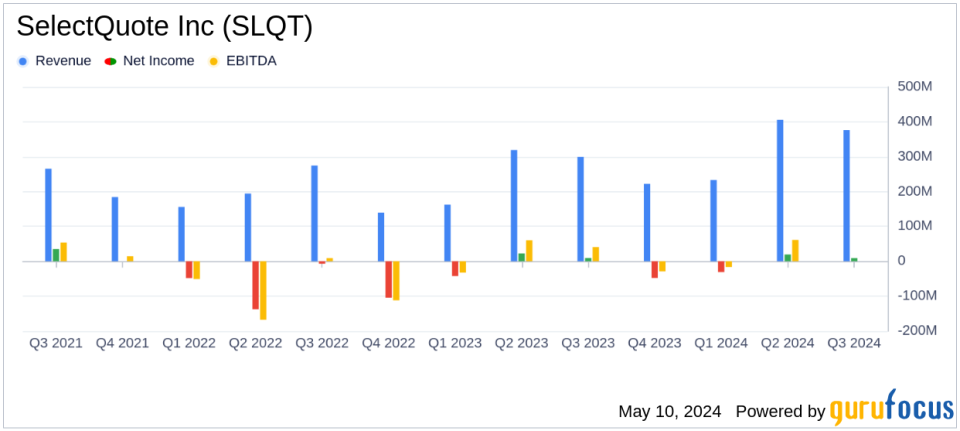

Revenue: Reported $376.4 million in Q3 2024, up 25.7% year-over-year, surpassing estimates of $339.7 million.

Net Income: Achieved $8.6 million in Q3 2024, exceeding estimates of $5.0 million.

Adjusted EBITDA: Reached $46.6 million in Q3 2024, indicating strong operational efficiency and growth.

Fiscal Year Revenue Guidance: Raised to $1.25 billion to $1.3 billion, up from previous estimates of $1.23 billion to $1.3 billion.

Net Loss Guidance: Improved forecast to a range of $34 million to $21 million, better than the prior range of $45 million to $21 million.

Senior Segment Revenue: Increased to $204.3 million in Q3 2024, demonstrating a robust 10% growth from the previous year.

Healthcare Services Growth: Substantial revenue increase of 76% to $124.2 million in Q3 2024, highlighting significant expansion.

SelectQuote Inc. (NYSE:SLQT) disclosed its financial results for the third quarter of fiscal year 2024 on May 9, 2024, revealing a robust performance with significant improvements in revenue and strategic advancements. The details of these results were outlined in their recent 8-K filing.

Company Overview

SelectQuote Inc. operates as a direct-to-consumer distribution platform, facilitating the online shopping experience for health, life, and auto & home insurance policies. The company earns revenue primarily through commissions by selling insurance products on behalf of carrier partners. It is structured into four key segments: SelectQuote Senior, SelectQuote Life, SelectQuote Auto & Home, and Healthcare Services.

Fiscal Q3 2024 Performance Highlights

The company reported a revenue of $376.4 million for the quarter, marking a substantial increase from $299.4 million in the same quarter of the previous year. This figure notably surpasses the analyst's expectation of $339.7 million. Net income stood at $8.6 million, slightly down from $9.3 million year-over-year but still ahead of the estimated $5 million. Adjusted EBITDA reached $46.6 million, compared to $44.0 million in the prior year's quarter.

Segment Performance

The Senior segment was particularly strong, generating $204.3 million in revenue and an Adjusted EBITDA of $61.5 million. This segment's success is attributed to a stable and attractive economic environment during the Medicare Advantage busy season. The Healthcare Services segment also showed remarkable growth, with revenue increasing by 76% to $124.2 million and a positive swing in Adjusted EBITDA to $1.6 million from a previous loss.

Strategic Developments and Future Outlook

CEO Tim Danker highlighted the company's consecutive outperformance and strategic positioning to enhance shareholder value. The success in the Senior and Healthcare Services segments has prompted SelectQuote to raise its fiscal year 2024 guidance. Revenue projections have been adjusted to a range of $1.25 billion to $1.3 billion, and the forecast for net loss has been narrowed to $34 million to $21 million. Adjusted EBITDA expectations have also been raised to $100 million to $110 million.

Operational and Financial Metrics

Key operational metrics such as the number of approved Medicare Advantage policies grew significantly, reflecting the company's effective customer acquisition and retention strategies. The lifetime value of commissions per approved policy also saw an increase, indicating higher profitability per policy.

Amendment to Credit Agreement

On the financial management front, SelectQuote amended its credit agreement on May 8, 2024, extending the maturity date of $683.8 million of term loans and adjusting the asset coverage and liquidity requirements. This amendment is expected to provide greater financial flexibility for the company.

Conclusion

SelectQuote's performance in the third quarter of fiscal 2024 demonstrates a solid trajectory with improved revenue streams across its segments and a positive revision to its full-year guidance. The strategic initiatives and operational efficiencies have positioned the company to capitalize on market opportunities and drive long-term growth. Investors and stakeholders may look forward to the continued execution of strategies aimed at enhancing overall shareholder value.

For detailed financial figures and further information, please refer to the full 8-K filing by SelectQuote Inc.

Explore the complete 8-K earnings release (here) from SelectQuote Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance