Rogers Communications (RCI) Misses on Q3 Earnings, Revenues

Rogers Communications RCI reported third-quarter adjusted earnings of 91 cents per share that missed the Zacks Consensus Estimate of $1.

Total revenues of $2.84 billion also missed the consensus mark of $2.92 billion.

Adjusted earnings decreased 1.7% year over year to C$1.19 per share. Total revenues decreased 0.4% year over year to C$3.75 billion.

Notably, third-quarter 2019 results were reported per IFRS 16.

Wireless Details

Wireless (61.9% of total revenues) decreased 0.3% from the year-ago quarter to C$2.32 billion.

Service revenues decreased 1.6% to C$1.81 billion, attributable to an expanded postpaid subscriber base and a 2% decrease in blended average revenue per user as a result of overage revenues due to faster adoption of Rogers Infinite unlimited data plan launched last quarter.

Equipment revenues were up 4.5% to C$516 million due to increase in gross postpaid subscribers. However, this was offset by lower device upgrades by existing users in the reported quarter.

Monthly blended average revenue per user (ARPU) was C$56.01, down 2.1% year over year. Monthly blended average billing per user (ABPU) was C$67.2, up 1.5%.

As of Sep 30, 2019, prepaid subscriber base totaled almost 1.48 million, a loss of 287K subscribers from the year-ago quarter. Monthly churn rate was 4.74% compared with 3.48% in the year-ago quarter.

As of Sep 30, 2019, postpaid wireless subscriber base totaled roughly 9.36 million, up 315K from the year-ago quarter. Monthly churn rate was 1.2% compared with 1.09% in the year-ago quarter.

Segment operating expense decreased 3.7% from the year-ago quarter to C$1.19 billion.

Adjusted EBITDA increased 3.5% year over year to C$1.14 billion. Adjusted EBITDA margin expanded 180 basis points (bps) on a year-over-year basis to 49%.

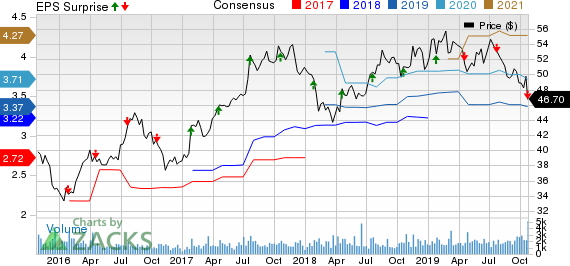

Rogers Communication, Inc. Price, Consensus and EPS Surprise

Rogers Communication, Inc. price-consensus-eps-surprise-chart | Rogers Communication, Inc. Quote

Cable Details

Cable (26.5% of total revenues) inched up 1.1% from the year-ago quarter to C$994 million. The increase was due to higher Internet subscriber base and increased Ignite TV subscriber base.

Service revenues climbed 1% to C$989 million.

Internet revenues increased 6.7% year over year due to user shift toward higher-GB tiers and increase in subscriber base, partially offset by increased promotional activities. As of Sep 30, 2019, Internet subscriber count was nearly 2.5 million, up 102K from the year-ago quarter.

During the quarter, Rogers Communications launched Fido Data Overage Protection plan, which enables customers to pause and purchase data when they reach their limit. Early responses noted 2, 60,000 customers on new plans using 14% more data.

Additionally, the company also launched the Ignite Wi-Fi Hub app and introduced Wall-to-Wall Wi-Fi pods to manage home Wi-Fi networks and enhance Wi-Fi connectivity in households.

The company is set to launch reciprocal roaming arrangement with AT&T to extend LTE-M coverage for IoT customers throughout Canada and the United States.

Television revenues were up 1.7% year over year due to pricing changes and addition of new Ignite TV subscribers. This was offset by decline in subscriber base.

Rogers Communications lost 17K subscribers on a year-over-year basis to reach an installed base of almost 1.6 million in the Television segment.

During the quarter, the company added new apps such as Sportsnet NOW, and The Zone on Ignite TV.

Phone revenues plunged 36.4% year over year primarily due to bundled discount pricing and decline in subscriber base. Subscriber count was nearly 1.08 million, a decline of 37K from the year-ago quarter.

Equipment revenues jumped 25% year over year to C$5 million.

Segment operating expense increased 0.4% from the year-ago quarter to C$495 million.

Adjusted EBITDA increased 1.8% year over year to C$499 million. Adjusted EBITDA margin expanded 40 bps on a year-over-year basis to 50.2%.

Media Details

Media (12.9% of total revenues) declined 1% from the year-ago quarter to C$483 million. The decline in revenues was primarily due to the sale of the company’s publishing business and lower Toronto Blue Jays revenues.

Segment operating expense decreased 14.9% year over year to C$353 million primarily attributed to lower publishing-related costs and Toronto Blue Jays player salaries.

Adjusted EBITDA increased 78.1% year over year to C$130 million.

Consolidated Results

Operating costs declined 4.8% from the year-ago quarter to C$2.05 billion. As a percentage of revenues, operating costs contracted 250 bps to 54.5%. The company deployed a cooling optimization program across network data centers during the quarter, which reduced annual electricity use by 2 gigawatt-hours.

Adjusted EBITDA increased 5.7% from the year-ago quarter to C$1.71 billion. Adjusted EBITDA margin expanded 260 bps to 45.6%.

Balance Sheet & Cash Flow Details

As of Sep 30, 2019, Rogers Communications had cash and cash equivalents of $262 million compared with $404 million at the end of the previous quarter.

Cash provided by operating activities increased 0.1% year over year to C$1.3 billion. Free cash flow increased 22.3% year over year to C$767 million, attributed to higher adjusted EBITDA along with capital efficiencies in cable and decrease in cash income taxes for the reported quarter.

Rogers Communications paid C$256 million in dividends in the reported quarter. The company repurchased shares worth $93 million.

Rogers Communications ended the third quarter with a debt leverage ratio (adjusted net debt/adjusted EBITDA) of 2.8, up from 2.5 at the end of 2018.

Guidance for 2019

Revenues are expected to be down 1% to up 1% against the prior guidance of increase in the range of 3%-5%.

Adjusted EBITDA is expected to increase in the range of 3%-5% compared with the prior guidance of increase in the range of 7%-9%.

Capital expenditure is expected in the range of C$2.75-2.85 billion compared with the prior guidance of C$2.85-3.05 billion.

Free cash flow is expected to increase in the range of C$100-200 million compared with the prior guidance of increase in the range of C$200-300 million.

Zacks Rank & Stocks to Consider

Rogers Communications currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader consumer discretionary sector include Callaway Golf Company ELY, Sony Corporation SNE and Weight Watchers International WW. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Callaway, Sony and Weight Watchers are set to report their quarterly earnings on Oct 24, Oct 30 and Nov 11, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sony Corporation (SNE) : Free Stock Analysis Report

Rogers Communication, Inc. (RCI) : Free Stock Analysis Report

Callaway Golf Company (ELY) : Free Stock Analysis Report

Weight Watchers International Inc (WW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance