SAP's Litmos Solutions Business Acquired by Francisco Partners

SAP SE SAP recently announced that it has completed the sale of Litmos Solutions’ business to Francisco Partners. Post the acquisition, SAP customers will have continued access to Litmos solutions via the SAP Store site.

In August, SAP announced that it was divesting SAP Litmos to Francisco Partners for an undisclosed amount. The company sold the business due to an overlap in the value propositions and features between the SAP SuccessFactors Learning solution and the SAP Litmos solutions.

Post-acquisition, Litmos solutions will experience greater flexibility as an independent-working company with Francisco Partners. It can focus on all its investments and operations for improved customer satisfaction, proprietary content library and third-party integrations.

SAP SE Price and Consensus

SAP SE price-consensus-chart | SAP SE Quote

Headquartered in Walldorf, Germany, SAP is one of the largest independent software vendors in the world and a leading enterprise resource planning software provider.

The company is gaining from continued strength in its cloud business (especially the new Rise with SAP solution) across all regions. Momentum in SAP’s Business Process Intelligence platform, particularly the S/4HANA solutions along with healthy traction witnessed in Qualtrics and other cloud-based offerings are noteworthy. Synergies from recent acquisitions bode well.

In the last reported quarter, SAP’s Cloud revenues were €3.288 billion, up 38% year over year on a non-IFRS basis (up 25% at cc). SAP’s S/4HANA Cloud revenues increased 98% (up 81% at cc) year over year to €546 million. Current cloud backlog of SAP’s S/4HANA rose 108% (up 90% at cc) year over year in the third quarter of 2022.

Given the business momentum, the company reiterated its outlook for 2022. SAP anticipates cloud revenues in the range of €11.55-€11.85 billion, suggesting an increase of 23-26% at cc. Cloud and software revenues are now expected to be between €25 billion and €25.5 billion, implying a 4-6% rise at cc.

Global macroeconomic weakness, geopolitical instability, and continued softness in software licenses are major headwinds for SAP. Stiff competition in the cloud space and increasing research & development and sales & marketing expenses are added concerns.

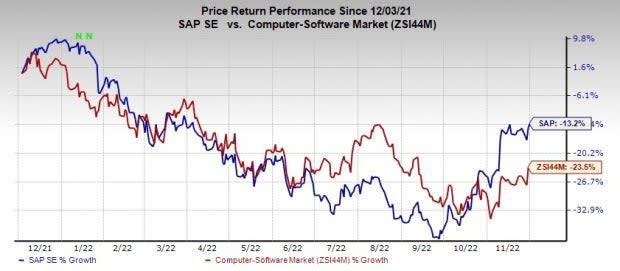

SAP currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 13.2% compared with the sub-industry’s decline of 23.5% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Arista Networks ANET, Blackbaud BLKB and Plexus PLXS. Arista Networks and Plexus currently sport a Zacks Rank #1 (Strong Buy), while Blackbaud carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated at 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 15.3% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.59 per share, up 1.6% in the past 60 days. The long-term earnings growth rate is anticipated at 4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.9%. Shares of BLKB have declined 15.8% in the past year.

The Zacks Consensus Estimate for Plexus’ fiscal 2023 earnings is pegged at $5.98 per share, up 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have increased 23.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plexus Corp. (PLXS) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance