Royce International Premier Fund's Strategic Moves: Spotlight on NICE Ltd with 1. ...

Insights from the First Quarter of 2024 N-PORT Filing

Royce International Premier Fund (Trades, Portfolio), known for its selective investment approach, targets high-quality, non-U.S. small-cap companies with strong competitive advantages and sustainable franchises. The fund's recent N-PORT filing for the first quarter of 2024 reveals its latest strategic decisions, focusing on businesses with robust industry positions, operational efficiency, and solid financials, aiming to deliver long-term value to investors.

Summary of New Buys

Royce International Premier Fund (Trades, Portfolio) expanded its portfolio with six new stocks in the first quarter of 2024. Noteworthy additions include:

NICE Ltd (NASDAQ:NICE), with 28,392 shares, making up 1.69% of the portfolio and valued at $7.4 million.

Halma PLC (LSE:HLMA), comprising 217,734 shares, representing 1.49% of the portfolio, with a total value of 6.5 million.

Johns Lyng Group Ltd (ASX:JLG), with 1,480,465 shares, accounting for 1.41% of the portfolio and a total value of A$6.2 million.

Key Position Increases

The fund also bolstered its stakes in 12 companies, with significant increases in:

Open Text Corp (TSX:OTEX), adding 149,807 shares for a total of 186,784 shares. This represents a 405.14% increase in share count, impacting the portfolio by 1.32%, and valued at C$7.2 million.

IMCD NV (XAMS:IMCD), with an additional 18,941 shares, bringing the total to 48,772 shares. This adjustment marks a 63.49% increase in share count, with a total value of 8.6 million.

Summary of Sold Out Positions

The fund exited three holdings entirely in the first quarter of 2024, including:

New Work SE (XTER:NWO), selling all 70,425 shares, impacting the portfolio by -1.28%.

Douzone Bizon Co Ltd (XKRX:012510), liquidating all 62,027 shares, affecting the portfolio by -0.41%.

Key Position Reductions

Portfolio adjustments also involved reducing positions in 42 stocks. The most significant reductions were:

Restore PLC (LSE:RST) by 1,613,326 shares, resulting in a -37.16% decrease in shares and a -0.94% impact on the portfolio. The stock traded at an average price of 2.28 during the quarter.

Intertek Group PLC (LSE:ITRK) by 68,255 shares, leading to a -30.96% reduction in shares and a -0.77% impact on the portfolio. The stock traded at an average price of 45.62 during the quarter.

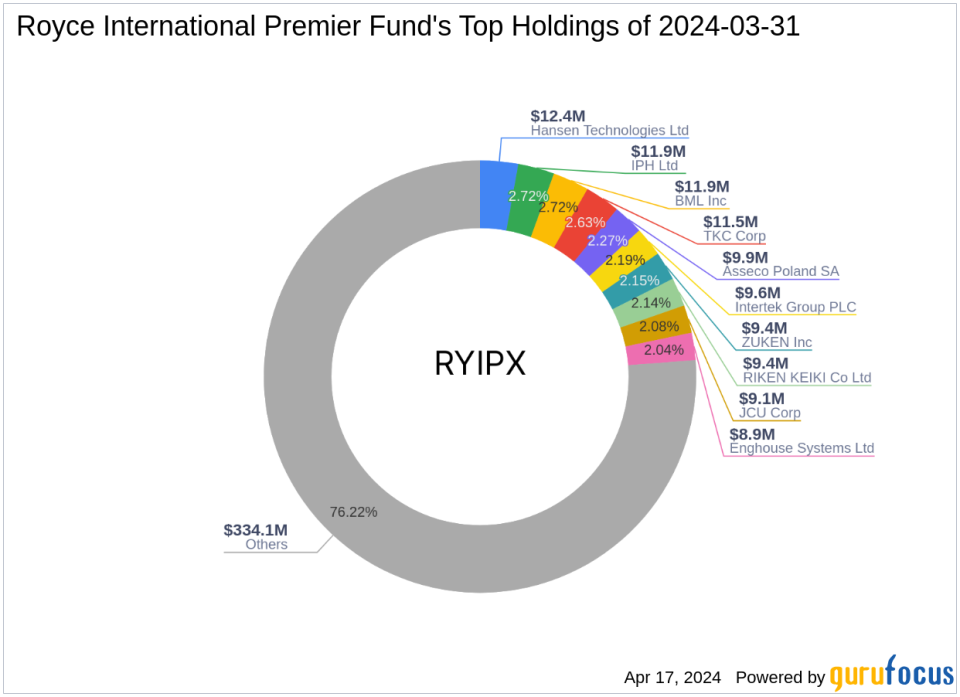

Portfolio Overview

As of the first quarter of 2024, Royce International Premier Fund (Trades, Portfolio)'s portfolio consisted of 61 stocks. The top holdings included 2.84% in Hansen Technologies Ltd (ASX:HSN), 2.72% in IPH Ltd (ASX:IPH), 2.72% in BML Inc (TSE:4694), 2.63% in TKC Corp (TSE:9746), and 2.27% in Asseco Poland SA (WAR:ACP). The investments are primarily concentrated across eight industries: Technology, Industrials, Basic Materials, Financial Services, Healthcare, Consumer Cyclical, Communication Services, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance