Schlumberger Ltd (SLB) Aligns with EPS Projections, Surpasses Revenue Estimates in Q1 2024

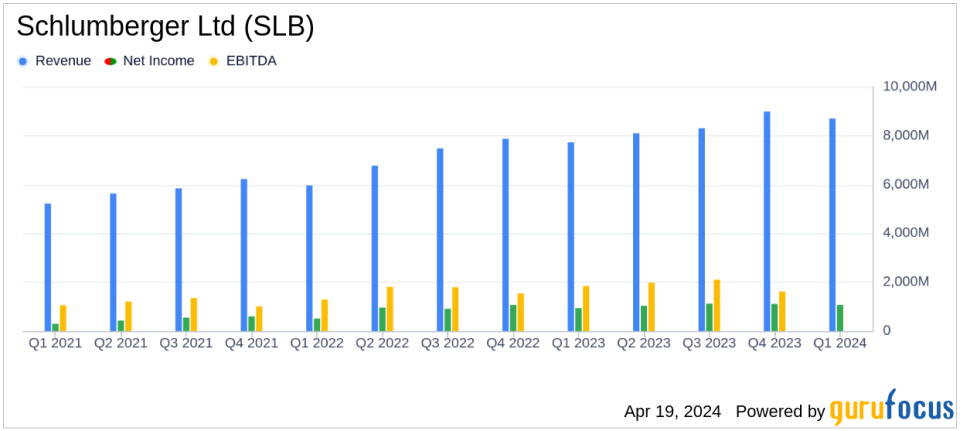

Revenue: Reported at $8.707 billion for Q1 2024, up 13% year-over-year, surpassing the estimated $8.693 billion.

Net Income: GAAP basis net income reached $1.068 billion, below the estimated $1.079 billion, reflecting a 14% increase from the previous year.

Earnings Per Share (EPS): GAAP diluted EPS was $0.74, falling short of the estimated $0.75, marking a 14% increase year-over-year.

Adjusted EBITDA: Achieved $2.057 billion, up 15% from the previous year, indicating continued operational efficiency and profitability.

Geographical Performance: International revenue grew by 18% to $7.056 billion, offsetting a 6% decline in North America to $1.598 billion.

Divisional Growth: Production Systems division saw a notable increase of 28% in revenue, driven by the acquisition of Aker subsea business and strong international sales.

Shareholder Returns: Targeting to return $7 billion to shareholders over 2024-2025, with a robust plan for buybacks and dividends.

On April 19, 2024, Schlumberger Ltd (NYSE:SLB), the world's preeminent oilfield services company, disclosed its first-quarter financial results through an 8-K filing. The company reported a quarterly revenue of $8.707 billion, surpassing the analyst's expectation of $8.693 billion, and aligning with the earnings per share (EPS) estimate at $0.75.

Company Overview

Schlumberger Ltd is not only the largest but also one of the most innovative firms in the oilfield services sector, with a robust presence across various disciplines such as reservoir performance, well construction, and digital solutions. The company's extensive expertise and technological advancements have secured its dominant position in numerous markets globally.

Financial Performance and Market Challenges

The first quarter of 2024 saw Schlumberger generating a net income of $1.068 billion on a GAAP basis, marking a 14% increase year-on-year. This performance underscores the company's robust operational framework and its ability to adapt to dynamic market conditions. Despite facing a slight sequential revenue decline of 3%, attributed to seasonal variations, the company's year-on-year revenue growth of 13% highlights its strong market position and operational efficiency.

Strategic Achievements and Industry Impact

SLB's strategic initiatives, including the significant acquisition of ChampionX Corporation, are set to enhance its production and recovery portfolio, indicating a proactive approach to growth and market expansion. The company's commitment to returning $7 billion to shareholders over 2024-2025 reflects confidence in its financial health and a shareholder-friendly capital allocation policy.

Detailed Financial Analysis

The company's income before taxes stood at $1.357 billion, with a pretax margin of 15.6%. Notably, the Adjusted EBITDA reached $2.057 billion, with an Adjusted EBITDA margin of 23.6%, demonstrating effective cost management and operational efficiency. The detailed divisional performance reveals significant growth in areas like Production Systems, which saw a 28% increase in revenue, largely driven by the acquisition of Aker's subsea business.

Internationally, SLB experienced an 18% increase in revenue, countering softer performance in North America, where revenue declined by 6%. This geographical revenue shift underscores SLB's strong positioning and strategic focus on international markets, particularly in the Middle East & Asia and Europe & Africa.

Outlook and Forward Movements

Olivier Le Peuch, CEO of Schlumberger, expressed optimism about the company's trajectory, emphasizing the sustained revenue growth and margin expansion. The company's strategic acquisitions not only promise to enhance its service offerings but also position it well to capitalize on the increasing global demand for energy-efficient and sustainable solutions.

In addition to its financial goals, SLB is actively pursuing advancements in digitalization and decarbonization, aligning with industry trends towards sustainability and efficiency. The acquisition of a majority stake in Aker Carbon Capture further illustrates SLB's commitment to leading in low-carbon technologies and carbon capture solutions.

As SLB continues to navigate the complexities of the global energy market, its strategic initiatives and robust financial performance are expected to drive continued growth and shareholder value in the upcoming quarters.

Conclusion

SLB's first-quarter earnings for 2024 reflect a company that is not only managing to align with market expectations but also exceeding them in key areas such as revenue growth. With strategic acquisitions and a focus on innovation, Schlumberger is well-positioned to maintain its leadership in the oilfield services sector and deliver on its promises to shareholders and the broader market.

Explore the complete 8-K earnings release (here) from Schlumberger Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance