Sea Limited (SE) Q1 Earnings Miss Estimates, Revenues Up Y/Y

Sea Limited SE reported earnings of 21 cents per share in first-quarter 2024, missing the Zacks Consensus Estimate of 41.67%. The company posted earnings of 61 cents per share in the year-ago quarter.

Revenues of $3.79 billion increased 27.8% on a year-over-year basis, beating the Zacks Consensus Estimate by 4.76%. The uptick was primarily driven by growth in Gross Merchandise Value (GMV) for e-commerce and the credit business.

The company’s shares have gained 63.6% year to date compared with the Zacks Computer & Technology sector’s rise of 12.5%.

Top-Line Details

Digital entertainment revenues totaled $458 million, missing the Zacks Consensus Estimate by 15.31% and declining 15% year over year.

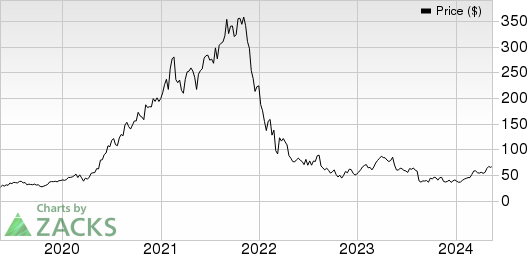

Sea Limited Sponsored ADR Price, Consensus and EPS Surprise

Sea Limited Sponsored ADR price-consensus-eps-surprise-chart | Sea Limited Sponsored ADR Quote

In the first quarter, Garena experienced an 11% year-over-year increase in bookings. Free Fire, one of its flagship games, remained one of the largest mobile games globally, with a 24% rise in average Monthly Active Users (MAU). The game continued to engage players with regular content updates and new features.

Quarterly active users (QAUs) reached 594.7 million compared with the previous quarter’s 528.7 million. The metric beat the consensus mark by 11.85%.

Quarterly paying users of 48.9 million marked a paying user ratio of 8.2% in the first quarter compared with 7.5% in the previous quarter. The metric beat the consensus mark by 22.25%.

Average bookings per user in the reported quarter were 86 cents compared with 94 cents in the year-ago quarter. Bookings were $512.1 million in first-quarter 2024 compared with the previous quarter’s $456.3 million.

E-commerce and other services revenues of $2.9 billion beat the consensus mark by 7.15% and increased 30.6% from the year-ago quarter’s levels.

The uptick was driven by robust performance in Shopee, with gross orders rising by 57% and GMV growing by 36%.

Sales of goods increased 34.9% year over year to $326.1 million in the first quarter of 2023.

Digital financial services revenues surged 21% year over year to $499 million. The figure beat the consensus estimate by 2.49%.

The growth was driven by the number of active consumer and SME loan users which grew by 42% year-over-year, surpassing 18 million. The credit business also experienced substantial growth, with off-Shopee loans making up more than 40% of the total outstanding consumer and SME loans.

Operating Details

Gross profit increased 10% year over year to $1.55 billion in first-quarter 2024.

Adjusted EBITDA was $401.1 million compared with an EBITDA of $507.1 million in the year-ago quarter.

Digital Entertainment's adjusted EBITDA was $ 292.2 million compared with $230 million reported in the year-ago quarter. The metric beat the Zacks Consensus Estimate by 26.3%.

E-commerce adjusted EBITDA declined $21.7 million compared with a profit of $207.7 million reported in the year-ago quarter. The metric beat the consensus mark by 81.7%.

Digital Financial Services' adjusted EBITDA was $149 million and increased 50.3% year over year. The metric missed the consensus mark by 4.32%.

Balance Sheet

As of Mar 31, 2024, Sea Limited had cash and cash equivalents of $2.46 billion compared with $2.81 billion as of Dec 31, 2023.

Zacks Rank & Other Stocks to Consider

Currently, Sea Limited has a Zacks Rank #2 (Buy).

Here are some other top-ranked stocks worth considering in the broader sector.

CrowdStrike CRWD, NVIDIA NVDA and Intuit INTU are some other top-ranked stocks that investors can consider in the broader sector.

All three stocks carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CrowdStrike shares have surged 29.1% year to date. CRWD is scheduled to release first-quarter fiscal 2025 results on Jun 4.

NVIDIA has surged 84.5% year to date. NVDA is scheduled to release first-quarter fiscal 2025 results on May 22.

Intuit shares have inched up 1.7% year to date. INTU is set to report third-quarter fiscal 2024 results on May 23.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance