Sabre's (SABR) Intelligent Platform Chosen by Golden Travel

Sabre Corporation SABR has received a multi-year contract from Golden Travel and Tourism for offering its innovative technology and platform. However, the companies haven’t disclosed the financial terms of the deal yet.

Per the terms of the agreement, one of the leading travel agencies in Saudi Arabia will now use Sabre’s intelligent platform — Sabre Red 360. The platform will enable Golden Travel and Tourism to harness more content and data, thereby boosting the flexibility to differentiate its offerings. Moreover, Sabre Red 360 platform will help the company efficiently manage operations and workflow, and grow faster in the region.

Deal Brings Respite Amid Coronavirus Crisis

The latest business contract from Global Travel and Tourism has brought some respite for Sabre which is witnessing negative impact of the travel restrictions imposed due to the COVID-19 pandemic-led restrictions.

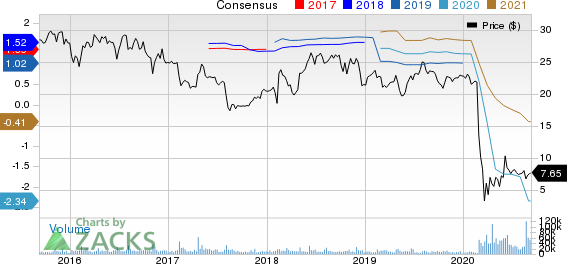

Sabre Corporation Price and Consensus

Sabre Corporation price-consensus-chart | Sabre Corporation Quote

The company’s second-quarter revenues tanked 92% year over year to $83 million. Moreover, the top-line figure missed the Zacks Consensus Estimate of $178 million. Revenues were primarily affected by significant reductions in air, hotel and other travel bookings due to the pandemic’s adverse impact on the global travel industry.

The company reported an adjusted loss per share of $1.30, way wider than the Zacks Consensus Estimate of loss of 78 cents. The bottom-line figure also compared unfavorably with the year-ago quarter’s earnings of 24 cents per share.

Global Travel and Tourism’s latest deal reflects that global tour and travel agencies are preparing for the post-coronavirus era. Furthermore, countries across the world have started reopening their economies which would steadily boost travel demand in the near future, which is encouraging for Sabre.

Sabre Cutting Costs to Stay Afloat

Sabre is focusing on cutting costs and is enhancing liquidity in an effort to stay afloat amid the ongoing financial and economic crisis due to the pandemic. The company has cut 25% salary of its US-based employees and has temporarily suspended the 401(K) program.

The company has also freeze its quarterly dividend and share-repurchase program to shore up balance sheet as it braces for a period of revenue slump amid the virus mayhem.

Zacks Rank & Stocks to Consider

Currently, Sabre carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks in the broader technology sector are salesforce.com inc. CRM, Blackbaud, Inc. BLKB and Synaptics Incorporated SYNA, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Salesforce, Blackbaud and Synaptics is currently pegged at 18%, 10% and 7.6%, respectively.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Sabre Corporation (SABR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance