Russell 2000 Closes on Record High: 5 Top Small-Cap Picks

Wall Street is about to celebrate its longest ever bull-run on Aug 22. While the major focus will be on large-cap stocks and stock indexes tracking those mega stocks, small-cap stocks have emerged as winning picks in the stock markets of 2018. The small-cap centric Russell 2000 index is breaking new ground while the broader market continues face severe fluctuations.

Lingering trade-related conflict between the United States and its largest trading partner China and other geopolitical concerns are denting investors’ confidence persistently. At this stage, investment in U.S. focused small-cap stocks with favorable Zacks Rank will be a lucrative option.

Russell 2000 Achieves All-Time High

On Aug 21, the Russell 2000 touched an all-time high of 1,722 before closing at a record level of 1,718.05. This represents a gain of 1.14% or 19.35 points in a single day. Year to date, the Russell 2000 has increased more than 11.9%.

This is significantly higher than its large-cap counterparts, the Dow 30 and S&P 500 which gained 4.5% and 7.1% respectively. The tech-heavy Nasdaq Composite recorded 13.9% and is the only major stock index which has outperformed the Russell 2000 year to date.

Special Features of Small-Cap Stocks

Small-cap stocks are mostly immune to any external shocks since the United States is the primary market of their products. This has been aiding the small-cap segment to outperform the broader market defying extreme volatility.

Small-cap companies generally benefit first from an improving economy. A strong economic condition tends to coincide with rising interest rate. However, in order to fund expansion, small-cap companies are less likely to opt for debt route compared with their large peers making them less sensitive to higher interest rate.

Furthermore, rising interest rate is often associated with stronger currency. A strong U.S. dollar will make exports of large companies uncompetitive. However, small-cap stocks remain unaffected by foreign exchange volatility.

Additionally, reduction of corporate tax from 35% to 21% is a major catalyst for small-cap corporates. These companies book almost all of their revenues in the homeland. As a result, a significant reduction in corporate tax rate is immediately accretive to their cash flow.

Trade War Fears Persist

The tariff-related conflicts between the United States and China are showing no signs of abatement. According to The Wall Street Journal, the Trump administration is considering imposing tariffs worth $200 billion on Chinese goods this week despite the fact that the two sides will sit for a meeting later this month to find an amicable solution.

Notably, both United States and China have imposed tariffs worth $50 billion on each other’s exports. On Aug 21, Trump told Reuters that he has “no time frame” for ending the trade dispute, and did not “anticipate much” from the upcoming talks with China.

Our Top Picks

Russell 2000 continues to achieve one milestone after the other in 2018. At this stage, investors with a higher risk appetite and return expectations can make the most by investing in small-cap stocks. However, picking winning stocks can be a difficult task.

This is where our VGM Score comes in handy. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select the winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We narrowed down our search on five stocks with a market cap of below $1 billion. Each of these stock have a Zacks Rank #1 (Strong Buy) and a VGM Score A. You can see the complete list of today’s Zacks #1 Rank stocks here.

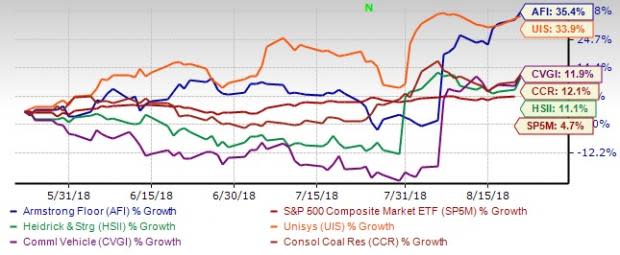

The chart below shows price performance of our five picks in the last three months.

Armstrong Flooring Inc. AFI is engaged in the design and manufacture of flooring solutions primarily in North America. The company has expected earnings growth of 104.8% for current year. The Zacks Consensus Estimate for the current year has improved by 79.2% over the last 30 days.

Heidrick & Struggles International Inc. HSII is a leading provider of leadership consulting, culture shaping and senior-level executive search services. The company has expected earnings growth of 84.4% for current year. The Zacks Consensus Estimate for the current year has improved by 11% over the last 30 days.

Unisys Corp. UIS is a global technology services and solutions provider for consulting, systems integration, outsourcing, infrastructure and server technology. The company has expected earnings growth of 246.9% for current year. The Zacks Consensus Estimate for the current year has improved by 13.9% over the last 30 days.

Commercial Vehicle Group Inc. CVGI supplies interior systems, vision safety solutions and other cab-related products for the global commercial vehicle market. The company has expected earnings growth of 218.2% for current year. The Zacks Consensus Estimate for the current year has improved by 6.9% over the last 30 days.

CONSOL Coal Resources LP CCR is engaged in underground mines and related infrastructure that produce high- BTU bituminuous thermal coal. The company has expected earnings growth of 43.8% for current year. The Zacks Consensus Estimate for the current year has improved by 1.4% over the last 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Unisys Corporation (UIS) : Free Stock Analysis Report

Commercial Vehicle Group, Inc. (CVGI) : Free Stock Analysis Report

Armstrong Flooring, Inc. (AFI) : Free Stock Analysis Report

Heidrick & Struggles International, Inc. (HSII) : Free Stock Analysis Report

CONSOL Coal Resources LP (CCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance