From Sci-Fi Dream to Market Maze: Eli Lilly's Weight-Loss Medication Faces Hurdles

Founded in Indianapolis in 1876, Eli Lilly and Co. (NYSE:LLY) is one of the world's top pharmaceutical companies. Its products are manufactured and distributed in more than 100 countries through facilities in the U.S., Europe and Asia. Colonel Eli Lilly - the founder, who also happened to be a chemist - manufactured the first quinine, a compound used to treat malaria. The treatment was the first in a long series of blockbusters produced by his company. Prozac (fluoxetine, antidepressant), Zyprexa (olanzapine), Cymbalta (duloxetine) and several other drugs followed.

The company may be even more famous for the excellent therapeutic solutions it gave diabetic patients, most notably Humalog (insulin lispro) and Trulicity (dulaglutide). It has a long history being a first-mover, producing human insulin using recombinant DNA (Humulin, Humalog), biosimilar insulin products (Basaglar, based on insulin glargine) and not to mention the big endeavor to mass-produce the polio vaccine developed by Jonas Salk. All this happened while surviving some tough scandals like in 2009 with the $1.4 billion penalty paid for illegally marketing Zyprexa (olanzapine) with off-label indications.

With this long history of pioneering advancements in medicine, it is no surprise Eli Lilly was among the first to successfully produce a weight-loss drug, an area with huge potential that was once a figment of sci-fi fantasy.

Weight-loss medication: An overview

Along with Novo Nordisk (NYSE:NVO), Eli Lilly once again distinguished itself from peers in 2023 with the introduction of tirzepatide, which is sold under the brand name Zepbound. The simple pill that will make you lose weight has taken the market by storm since then.

Obesity was designated as a chronic disease in 2013 by the American Medical Association. Even if the AMA's definition has no legal authority, this change was epochal. Along with reducing the stigma around obesity (e.g., alleged lack of willpower), it brought more interest in the field with research for prevention and treatment strategies. Indeed, several attempts have been made, yielding only scarce results (2% to 10% of weight loss) until recently.

Research shifted toward a once diabetes-only class of drugs, incretin-mimetics (or incretins for short). These compounds were found to reduce weight up to between 20% and 25%. Without further delving into the matter, the science behind these drugs is plentiful, and it is sound.

The total addressable market for anti-obesity medications is projected to be in the range of $100 billion to $130 billion according to Goldman Sachs Research. This bold estimate is based on some clear data and projections.

First, 16% of adults aged 18 years and older worldwide were obese in 2022, according to March 2024 data from the World Health Organization. That's 2.89 million adults evenly spread among both sexes. This figure has more than doubled since 1990. The rate of overweight individuals - defined as a body-mass index above 25 - is obviously higher at 2.50 billion adults, or 43%, almost double the 25% figure for 1990. Obviously, prevalence varies between countries and regions. In the U.S. alone, 42.40% of the population is obese (2018 data), or 138 million people considering a demography of around 326 million people. Based on the World Obesity Atlas 2023 forecast, the trend is clear: around half the global population will be overweight by the end of the decade.

Next, we need to estimate the penetration. Goldman Sachs considered a 13% penetration of eligible U.S. adults. Let's assume this is an accurate estimate, combined with the data aforementioned, the TAM would be 18 million adults.

Lastly, the cost per year of medication. That's a tough one. Right now it is around $15,000 per patient. Even if it is said to be higher with more insurance covering the compounds, let's be conservative and put half that figure into the calculation.

As such, the estimated market size will be around $135 billion by the end of the decade. That's a per-year potential figure that will be split between the different competitors. Right now the market is split between Eli Lilly and Novo Nordisk, which are expected to retain 80% of the obesity market in 2030.

However, a couple of important potential headwinds must be considered. More patients will mean more insurance companies covering the medication costs. This may result in lower price realized per patient. Nonetheless, the economic advantage to prevent and treat obesity is huge considering all the noncommunicable diseases that have obesity as a major risk factor (e.g., type 2 diabetes, heart failure), hence a rising price could be justified in a cost-benefit analysis.

Second, the market will likely see the influx of new drugs of the same class or similar. This could lead to increased competition and may lower the selling prices, but is highly unlikely considering the patent protection that will last until the mid-2030s and the first mover advantage.

Last but not least, if future studies show significant weight regain after months of discontinuing the medication will accumulate, sales could decline. Indeed, a percentage of patients will not like to feel dependent on a drug to keep their weight in check.

Equally splitting the estimated TAM figure between the two pharmaceutical behemoths, we end up with a potential revenue stream of $54 billion to $67.5 billion per year for both Eli Lilly and Novo Nordisk.

The pipeline is alive and well

Eli Lilly has a lot more to offer than anti-obesity medications, however.

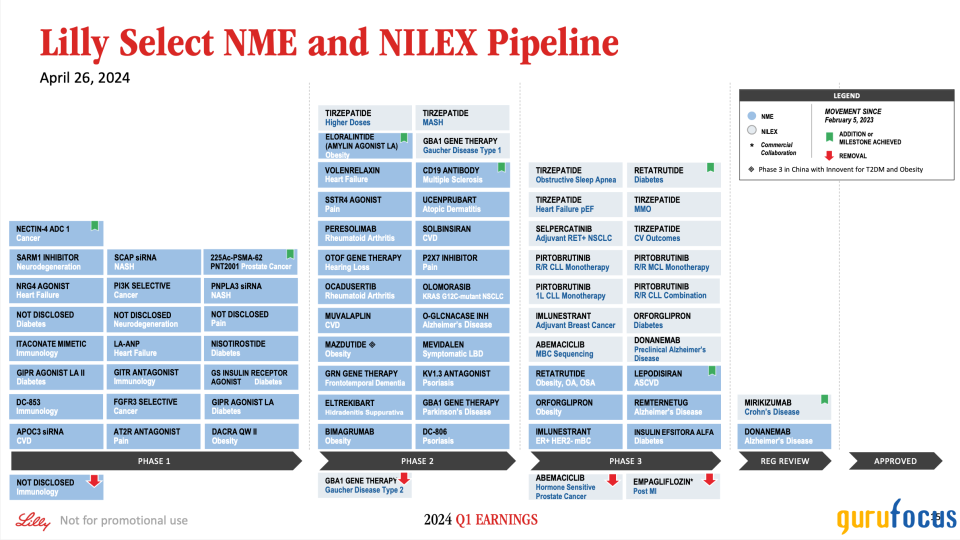

In its pipeline, the company noted it has 21 New Molecular Entities or New Indication or Line Extension products in the first phase of clinical trials. There are also 24 drugs in Phase 2 trials and 20 in Phase 3.

Source: Eli Lilly official investor presentation.

Two compounds awaiting regulatory review are even closer to hitting the market: donanemab and mirikizumab. The U.S. Food and Drug Administration is set to ask its advisory committee about the soundness of the results of the Phase 3 TRAILBLAZER-ALZ 2 trial on donanemab. The biological drug has been tested in treating early symptomatic Alzheimer's disease. Eli Lilly expects the FDA to decide on the matter before the end of 2024. This could be a great driver for the company's bottom line.

Mirkizumab, on the other hand, is seeking approval for the treatment of Crohn's disease.

Donanemab is expected to bring in north of $4 billion in revenue by the end of the decade, if approved. A quarter of that value is reasonably to be expected as peak sales of mirikizumab are granted extension to Crohn's disease following the 2023 year-end approval for ulcerative colitis with brand name Omovh after it was refused for manufacturing concerns a couple of months earlier.

Deconstructing the valuation

Turning to its valuation, the innovative company had a price-sales ratio of 20.91 at the time of writing. But there's more, currently Mr. Market - a well-known analogy for the financial market - is pricing the stock at 122 times its trailing earnings, or about half that figure for the forward net income.

As you might expect, the high price-earnings ratio leads to high price-earnings-to-growth, or PEG, ratio. This metric is often used to contextualize the price-earnings based on the expected growth rate of the earnings in a specified period. By doing so, you would aim for a number under one. Ely Lilly has a PEG of 2.46.

All traditional value metrics point to the same conclusion: overvaluation.

Considering the capital structure of the company is always a top priority in the quest to understand the business and its value. Eli Lilly, in the most recent quarter, declared $26.35 billion of total debt covered by only $12.90 billion in shareholder's equity. It's an unfavorable debt-to-equity ratio above 200%, which can perhaps be explained with the capacity expansion it has undergone since last year.

Shipments hurdles, a not-so-bad headache to have

A lot of debt means a lot of interest, too. All money spent on interest is not available for prospective expansion, generally speaking. The Eli Lilly case, though, is peculiar. Indeed, the management team just reported a production bottleneck during the first-quarter earnings call. Hence, to meet all the (growing) demand, they have to enrich production and not just productivity. Several acquisitions have been made in the previous months and more are expected.

In the near future, production capacity will be amplified, but not before the end of the year. Here is a quick recap of the ongoing investments to expand the manufacturing capacity, particularly affecting the weight-loss drug Zepbound.

North Carolina: One already built for around $1 billion; the second one under construction and to be ready by the end of 2024 for $1.7 billion.

Wisconsin: Acquisition of already FDA-approved Nexus parental medicine manufacturing facility; production expected by the end of next year.

Limerick, Ireland: New building of around $1 billion with expected production by the end of 2025.

Indiana: $3.70 billion for two properties that will produce from 2026.

Alzey, Germany: $2.5 billion facility with 2027 as an opening deadline.

Management said the supply-constrained situation could last through 2025. All these led to growing net debt (i.e., total debt minus cash and cash equivalents) in recent quarters - from $11.89 billion in 2019 to $17.97 billion in the first quarter of 2024.Gauging this number against Ebitda is one of the most used ratios to assess the leverage of a company. The average debt-to-Ebitda ratio for the biotech sector is 1.26 and 1.69 for drug manufacturers. Eli Lilly's ratio of 2.71 is in line with the average, but more than ten-fold the same ratio of direct competitor Novo Nordisk's 0.22. Even if the supply issue is a commonality between the two companies around the incretins segment, Novo seems to manage it way better.

Sporting $2.59 billion in total cash, in the short term the company has two reassuring ratios relating to its liquidity. At 1.35, the current ratio (current assets divided by current liabilities) points toward sustainable debt and is in line with the average of the last decade. If we look to the more strict metric, the quick ratio - which subtracts inventories from the current assets while leaving the denominator unchanged - the result is reassuring since right now it is 1.03. Note, a number above one for both metrics denotes a healthy operating structure.

Is Eli Lilly worth the price?

Valuation is an art on its own. But let's make some bold assumptions and see where it goes from there.

Let's assume the revenue for the next couple of years will grow to a range of $89.90 billion to $100.4 billion thanks to the approval of donanemab ($4 billion per year), the overcoming of the shipping volumes obstacle for the incretins segment ($54 billion to $67.5 billion per year on tirzepatide and biosimilars) and the retention of the market share for the remaining compounds ($28.90 billion in the previous fiscal year).

Considering a price-sales ratio of 6.4, which is the average for the biotech sector (e.g., Abbvie (NYSE:ABBV), Amgen (NASDAQ:AMGN), Vertex (NASDAQ:VRTX)), this translates to a target price between $575 and $643 based on the estimated sales range.

A much lower number will result for the average price-sales ratio of the pharmaceutical sector (e.g., Johnson & Johnson (NYSE:JNJ), Merk (NYSE:MRK)) of 4.50; indeed, this will be around $407 to 452 per share.

Considering the actual share price of around $870, Mr. Market is awarding the stock a significant premium in the range of 35% to 115%. Even without considering the profitability of the company that generally discounts the sales, it appears to have a significant premium already factored in.

Risk factors

As all the news keeps on reminding us, the competition in the drug industry is fierce. In this case, the biggest competitor is Novo Nordisk. Conversely, this can also facilitate deeper market penetration across diverse regions.

As mentioned above, if Eli Lilly is not fast enough in meeting demand, the shipping volumes will not increase sufficiently and the risk for a competitor to take its place is tangible.

Lastly, let's not forget the eventuality of later incurring adverse effects (e.g. neuroendocrine system pathology, neoplasms) and failure of lasting successful outcomes (regaining weight). All of these will be assessed during the Phase 4 clinical trials, also called post-marketing surveillance.

Conclusion

The legacy company is on top of the incretins game and has plenty of room to grow sales-wise. Even considering the brightest future outcome and the highest estimates, it appears the market has already factored in a significant premium of at least 35% of the average price expected for the sector. Investors need not fear holding on to some of the shares if already bought, but should carefully consider reducing their positions and perhaps not adding to them.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance