Schlumberger (SLB), Aramco to Develop Low-Carbon Solutions

Schlumberger Limited SLB collaborated with Saudi Aramco to develop a digital platform to provide sustainable solutions for industrial sectors, which are among the most challenging to decarbonize.

The platform will enable industrial companies such as oil and gas, chemicals, utilities, cement, and steel to collect, measure, report and validate their emissions. It will also enable them to assess different decarbonization pathways.

The platform will be extendable into other aspects of the industries’ sustainable efforts. It will involve workflows such as water sustainability and management, methane emissions measurement, flaring reduction and prevention, and carbon capture and storage.

The companies will be able to measure and report baselines, targets, emissions, offsets and credits to manage their carbon footprints efficiently by increasing the availability and visibility of relevant data in a transparent and flexible solution.

As the current energy crisis is gripping the world, Aramco believes that raising oil and gas investments, and creating a more reliable roadmap to energy transition is necessary to address climate priorities and energy security challenges for a secure and sustainable energy future.

Schlumberger and Aramco will leverage their expertise to deliver a digital sustainability ecosystem, allowing global organizations to reduce carbon emissions and achieve sustainability goals. The proposed platform will be a striking change for the energy and hard-to-abate industry sectors.

The latest collaboration demonstrates an excellent opportunity for both companies to leverage digitalization to address one of the most critical challenges — climate change. Meanwhile, it would expand digital capabilities within Saudi Arabia and exploit Schlumberger’s extensive reach to deliver a worldwide impact.

Company Profile & Price Performance

Headquartered in Houston, TX, Schlumberger is a leading oilfield service provider. The company provides leading digital solutions and deploys innovative technologies to enable performance and sustainability for the energy industry.

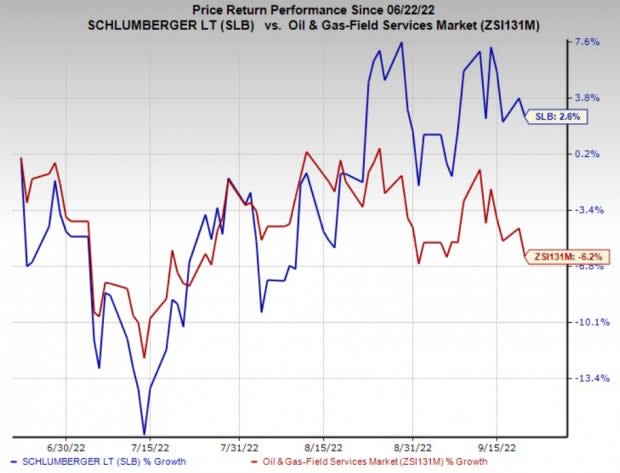

Shares of Schlumberger have outperformed the industry in the past three months. Its stock has gained 2.6% against the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Schlumberger currently flaunts a Zacks Rank #1 (Strong Buy).

Investors interested in the energy sector can look at the following companies that also presently sport a Zacks Rank #1. You can see the complete list of today's Zacks #1 Rank stocks here.

Murphy USA Inc. MUSA is a leading independent retailer of motor fuel and convenience merchandise in the United States. MUSA remains committed to returning excess cash to its shareholders through continued share buyback programs. The fuel retailer approved a repurchase authorization of up to $1 billion, which will commence once the existing $500-million authorization expires and be completed by Dec 31, 2026.

Murphy USA has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of B for Value and Growth. MUSA is expected to see an earnings surge of 61.5% in 2022.

Liberty Energy LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s debt-to-capitalization stands at just 16% compared with many of its peers, which are hugely burdened with debts, accounting for around 50% of their total capital structure.

Liberty Energy has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Growth, and B for Value and Momentum. LBRT is expected to see an earnings surge of 266.7% in 2022.

Canadian Natural Resources Limited CNQ is one of Canada’s largest independent energy companies that explores, develops and produces oil and natural gas. CNQ recently declared a special cash dividend on its common shares of C$1.50 per share, reflecting strength in its cash flows.

Canadian Natural Resourceshas witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and Growth, and B for Momentum. CNQ is expected to see an earnings surge of 75% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance