Schneider's (SNDR) Q1 Earnings Beat Estimates, Increase Y/Y

Schneider National, Inc.’s SNDR first-quarter 2020 earnings (excluding 1 cent from non-recurring items) of 24 cents per share surpassed the Zacks Consensus Estimate by 5 cents. Moreover, the bottom line increased 14.3% on a year-over-year basis. Also, operating revenues dropped 6.3% to $1,119.1 million and lagged the Zacks Consensus Estimate of. Moreover, revenues (excluding fuel surcharge) fell 6% to $1,016.1 million. Results were hampered by lower volumes, downside in fuel surcharge revenues and coronavirus-led disruptions.

Income from operations (on a reported basis) increased 7% from the prior-year quarter’s level to $54.9 million owing to elimination of FTFM operating losses, cost-cut initiatives and lower fuel costs. Adjusted income from operations increased 4% to $53.7 million in the March-end quarter. Also, adjusted operating ratio (operating expenses as a percentage of revenues) improved 50 basis points to 94.7%. Notably, lower the value of the ratio the better.

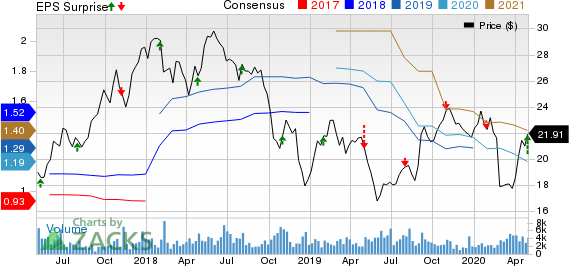

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) slipped 12% to $469.4 million. Average trucks (company trucks and owner-operated trucks) in the segment also fell 11.8% to 10,207. Further, revenue per truck per week for the segment dropped 1.3%. This downside was mainly due to shutdown of FTFM operations and unfavorable pricing. Truckload income from operations was $36.6 million in the reported quarter, up 58%. Moreover, adjusted operating ratio improved to 92.2% from 95.6% in the year-earlier quarter.

Intermodal revenues (excluding fuel surcharge) were $261.2 million, flat with the first quarter 2019. Revenue per order declining 4%, primarily due a higher mix of shorter length of haul volume. Segmental income from operations decreased 18% to $16.3 million as a result increased rail purchased transportation costs. Additionally, intermodal operating ratio deteriorated to 93.2% in the first quarter from the prior year’s 91.6%.

Logistics revenues (excluding fuel surcharge) dropped 2% to $239.6 million, primarily due to a customer in-sourcing activity in the segment’s import/export operations. However, net revenue compression primarily induced a 59% decline in segmental income from operations to $4.2 million. Further, operating ratio in the segment deteriorated to 98.2% from 95.8% in the first quarter of 2020.

Liquidity

Schneider, carrying a Zacks Rank #4 (Sell), exited the first quarter with cash and cash equivalents of $600.6 million compared with $551.6 million at the end of 2019.

Suspends 2020 EPS Guidance

Due to uncertainties related to the magnitude and duration of COVID-19 crisis, Schneider has suspended its full year 2020 EPS guidance.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshot

Apart from Schneider, there are a few companies in the Zacks Transportation sector like Werner Enterprises, Inc. WERN , Union Pacific Corporation UNP and Canadian Pacific Railway Limited’s CP that have beaten earnings estimates in first-quarter 2020.

Werner Enterprises reported first-quarter 2020 earnings per share (excluding 7 cents from non-recurring items) of 40 cents, which surpassed the Zacks Consensus Estimate of 35 cents. However, the bottom line declined 23.1% year over year.

Union Pacific’s first-quarter 2020 earnings of $2.15 per share surpassed the Zacks Consensus Estimate of $1.86. Moreover, the bottom line increased 11.4% on a year-over-year basis.

Canadian Pacific’s first-quarter 2020 earnings (excluding $1.08 from non-recurring items) of $3.3 (C$4.42) per share surpassed the Zacks Consensus Estimate of $2.86. Quarterly earnings surged more than 55% year over year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance