Scalping the AUDCAD Reversal- Shorts Favored Below 9928

DailyFX.com -

Talking Points

AUDCAD reversal off key resistance in focus

Possible head & shoulders formation underway

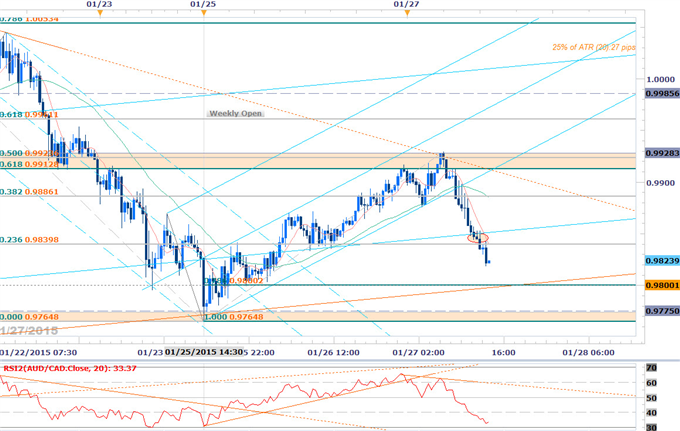

AUD/CAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

AUDCAD reversal off key resistance / RSI trigger break shifts scalp bias lower

Resistance at 9912/28- bearish invalidation- Breach targets 9985 & 2013 TL resistance

Interim support 9739, 9684 & 9658

Look for daily RSI break sub-50 to validate our bias- bearish

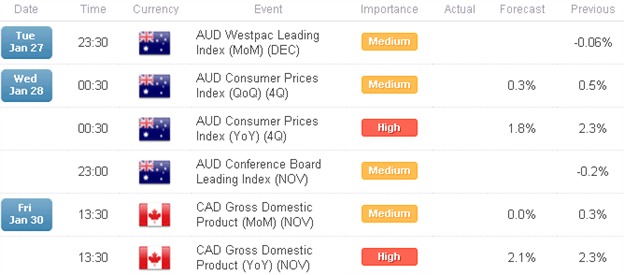

Event Risk Ahead: Consumer Price Index (CPI) tonight, Canada GDP on Friday & RBA Interest Rate Decision next week

AUD/CAD Hourly

Notes:We’ve been tracking the AUDCAD lower since last week’s reversal off the 2013 trendline resistance with the rally overnight offering short entries back at the 9913/28 resistance level. We will continue to reserve this region as our near-term bearish in validation level with shorts-scalps favored below this zone. A quarter of the daily average true range yields profit targets of 25-28 pips per scalp.

Bottom line: we’ll favor selling rallies / short triggers with a break below the weekly opening range low at 9765 putting targets in view at 9733/39, 9684 & 9658. Note that a possible head & shoulders formation may be underway here and as such a measured move puts in to target the 100% extension of the decline at 9612. Caution is warranted heading into tonight’s Australia data with the release of the 4Q inflation numbers likely to fuel added volatility in the Aussie crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

Gold Stalls at Technical Resistance- Remains Constructive Above 1262

GBPUSD Reversal Pauses at Resistance- Longs Favored Above 1.5170

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance