RPC (RES) Beats Q4 Earnings Estimates, Ups Capex Guidance

RPC Inc. RES reported adjusted earnings of 41 cents per share in the fourth quarter, beating the Zacks Consensus Estimate of 30 cents. The bottom line significantly increased from the year-ago quarter’s 6 cents per share.

Total quarterly revenues of $482 million beat the Zacks Consensus Estimate of $450 million. The top line significantly improved from the year-ago figure of $268 million.

The strong quarterly results were backed by higher activity levels in all the service lines and rising equipment utilization.

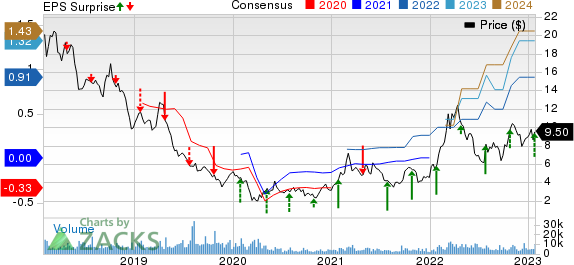

RPC, Inc. Price, Consensus and EPS Surprise

RPC, Inc. price-consensus-eps-surprise-chart | RPC, Inc. Quote

Segmental Performance

Operating profit in the Technical Services segment totaled $110.5 million, higher than the year-ago quarter’s profit of $20.5 million. The upside was caused by increased customer activities, along with higher pricing and a larger active fleet of revenue-producing equipment.

Operating profit in the Support Services segment was $6.7 million, reversing from a year-ago loss of $373,000. The improvement was owing to a hike in pricing within rental tools, along with increased activities.

Total operating profit in the quarter was $112.3 million, skyrocketing from $20.1 million. The average domestic rig count was 776, reflecting a 38.3% increase from the year-ago level. The average oil price in the quarter was $82.67 per barrel. The same for natural gas was $5.55 per thousand cubic feet.

Cost and Expenses

In fourth-quarter 2022, the cost of revenues increased from $200.6 million to $308.6 million. Selling, general and administrative expenses increased to $38.2 million from the year-ago figure of $32.1 million.

Financials

RPC’s total capital expenditure for the December-end quarter of 2022 amounted to $49.3 million.

As of Dec 31, RPC had cash and cash equivalents of $126.4 million, up sequentially from $73.2 million. Nonetheless, the company managed to maintain a debt-free balance sheet.

Outlook

For 2023, the Zack Rank #3 (Hold) company expects capital expenditure of $250-$300 million, indicating an increase from $140 million reported in 2022.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Q4 Results of Other Downstream Companies

Halliburton Company HAL reported fourth-quarter 2022 adjusted net income per share of 72 cents, surpassing the Zacks Consensus Estimate of 67 cents. The outperformance reflects stronger-than-expected profit from both its divisions.

HAL is expected to see earnings growth of 42.8% in 2023. In more good news for investors, Halliburton raised its quarterly dividend by 33.3% to 16 cents per share (or 64 cents per share annualized).

Schlumberger Limited SLB reported fourth-quarter 2022 earnings of 71 cents per share (excluding charges and credits), comfortably beating the Zacks Consensus Estimate of 69 cents. The strong quarterly results were primarily driven by strong activities in land and offshore resources in North America and Latin America.

SLB is expected to see earnings growth of 38.5% in 2023. Schlumberger’s board approved a quarterly cash dividend of 25 cents per share, indicating a 43% increase from the last paid dividend.

Baker Hughes Company BKR reported fourth-quarter 2022 adjusted earnings of 38 cents per share, missing the Zacks Consensus Estimate of 41 cents. The lower-than-expected quarterly results were driven by higher costs and expenses.

BKR is expected to see earnings growth of 80.9% in 2023. Baker Hughes has been investing in energy transition and industrial initiatives. It expects to return 60-80% of free cash flow to shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance