Scott Black's Strategic Moves in Q4 2023: Spotlight on WR Berkley Corp

Insights from Delphi Management's Latest 13F Filing

Scott Black (Trades, Portfolio), the seasoned investor and president of Delphi Management, Inc., has made notable changes to his investment portfolio in the fourth quarter of 2023. With a rich background in value investing, Black's strategy focuses on fundamental performance and rigorous quantitative criteria. His latest 13F filing reveals significant transactions in various sectors, reflecting his strategic investment decisions based on in-depth analysis and a commitment to value investing principles.

New Additions to the Portfolio

During the fourth quarter, Scott Black (Trades, Portfolio) expanded his portfolio by adding 10 new stocks. Noteworthy new positions include:

Global Payments Inc (NYSE:GPN) with 11,933 shares, making up 1.4% of the portfolio and valued at $1.52 million.

The Walt Disney Co (NYSE:DIS) with 15,767 shares, representing about 1.3% of the portfolio, valued at $1.42 million.

Merck & Co Inc (NYSE:MRK) with 12,681 shares, accounting for 1.27% of the portfolio, valued at $1.38 million.

Significant Increases in Existing Positions

Scott Black (Trades, Portfolio) also strategically increased his stakes in several existing holdings:

Comcast Corp (NASDAQ:CMCSA) saw an addition of 24,250 shares, bringing the total to 54,678 shares. This represents a 79.7% increase in share count and a 0.98% impact on the current portfolio, with a total value of $2.4 million.

Oshkosh Corp (NYSE:OSK) with an additional 7,499 shares, bringing the total to 14,694 shares. This adjustment represents a 104.23% increase in share count, valued at $1.59 million.

Complete Exits from Certain Holdings

In the same quarter, Scott Black (Trades, Portfolio) decided to exit completely from nine positions:

AGCO Corp (NYSE:AGCO), where all 10,767 shares were sold, impacting the portfolio by -1.3%.

Devon Energy Corp (NYSE:DVN), with all 26,270 shares liquidated, causing a -1.28% impact on the portfolio.

Reductions in Key Positions

Adjustments were also made to reduce positions in several stocks:

WR Berkley Corp (NYSE:WRB) saw a reduction of 22,304 shares, a -51.11% decrease, impacting the portfolio by -1.46%. The stock traded at an average price of $68.37 during the quarter and has seen a return of -3.87% over the past three months and 11.43% year-to-date.

Sanmina Corp (NASDAQ:SANM) was reduced by 13,913 shares, a -59.15% reduction, impacting the portfolio by -0.77%. The stock traded at an average price of $51.03 during the quarter and has returned 12.00% over the past three months and 30.25% year-to-date.

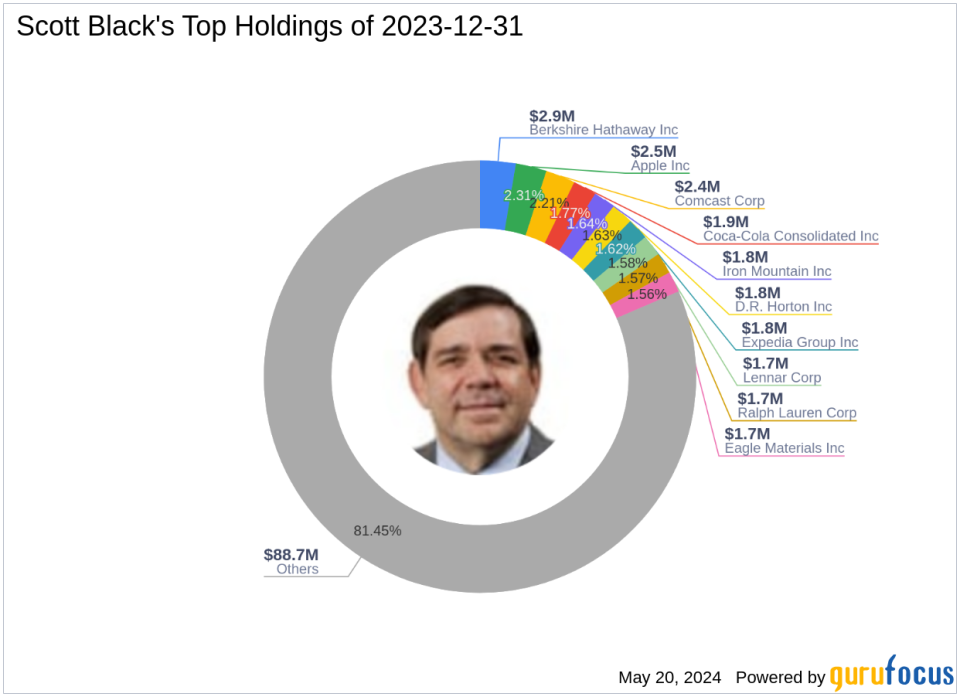

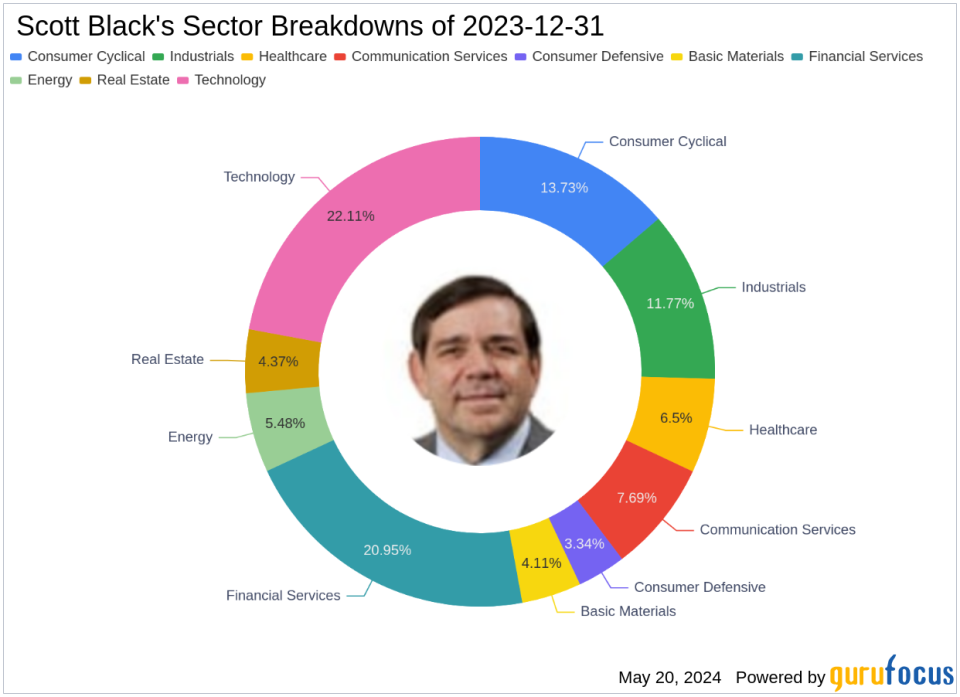

Portfolio Overview and Sector Allocation

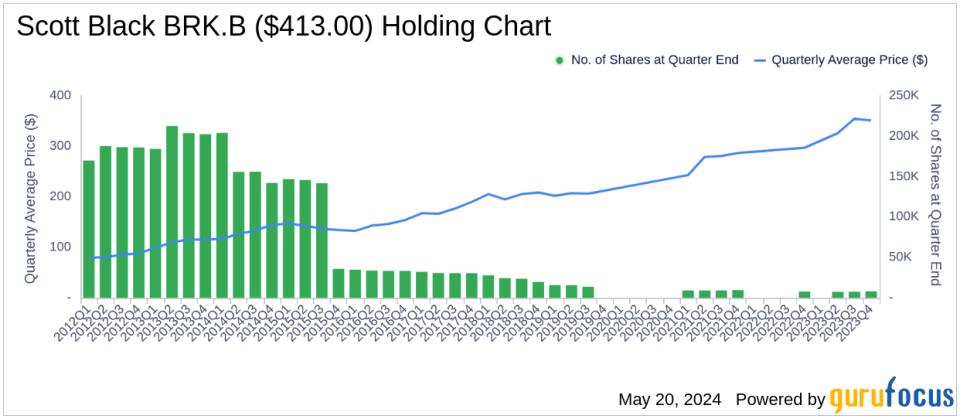

As of the end of Q4 2023, Scott Black (Trades, Portfolio)'s portfolio comprised 81 stocks. The top holdings included 2.66% in Berkshire Hathaway Inc (NYSE:BRK.B), 2.31% in Apple Inc (NASDAQ:AAPL), and 2.21% in Comcast Corp (NASDAQ:CMCSA). The portfolio is mainly concentrated across 10 industries, with significant investments in Technology, Financial Services, and Consumer Cyclical sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance