Seafarms Group (ASX:SFG) Shareholders Have Enjoyed A 76% Share Price Gain

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Seafarms Group Limited (ASX:SFG) share price is up 76% in the last year, clearly besting the market return of around 28% (not including dividends). That's a solid performance by our standards! Having said that, the longer term returns aren't so impressive, with stock gaining just 8.6% in three years.

View our latest analysis for Seafarms Group

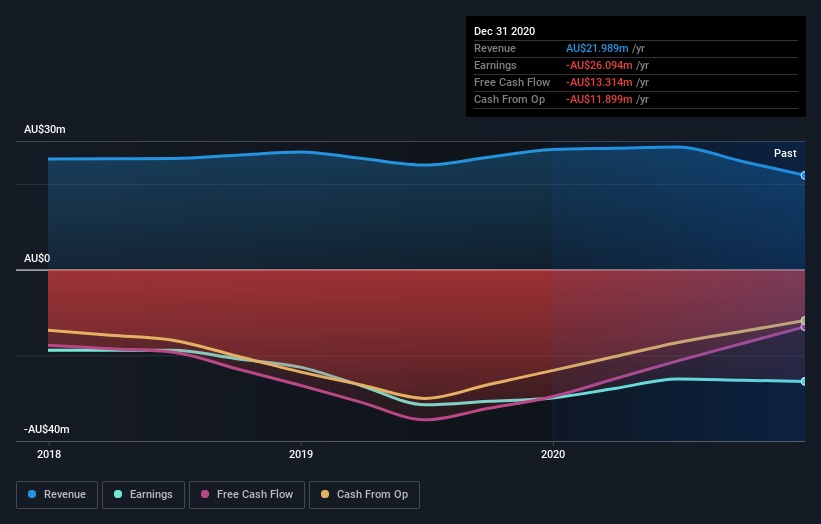

Seafarms Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Seafarms Group actually shrunk its revenue over the last year, with a reduction of 21%. The stock is up 76% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Seafarms Group shareholders have received a total shareholder return of 76% over the last year. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Seafarms Group is showing 3 warning signs in our investment analysis , and 2 of those are significant...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance