Science Applications (SAIC) Q2 Earnings Beat, Increase Y/Y

Science Applications SAIC reported second-quarter fiscal 2020 earnings of $1.35 per share, beating the Zacks Consensus Estimate of $1.27. The bottom line also improved 11% year over year.

Moreover, revenues jumped 43% from the year-ago quarter to $1.59 billion. Revenues realized from the acquisition of Engility drove the top-line growth.

However, excluding Engility, revenues were flat year over year. The figure also missed the Zacks Consensus Estimate of $1.64 billion. The company witnessed some delays in contract awards due to protests. Moreover, unmaterialized new businesses were also an overhang on the top line.

Nonetheless, adjusting for nearly $30 million in dissynergies due to elimination of prime sub-revenues, lower revenues on cost, and lower contract revenues due to cost synergy achievement, the company achieved 2% organic growth year over year.

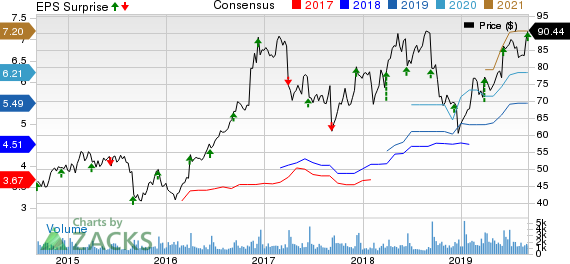

Science Applications International Corporation Price, Consensus and EPS Surprise

Science Applications International Corporation price-consensus-eps-surprise-chart | Science Applications International Corporation Quote

Quarter in Detail

Net bookings for the quarter were approximately $1.9 billion, excluding $400 million of single-award IDIQ value, as a result of contract award activities, reflecting a book-to-bill ratio of approximately 1.2.

Science Applications’ estimated backlog of signed business orders was approximately $13.9 billion of which, $2.6 billion was funded.

Adjusted operating margin contracted 30 basis points (bps) year over year to 6.3% in the reported quarter.

Adjusted EBITDA margin expanded 90 bps to 8.4%, backed by an improved program performance, cost discipline and higher margin portfolio of Engility. The figure does not include $6 million of integration related costs in the quarter.

Balance Sheet & Cash Flow

Science Applications ended the quarter with cash and cash equivalents of $179 million, up from $151 million reported in the previous quarter.

Operating cash flow was $95 million, down from $178 million in the previous quarter. Free cash flow was $90 million compared with $169 million in the preceding quarter. The second quarter is usually the lowest cash generating quarter for the year due to additional payroll cycles compared to the other quarters, and two income tax payments.

Nonetheless, significant cash collections and reduced working capital were positives.

During the quarter, Science Applications deployed $156 million of capital, consisting of $133 million in planned share repurchases, $21 million in cash dividends and a $2 million in debt repayment.

Guidance

Science Applications maintained revenue target per its report presented at the investors’ conference held in January.

For the full fiscal year, adjusted EBITDA margin is expected to expand 80 bps year over year.

Free cash flow is still expected to be around $425 million for fiscal 2020.

The company’s full-year effective tax rate is forecast in the 22-24% range.

The company expects headwinds of nearly $100 million in dissynergies due to elimination of prime sub-revenues, lower revenues on cost, and fall in contract revenues due to cost synergy achievement during the fiscal year.

Zacks Rank and Stocks to Consider

Currently, Science Applications has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Chegg CHGG, Benefitfocus BNFT and Anixter International AXE. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Chegg, Benefitfocus and Anixter is currently pegged at 30%, 25% and 8%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chegg, Inc. (CHGG) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

Anixter International Inc. (AXE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance