5 savings accounts with a better rate than ING’s orange card

A few years ago, the Barefoot Investor launched his best-selling Guide to Financial Freedom and made the ING orange card famous.

It became popular for its high savings rates, beating out all the big four banks.

But that was then, and this is now. Since mid-2019, the Reserve Bank of Australia has made a handful of rate cuts in a bid to help the Australian economy which was already struggling before it was hit by the pandemic. In the span of 18 months, the RBA has brought down the national interest rate from 1.5 per cent to 0.10 per cent.

It means that savings rates all across Australia aren’t looking too hot right now – but some deals are better than others.

At the time of publishing, the savings account with the highest interest rate (without any age limit) was Rabobank, with a total savings rate of 2 per cent.

ING’s Savings Maximiser hung onto its 1.5 per cent rate until Wednesday, at which point it brought down its rate off the back of the RBA’s 0.15 per cent cut.

Its new rate is 1.35 per cent, putting it at only the fourth most competitive rate in the market right now, alongside HSBC and 86 400.

Reddit users also noted the ING interest rate drop, with user UnseatingCargo1 posting an email they received from the digital bank on Tuesday.

Fellow Reddit users jumped in the comments to observe other banks had slashed rates as well.

“Both 86 400 (1.35 per cent) and Up Bank (1.1 per cent) have also reduced their interest rates recently too :(,” said bugHunterSam.

“Given the current RBA cash rate you really shouldn't be surprised that the "maximum" is pretty low,” said Whatsapokemon.

The best savings rates Aussies can find right now

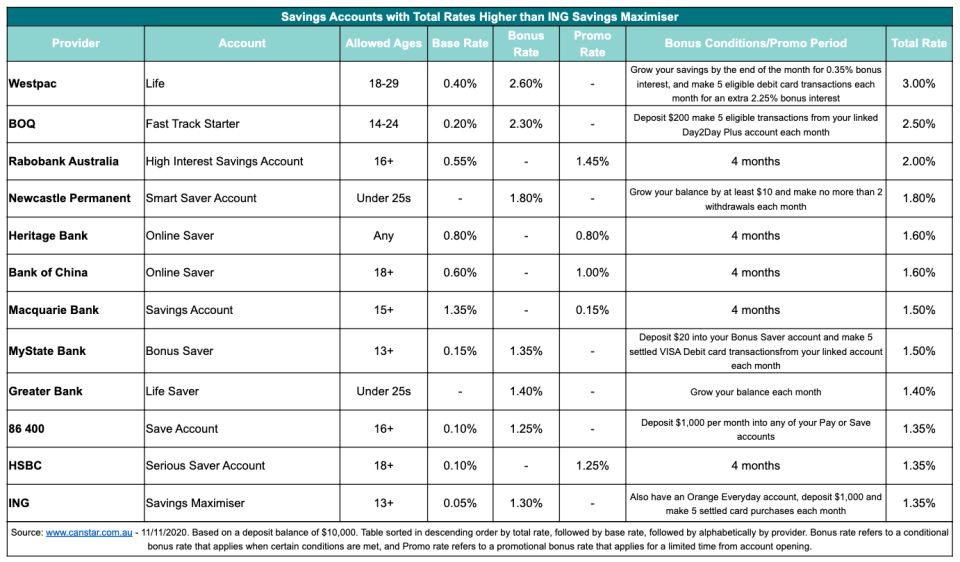

According to Canstar data provided to Yahoo Finance, here are the best total savings rates around at the moment:

Taking only the rates available to adults of all ages, here are the top rates summarised in a nutshell:

Rabobank: 2%

Heritage Bank and Bank of China: 1.6%

Macquarie and MyState: 1.5%

86 400, HSBC, ING: 1.35%

Read the fine print

If these savings rates seem too good to be true right now, you’d be right in a way.

All of these rates come with conditions – the rates might only be eligible for a short length of time (e.g. four months) or you have to make a certain number of transactions with that account a month.

Some of them also have age limits, with some cards eligible only to children or young adults.

“So if you're looking to switch to one of these accounts, you won’t be saving much money by ‘setting and forgetting,’” said Canstar finance expert Steve Mickenbecker.

“The other option to secure a higher rate up to 2 per cent at the moment is to choose an introductory rate and be willing to move your money to the next top offer after the intro period expires,” he told Yahoo Finance.

“The banks are likely to continue to cut savings rates so savers have to be watching and be ready to chase the better rate offers.”

Young Aussies get the best deal

If you’re above 18 but under 24 or 29 years old, it’s more good news for you: the very best savings rates are available only to you.

Westpac launched a savings account just for young Aussies aged 18-29 at an unmatched interest rate of 3 per cent.

BOQ’s Fast Track Starter isn’t far too behind at 2.5 per cent, while Newcastle Permanent’s rate of 1.8 per cent is available only to those under 25 years old.

Similarly, Greater Bank’s Life Saver (1.4 per cent) is only available to those under 25.

Want to get better with money and investing in 2021? Sign up here to our free newsletter and get the latest tips and news straight to your inbox.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance