Sarepta (SRPT) Q2 Earnings Miss, DMD Drugs' Sales Robust

Sarepta Therapeutics, Inc. SRPT reported a loss of $2.65 per share for the second quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $1.07 per share. The loss was also wider than the year-ago loss of $1.02 per share.

The company reported an adjusted loss of $1.18 per share, narrower than a loss of $1.64 in the year-ago quarter. The adjusted figure excludes one-time items, depreciation & amortization expenses, interest expenses, income tax benefit, stock-based compensation expenses, and other items.

Sarepta recorded total revenues of $233.5 million, up 42.3% year over year. Revenues beat the Zacks Consensus Estimate of $220.1 million. The year-over-year increase in revenues was driven by the sales of Sarepta’s three currently approved RNA-based PMO therapies for DMD.

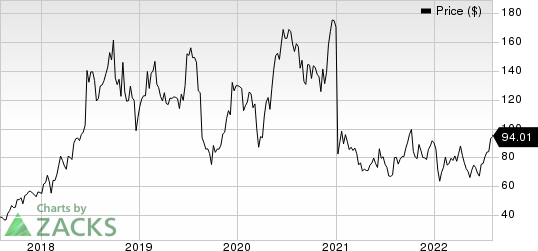

Shares of Sarepta were down 1.8% in after-hours trading on Aug 2, likely due to the wider-than-expected loss per share during the quarter. Sarepta’s shares have moved up 4.4% so far this year against the industry’s 22.6% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Sarepta’s commercial portfolio includes three drugs approved for treating Duchenne muscular dystrophy (“DMD”) — Exondys 51, Vyondys 53 and Amondys 45.

The company derived product revenues of $211.2 million, up 49% year over year.

The company recorded $22.3 million in collaboration revenues, primarily from its licensing agreement with Roche RHHBY. Collaboration revenues were flat compared with the year-ago quarter’s levels.

Sarepta and Roche entered into a licensing agreement to develop SRP-9001, its investigational gene-therapy candidate for DMD, in 2019. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $230.4 million in the second quarter, up 4.4% year over year.

Adjusted selling, general & administrative (SG&A) expenses were $63.7 million, up 18% year over year.

2022 Guidance

Following the outperformance of net product revenues in first-half 2022, Sarepta raised its revenue guidance for 2022. SRPT now expects total revenues in 2022 to be in the range of $905-$920, up from the previous guidance of total revenues to be more than $880 million.

Sarepta expects its net product revenues for 2022 to be in the range of $825-$840 million, up from the previous guidance of net product revenues being more than $800 million.

Pipeline Updates

Last month, Sarepta and Roche shared new functional data across multiple studies from the clinical development program evaluating SRP-9001. The data from these studies demonstrated that treatment with SRP-9001 led to significant functional improvements in individuals suffering from DMD when compared to a propensity-weighted external control group at multiple time points, including one-, two- and four-years post treatment.

Last week, Sarepta announced its intent to file a biologic license application (BLA) with the FDA seeking accelerated approval for SRP-9001 in DMD later this year during the fall season.

In June 2022, the FDA placed a clinical hold on Sarepta’s PPMO-based, exon 51 skipping candidate, SRP-5051, following a report of a serious adverse event of hypomagnesemia in the ongoing phase II MOMENTUM study. During its earnings call, management announced that it provided the data requested by the regulatory agency for resuming clinical studies. It expects to complete enrolment in the study later this year.

Sarepta Therapeutics, Inc. Price

Sarepta Therapeutics, Inc. price | Sarepta Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Sarepta currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector include Eli Lilly LLY and Jazz Pharmaceuticals JAZZ. While Jazz Pharmaceuticals sports a Zacks Rank #1 (Strong Buy) at present, Eli Lilly carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Jazz Pharmaceuticals’ 2022 earnings have increased from $17.05 to $17.06 in the past 30 days. JAZZ’s earnings estimates for 2023 have increased from $18.05 to $18.15 in the past 30 days. Shares of Jazz Pharmaceuticals have risen 19.9% in the year-to-date period.

Earnings of Jazz Pharmaceuticals beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 12.81%. In the last reported quarter, JAZZ delivered a negative earnings surprise of 0.53%.

Eli Lilly’s stock has increased 15.9% this year so far. Eli Lilly’s earnings estimates for 2022 have gone up from $8.29 per share to $8.34 per share, while that for 2023 has increased from $9.47 per share to $9.55 per share over the past 30 days.

Eli Lilly missed earnings estimates in three of the last four quarters while beating the mark on one occasion. Eli Lilly has a four-quarter earnings surprise of 2.26%, on average. In the last reported quarter, LLY reported a negative earnings surprise of 12.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance